A number of altcoins entered September with imbalances on their liquidation maps, highlighting a transparent hole between bullish and bearish sentiment. These situations create a positive setup for large-scale liquidations.

The next are three altcoins vulnerable to liquidations within the first week of September, based mostly on liquidation information and the most recent information more likely to affect their worth actions.

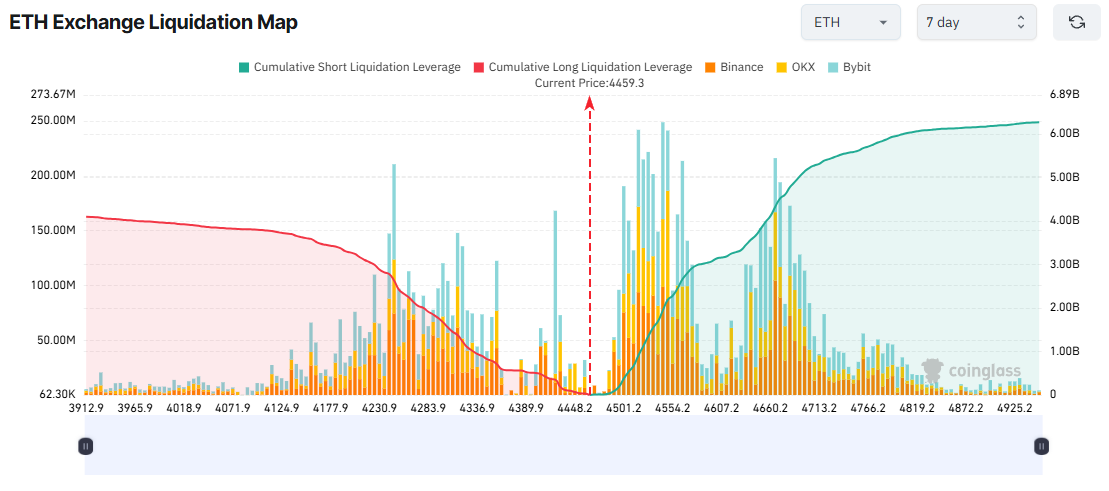

1. Ethereum (ETH)

Ethereum’s 7-day liquidation map exhibits a serious imbalance. If ETH rises to $4,925 this week, collected quick liquidations may exceed $6 billion.

Then again, if ETH falls beneath $4,000, lengthy positions value about $3.96 billion could be liquidated.

Information signifies that short-term merchants are leaning towards shorting Ethereum this week. They positioned bigger bets and used increased leverage on quick positions.

Nevertheless, they could face setbacks. On-chain information from the primary day of September exhibits giant whale transactions promoting BTC to purchase ETH.

Lookonchain reported that Bitcoin whale wallets constantly offered BTC to buy greater than $4 billion value of ETH.

This whale exercise of swapping BTC for ETH may have an effect on dealer sentiment. It could drive ETH’s price higher and inflict losses on quick positions.

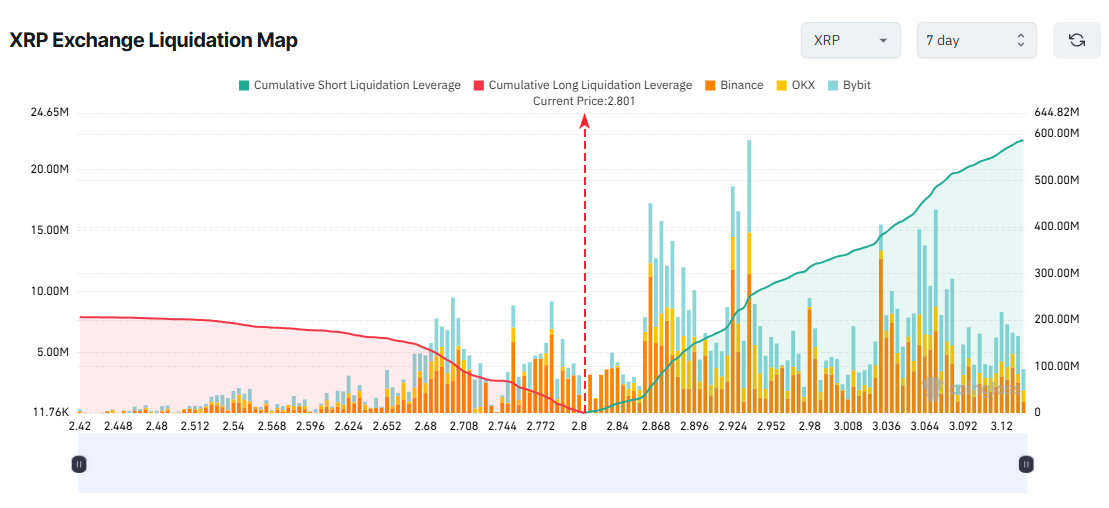

2. XRP

XRP’s 7-day liquidation map exhibits a extreme imbalance. Brief liquidations far outweigh lengthy liquidations. Many short-term merchants look like betting closely on XRP’s decline within the first week of September.

If XRP climbs to $3, over $500 million in brief positions could be liquidated. In distinction, if XRP falls to $2.42, solely about $200 million in lengthy positions would face liquidation.

From a technical perspective, analysts warn that the present $2.70 stage acts as sturdy assist. Costs could rebound from right here, placing quick positions at excessive threat.

As well as, 15 XRP ETF purposes are nonetheless pending with the SEC. Any optimistic information concerning these ETFs may ignite a bullish wave amongst XRP buyers.

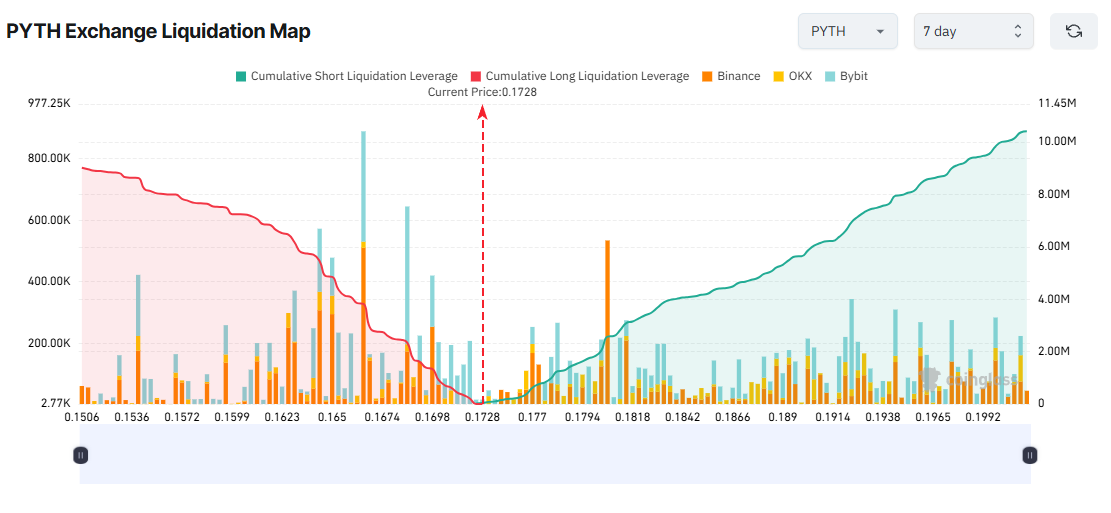

3. Pyth Community (PYTH)

On August 28, the US Division of Commerce shocked crypto buyers by partnering with Pyth and Chainlink to place GDP information on the blockchain. PYTH’s worth doubled in one day.

That optimistic sentiment seems to be spilling into September. Brief-term merchants are actively going lengthy on PYTH. They threat almost $9 million in losses if PYTH drops to $0.15 this week.

Charts present that lengthy liquidations speed up quicker as the value declines, mirrored by taller bars on the left facet of the distribution.

Conversely, if PYTH rises to $2 this week, collected quick liquidations may attain $10 million.

Excellent news could gas extreme short-term euphoria. But it may additionally set off a “promote the information” occasion, as early patrons take income. If that occurs, PYTH could bear a deeper correction than lengthy merchants count on.

The submit 3 Altcoins at Risk of Major Liquidations in the First Week of September appeared first on BeInCrypto.