The crypto market is again on a contemporary bullish path after a ugly couple of weeks. Bitcoin value tumbled under $25,000 following the U.S. Federal Reserve resolution on rates of interest. Whereas a pause on rate of interest hikes was a optimistic signal for threat property like BTC, the feedback made by the financial institution’s Chair Jerome Powell triggered the sell-off.

Primarily based on Powell’s hawkish speech, buyers ought to anticipate extra rate of interest hikes, making this a short lived injunction. Alternatively, buyers hoped that the period of hikes if lastly coming to an finish.

Nonetheless, the Fed remains to be dedicated to bringing inflation right down to 2%.

Bitcoin value, which felt the pinch after the Fed announcement, has bounced from assist at $24,700 and is buying and selling at $25,500 on Friday. Live price data tracked by CoinGape, exhibits a 2% bullish pump within the final 24 hours.

The uptick in BTC value may be attributed to a couple elements together with the extraordinarily oversold situations. Nevertheless, the news of Blackrock filing for a spot Bitcoin exchange-traded fund (ETF) might be the first driving pressure.

And can hit the SEC wall identical because the GBTC. GBTC vs SEC points: Index Value, BTC value distinction between spot and futures…and many others.

However it’s excellent news, it means an enormous participant is stepping in and the regulation dispute is unfolding in optimistic manner— SimeC (@c_sime) June 16, 2023

Blackrock Takes First Step Towards a Spot Bitcoin ETF

International behemoth Blackrock took the initial step towards one of the vital coveted regulatory approvals within the crypto trade on Thursday. In accordance with a report by CNBC, the corporate filed an software with the Securities and Alternate Fee (SEC) eyeing the launch of iShares Bitcoin Belief.

Ought to it obtain the inexperienced mild, the ETF will function a gateway for buyers to realize crypto publicity, courtesy of a product by one in all Wall Road’s heavyweight companies.

“The Shares are meant to represent a easy technique of investing just like an funding in bitcoin moderately than by buying, holding and buying and selling bitcoin straight on a peer-to-peer or different foundation or through a digital asset alternate,” the submitting reads partly.

To this point, the SEC has held again from green-lighting the roll-out of a spot bitcoin ETF on American soil. It’s at the moment entangled in a authorized tussle with Grayscale in regards to the agency’s quest to metamorphose its Grayscale Bitcoin Belief into an ETF. The decision of this dispute is anticipated later inside the 12 months.

Bitcoin Value on The Transfer Eyeing $28,000

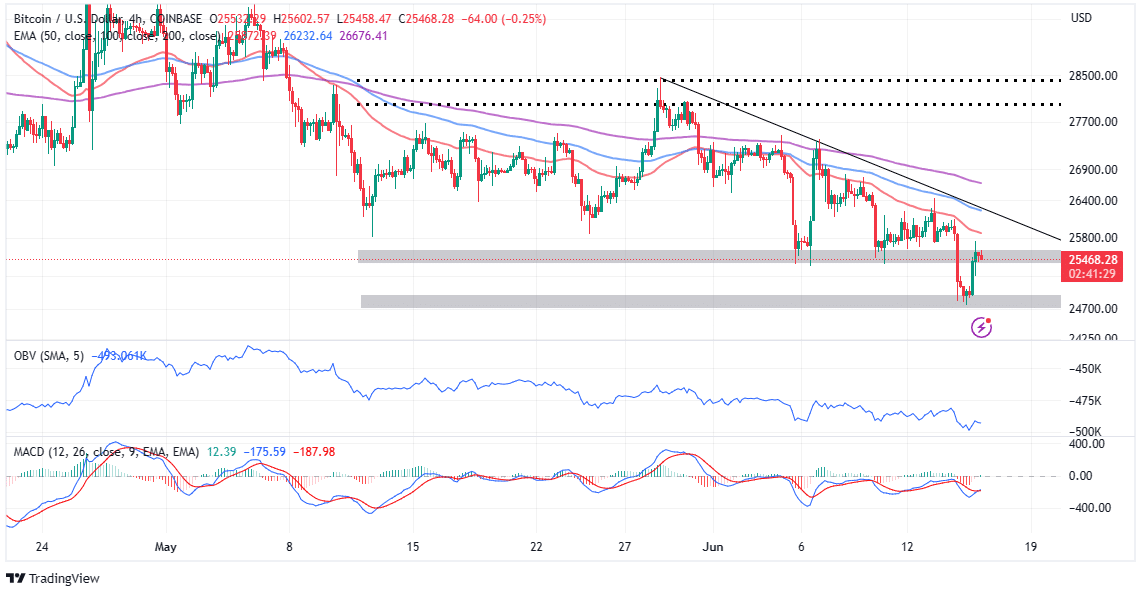

The biggest crypto is hovering barely above $25,500 following Thursday’s knee-jerk response to Blackrock’s spot BTC ETF submitting. A purchase sign additionally flashed from the Shifting Common Convergence Divergence (MACD) indicator, calling extra buyers into the market to guide lengthy positions in BTC.

As per the On-Steadiness-Quantity (OBV) influx quantity is now larger in comparison with outflow quantity. This suggests that buyers and merchants are betting on the restoration to hold on into the weekend and shrink the hole to $28,000.

Regardless of the uptick above $25,500, the technical market construction remains to be not sturdy sufficient. Subsequently, merchants must be cautious to keep away from bull traps, particularly if resistance at $26,000 will not be reclaimed.

BlackRock filed for a #Bitcoin spot ETF.

Right here’s what occurs when an enormous fund will increase bitcoin demand. pic.twitter.com/QhTaCG2bZm

— Julio Moreno (@jjcmoreno) June 15, 2023

Alternatively, short-term assist at $25,400 should maintain to cut back the likelihood of the downtrend gaining momentum. Merchants ought to tread with the subsequent purchaser congestion at $24,700 in thoughts, understanding that it might decide if BTC goes to $20,000 or sustains the uptrend to $28,000.

Associated Articles:

The introduced content material could embrace the non-public opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any accountability on your private monetary loss.