Some of the widespread debates at present happening inside the financial sphere is what constitutes the perfect inflation hedge. You realize, as a result of a KitKat Chunky practically prices extra right this moment than a two-bed condo did this time 5 years in the past.

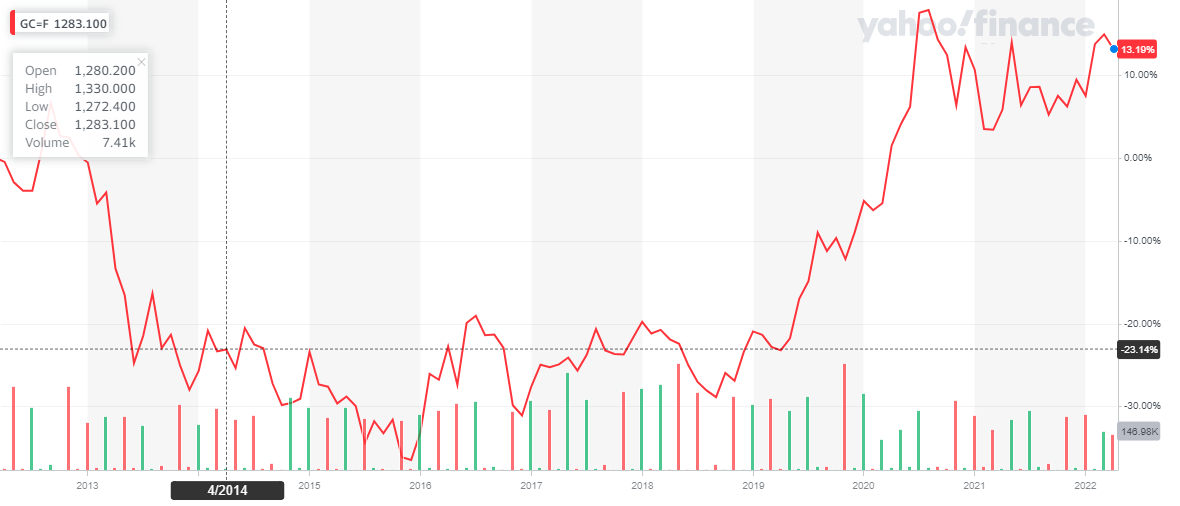

Previous-school traders nonetheless argue gold is the perfect hedge, which historically is the last word strategy to shield oneself towards a depreciating foreign money. In spite of everything, the shiny metallic has been a part of nearly each human tradition all through historical past. It’s stood the check of time. But its returns because it spiked after the GFC have been lacklustre, to say the least – up solely 21% within the final ten years.

The extra irreverent traders assume there’s a brand new child on the block, first title Bit, second title Coin. Is Bitcoin digital gold? Is it a superior store-of-value than the OG king that’s gold? The bulls argue that Bitcoin’s (outrageous) outperformance of gold over the past decade highlights its superiority. Then once more, amid the best inflation atmosphere in current reminiscence, gold is up 3% YTD, whereas Bitcoin is down 17%. So, what provides?

What About Each?

Effectively, the excellent news is that, like a smart politician, we are able to sit on the fence. As a result of right this moment a novel exchange-traded product has been launched on the Swiss SIX Inventory Change which mixes Bitcoin and gold. It’s the primary mixed gold/bitcoin exchange-traded product on the planet, and has been developed by crypto ETF supplier 21Shares, in partnership with crypto knowledge supplier ByteTree Asset Administration.

Even the ticker image is an amalgamation of the 2 belongings – BOLD. The issuing companies acknowledged the ETP will present “safety towards inflation, giving optimum risk-adjusted publicity to bitcoin and gold”. What’s that breakdown? It’s 81.5% gold and 18.5% Bitcoin, and can “rebalance month-to-month in response to every asset’s inverse historic volatility”.

“BOLD seeks to remove the effort of personally managing the 2 belongings whereas imposing a disciplined course of on the subject of delivering greater risk-adjusted returns”, 21Shares CEO Hany Rashwan mentioned.

Asset Traits

It’s an fascinating idea. After all, traders can merely put money into gold and Bitcoin of their desired proportions, however that’s the case with most ETPs. It provides an automatic, straightforward publicity to each belongings, and the risk-weighted adjustment is a neat function. It could additionally make it simpler for sure establishments to achieve Bitcoin publicity, as regulatory limitations to the cryptocurrency stay in place for a number of entities.

Novice traders can rotate into belongings outdoors the normal inventory/bond sphere, each of which have been getting hammered amid the high-inflation atmosphere. Sometimes negatively correlated, shares and bonds have each been struggling just lately, which has been the case all through historical past when inflation soars previous manageable ranges.

With a big portion of traders nonetheless intimidated by Bitcoin, and hesitant to completely embrace its risky nature, the BOLD ETP is a pleasant avenue to achieve publicity to Bitcoin in a reasonable capability. With its excessive danger/return profile mixed with gold’s extra conservative value motion, it’s no shock 21Shares have chosen to launch the product – which quantities to the 30th digital asset ETP that the innovate agency has dropped at market.