The fourth week of July marks a record-breaking second as the overall crypto market capitalization reaches $4 trillion. Altcoin market cap can also be on a path towards reclaiming its all-time excessive (ATH).

On this context, a number of altcoins, extremely favored by short-term merchants utilizing vital leverage, could face main liquidations.

1. XRP

In accordance with Coinglass, XRP’s Open Curiosity—the overall worth of open positions within the derivatives market—hit an all-time excessive of $10.9 billion in July.

Notably, the Funding Charge turned optimistic and climbed to its highest stage for the reason that begin of the 12 months. A optimistic Funding Charge happens when the longer term value exceeds the spot value. This displays sturdy market optimism, as most merchants anticipate the worth to rise and are opening lengthy positions.

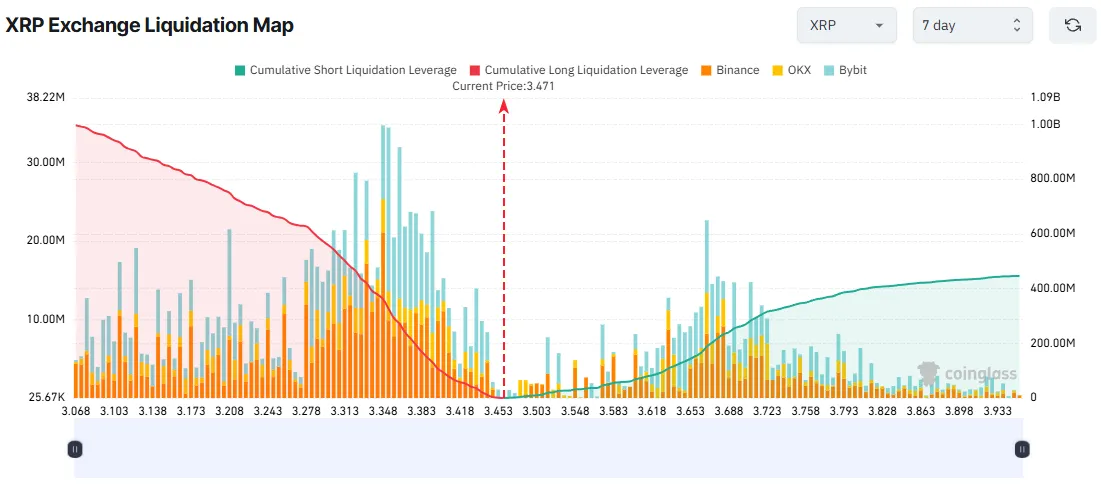

This has brought about XRP’s liquidation map to develop into imbalanced between lengthy and brief positions.

In accordance with the 7-day liquidation map, the overall cumulative liquidation for lengthy positions far exceeds that of brief positions. If XRP drops to $3 this week, lengthy liquidations may attain practically $1 billion.

This concern has some foundation. BeInCrypto not too long ago reported warning indicators of a potential short-term correction for XRP, together with a decline in new investors.

Nonetheless, Kaiko’s newest report reveals that XRP’s 1% market depth reached a brand new yearly excessive of practically $10 million on the spot market. This locations it above SOL, BNB, and ADA, second solely to ETH.

This increased market depth and liquidity recommend that XRP could get better rapidly if the worth drops. Nonetheless, fast and surprising value swings may put each lengthy and brief derivatives merchants at vital threat.

2. DOGE

DOGE has drawn excessive investor expectations in July, particularly as Bit Origin plans to raise $500 million to determine a Dogecoin treasury. Moreover, a number of indicators trace at a potential return of meme coin season alongside the ongoing altcoin season.

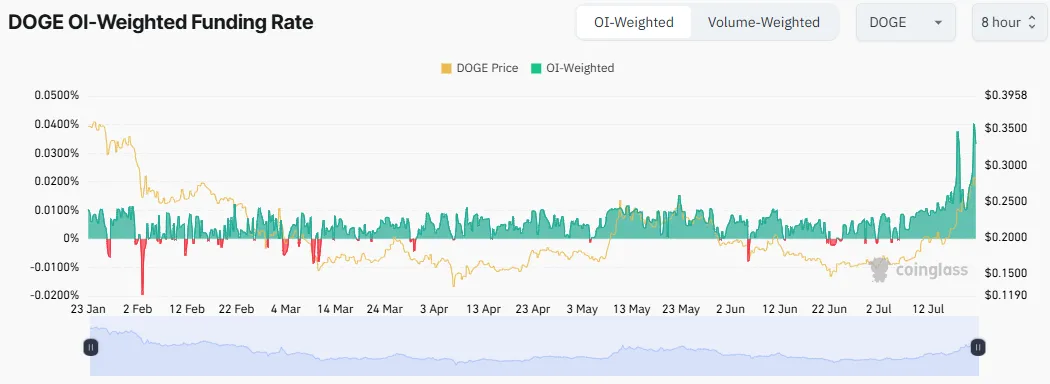

Coinglass knowledge reveals DOGE’s Funding Charge hit a yearly excessive on July 21, when the worth returned to $0.28. Many short-term merchants opened lengthy positions, hoping DOGE would proceed rising.

The danger of lengthy liquidations will increase as extra merchants use leverage to wager on DOGE’s value surge.

Lately, Lookonchain reported that well-known Hyperliquid dealer James Wynn liquidated a part of his place, for 4.45 million DOGE ($1.15 million) after closing his lengthy commerce.

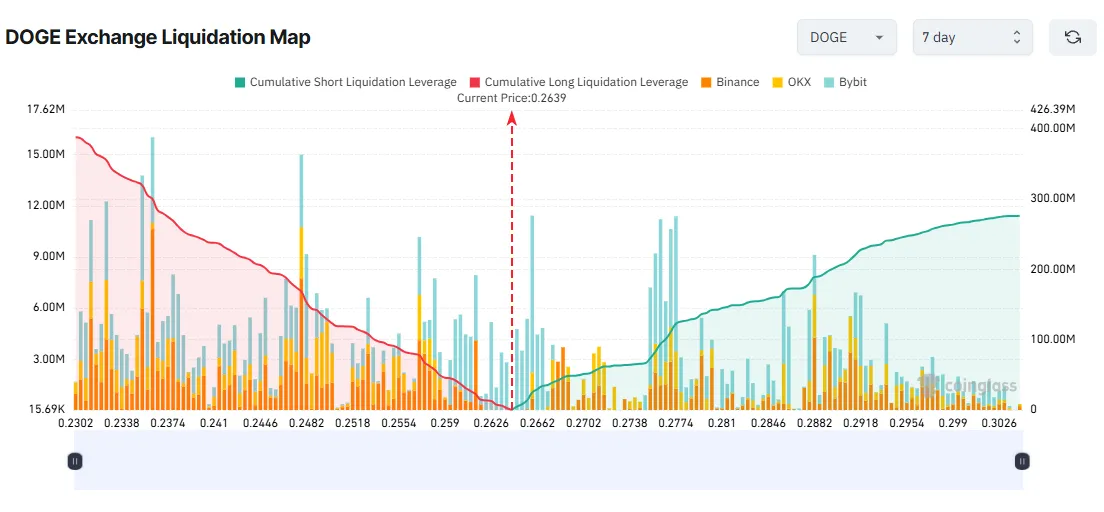

On the time of writing, DOGE has fallen from its July excessive of $0.28 to $0.266. The 7-day liquidation map reveals that if DOGE drops to $0.236 this week, whole cumulative lengthy liquidations may attain $300 million.

A latest BeInCrypto report notes that long-term DOGE holders are quietly withdrawing funds, signaling potential profit-taking.

3. ADA

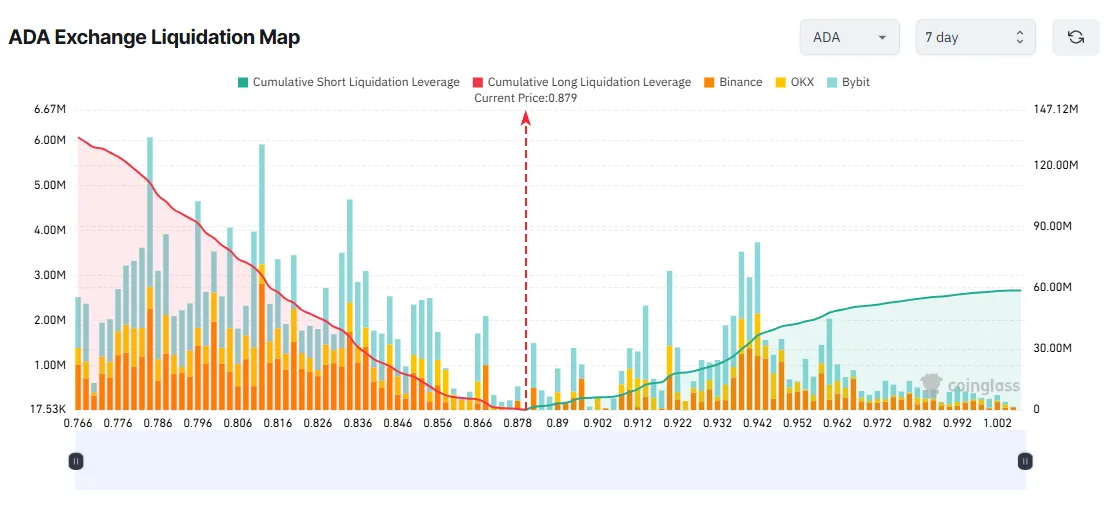

Cardano (ADA) reached a brand new all-time excessive in open curiosity in July, at $1.74 billion. This comes as ADA enters its fifth consecutive week of value good points.

Many analysts stay bullish, predicting that ADA may quickly hit $1. On-chain metrics akin to Age Consumed and the MVRV Ratio suggest the price may continue climbing in July.

In accordance with the 7-day liquidation map, if ADA hits $1, brief positions may withstand $58 million in cumulative liquidations. Nonetheless, the draw back threat is even better. If ADA falls to $0.78 this week, cumulative lengthy liquidations may attain $120 million.

Is there any trigger for concern that may negatively have an effect on ADA’s value? Probably. Information has emerged that Cardano co-founder Charles Hoskinson is preparing to publicly release an audit report, which may affect dealer sentiment.

On the time of writing, general market Open Curiosity continues to rise, surpassing $213 billion. The crypto derivatives market has by no means been hotter.

“Previously 24 hours, 152,419 merchants had been liquidated, with whole liquidations amounting to $553.68 million,” Coinglass reported.

Of the greater than half a billion {dollars} liquidated up to now 24 hours, over $370 million got here from lengthy positions. This raises considerations that the development could proceed into the fourth week of July.

Disclaimer

In adherence to the Trust Project tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed data. Nonetheless, readers are suggested to confirm information independently and seek the advice of with knowledgeable earlier than making any selections primarily based on this content material. Please notice that our Terms and Conditions, Privacy Policy, and Disclaimers have been up to date.