Traders will probably bear in mind the market occasions of July 2025, which noticed Bitcoin surge to a brand new all-time excessive above $120,000. Many affected person Bitcoin holders grew to become millionaires this month.

Nevertheless, July additionally witnessed record-setting liquidation losses. Open Curiosity (OI) volumes hit historic highs. In addition to BTC and ETH, a number of altcoins now pose vital liquidation dangers to derivatives merchants, as value volatility will increase.

1. Solana (SOL)

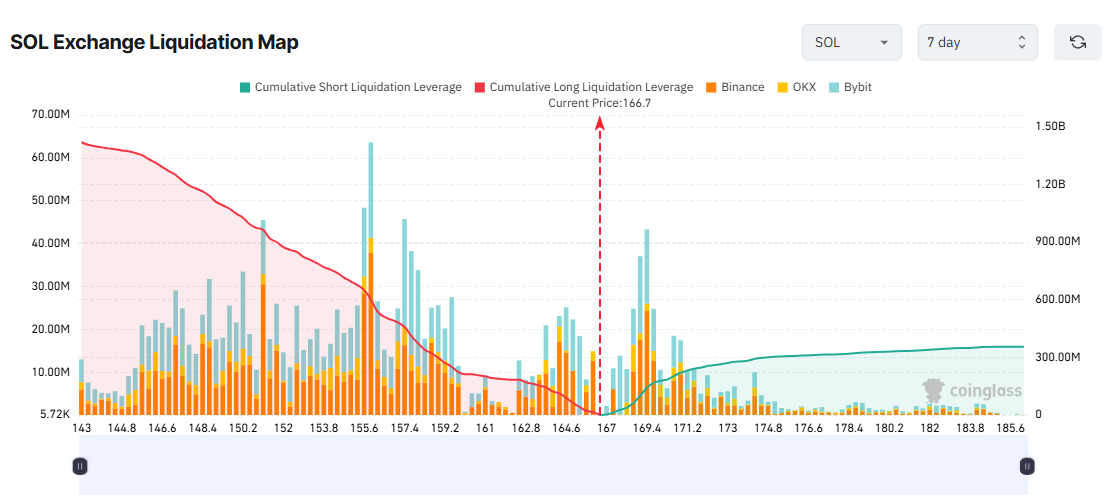

Knowledge from Coinglass exhibits that Solana’s Open Interest in July reached $7.9 billion, its highest degree since January 2025, when SOL peaked at $294.

The liquidation map for SOL reveals a transparent imbalance between lengthy and quick positions. Most merchants are betting on additional short-term value will increase, allocating capital and leverage to lengthy positions.

Consequently, the full accrued long-side liquidation quantity might attain $1 billion if SOL drops under $150. This may characterize a decline of over 10% from the present value of $167 on the time of writing.

Though Solana flashed a bullish five-year signal, BeInCrypto not too long ago reported that FTX unstaked practically 190,000 SOL, price round $31 million. This transfer got here amid rising creditor strain, sparking fears of market impression.

2. XRP

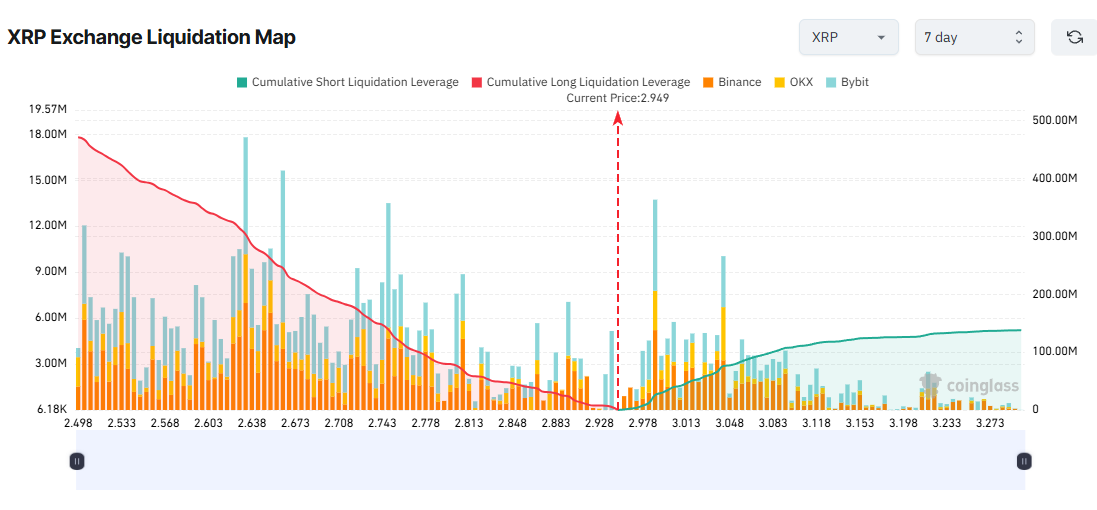

XRP’s Open Interest hit $7.6 billion entering the third week of July. That’s simply $250 million under its highest OI degree in January.

The liquidation map for XRP additionally exhibits short-term merchants are assured that the worth will proceed rising. That is evident from the imbalance between cumulative lengthy and quick liquidations.

The info means that as much as $500 million in lengthy positions could possibly be liquidated if XRP falls under $2.5. Historic value motion exhibits XRP usually experiences huge every day ranges, 20% to 30% strikes.

Moreover, recent analysis suggests XRP’s rally could also be dropping momentum, as some merchants could possibly be getting ready to take income.

3. Hypeliquid (HYPE)

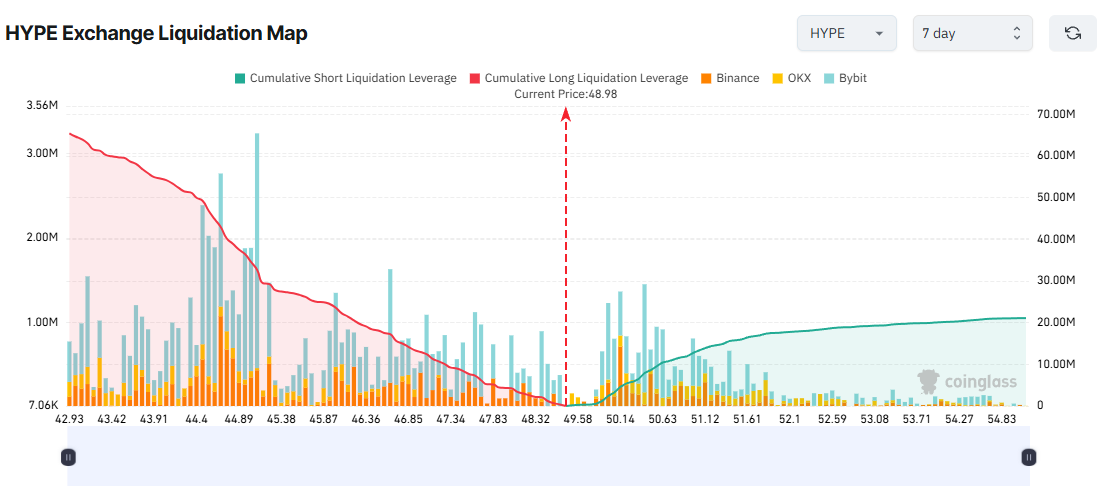

In July, Hypeliquid (HYPE) set a new all-time high in Open Curiosity at $2.1 billion. The Lengthy/Brief quantity ratio — in addition to the Lengthy/Brief ratio amongst high accounts on Binance and OKX — exceeds 1, signaling short-term bullish sentiment.

In the meantime, HYPE’s value has climbed for six consecutive days. It hit a brand new excessive of $49.8 today. Merchants are nonetheless aggressively pursuing lengthy positions, which will increase liquidation danger if a pullback happens.

The liquidation map exhibits that over $60 million in cumulative lengthy positions could possibly be liquidated if HYPE drops under $43.

In July, HYPE’s value closely mirrored Bitcoin’s. With BTC now exceeding $122,000, any correction in Bitcoin might set off a deeper retracement in HYPE, resulting in large-scale liquidations.

The Crypto Derivatives Market is Hotter Than Ever

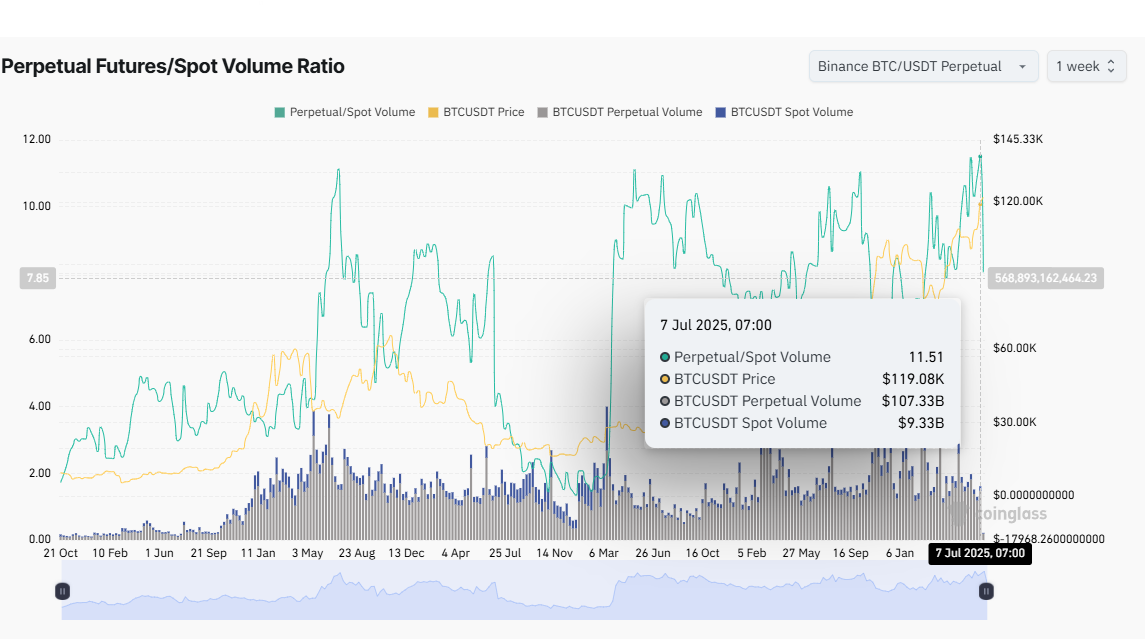

In line with Coinglass, Bitcoin’s futures buying and selling quantity final week was over 10 occasions its spot buying and selling quantity. The Perpetual Futures/Spot Quantity Ratio reached 11.5, the best in historical past.

Moreover, the full crypto market Open Curiosity hit a brand new all-time excessive of over $187 billion on July 14. Open Curiosity represents the full variety of excellent contracts but to be settled.

It displays investor participation in each altcoins and Bitcoin in the mean time.

These figures recommend that merchants are participating extra with derivatives than spot markets regardless of the bull market. It is a warning signal that main liquidation occasions could also be on the horizon.

“Up to now 24 hours, 127,894 merchants have been liquidated. Whole liquidations reached $732.59 million,” Coinglass reported.

On the time of writing, 24-hour liquidation volumes have already surpassed $700 million, and most losses proceed to fall on short positions.

Disclaimer

In adherence to the Trust Project tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed info. Nevertheless, readers are suggested to confirm details independently and seek the advice of with an expert earlier than making any choices primarily based on this content material. Please notice that our Terms and Conditions, Privacy Policy, and Disclaimers have been up to date.