After three consecutive weeks of inexperienced candles, the altcoin market cap (TOTAL3) began in crimson within the remaining week of August. Blended bearish and bullish indicators make this week essential in shaping the market’s path for the rest of the yr.

On this context, a number of altcoins have seen a surge in open curiosity, elevating the danger of large-scale liquidations.

1. Ethereum (ETH)

Ethereum just lately set a notable report in open curiosity, which is the whole worth of unsettled contracts, surpassing $70 billion on August 23, marking an all-time excessive, in accordance with Coinglass.

As of now, that determine stays close to $69.8 billion. This displays the depth of Ethereum’s derivatives market, the place merchants are closely betting with capital and leverage on short-term worth strikes.

On the identical time, excessive OI indicators a warning that ETH could face heightened volatility within the coming week.

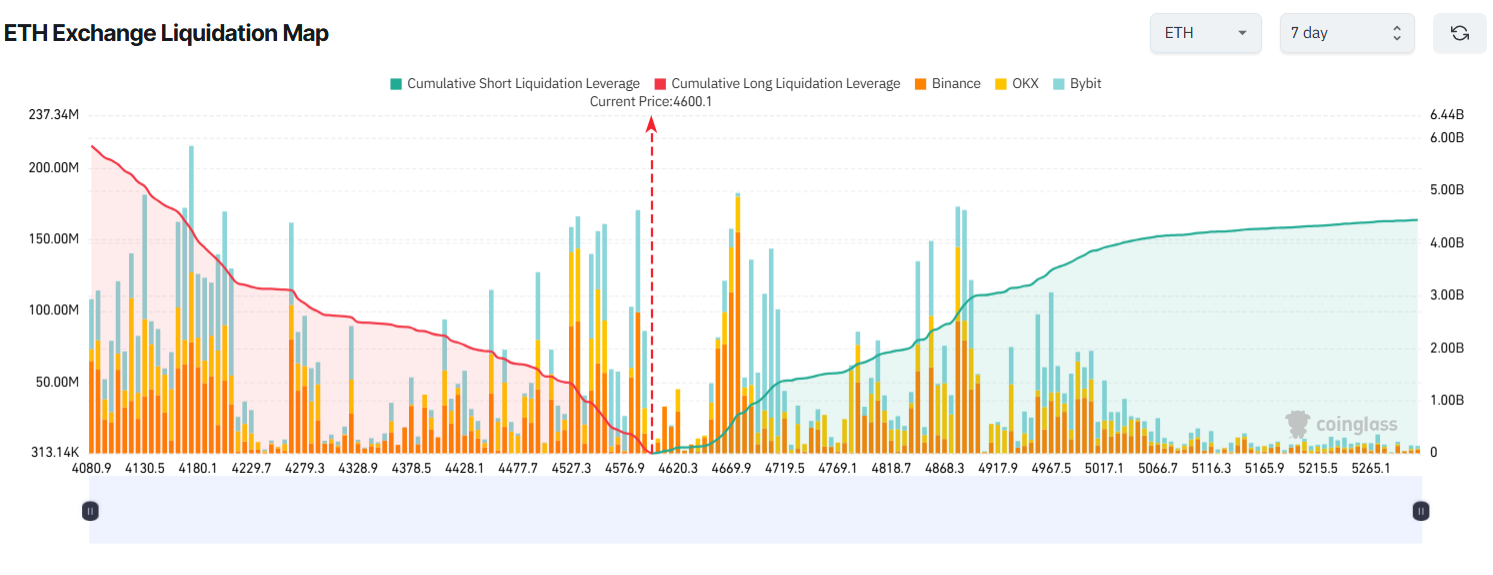

ETH’s seven-day liquidation map reveals that lengthy positions (crimson on the left) barely outweigh brief positions (blue on the best).

This imbalance stems from accumulation activity by major players, which has fueled constructive sentiment. Extra merchants are betting on an upside scenario, however their losses could possibly be bigger if they’re flawed.

If ETH continues its rally and climbs above $5,100 this week, brief liquidations might whole as much as $4.1 billion. Nevertheless, if the value strikes towards bullish expectations and drops under $4,100, lengthy liquidations might method $6 billion.

A current BeInCrypto evaluation revealed that older ETH holdings are being moved, a development usually tied to profit-taking. Moreover, Validator Queue data reveals greater than 846,000 ETH awaiting unstaking, which might circulate again into the market.

These components might set off a draw back transfer this week, placing lengthy positions in danger.

2. Dogecoin (DOGE)

Latest analyses of DOGE recommend the meme coin is forming a big symmetrical triangle sample. The ultimate week of August marks a crucial level as the value nears the triangle’s apex, the place a breakout will confirm the next trend.

Crypto analyst KALEO predicts DOGE could quickly break upward this week.

“Fast transfer again to $0.40 – $0.50 vary from right here. It’s time,” KALEO predicted.

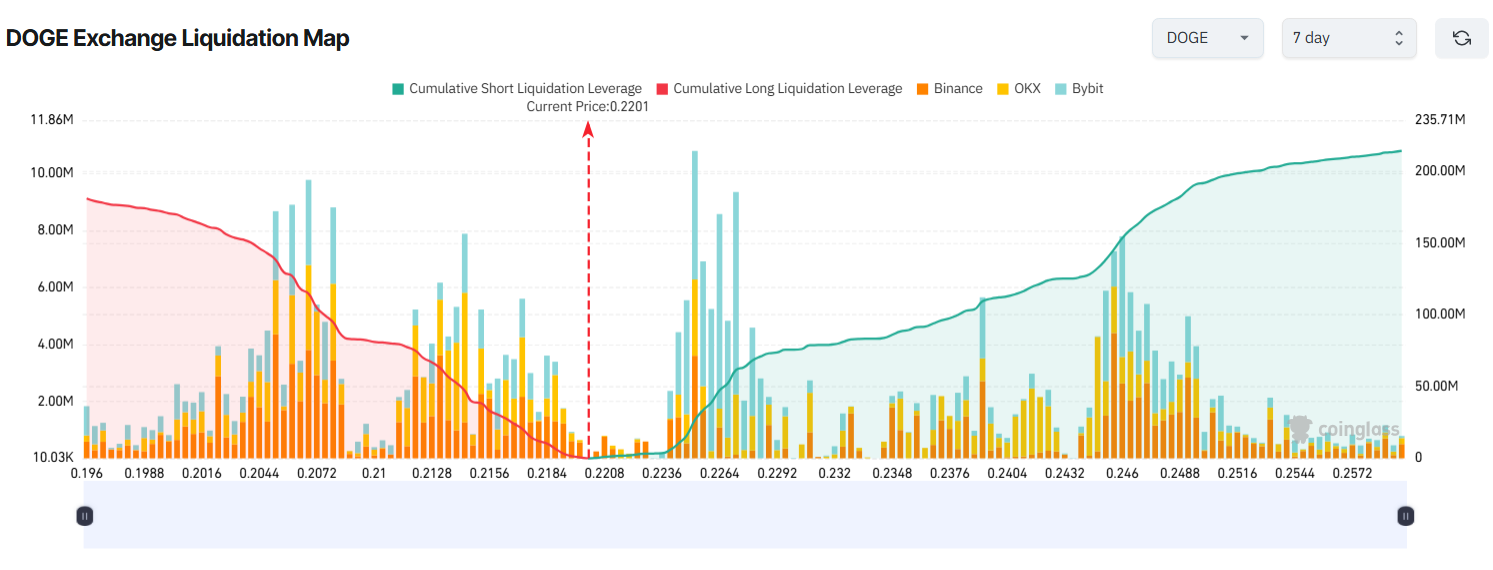

This outlook aligns with many buyers’ expectations, anticipating an altcoin season within the coming month. If DOGE climbs above $0.25 this week, brief liquidations might cross $200 million.

Conversely, if DOGE falls under $0.20, lengthy liquidations might exceed $170 million.

Presently, the whole brief liquidation quantity outweighs the lengthy liquidation quantity. DOGE’s 6% pullback on August 25 seems to have weakened earlier bullish sentiment.

3. Hyperliquid (HYPE)

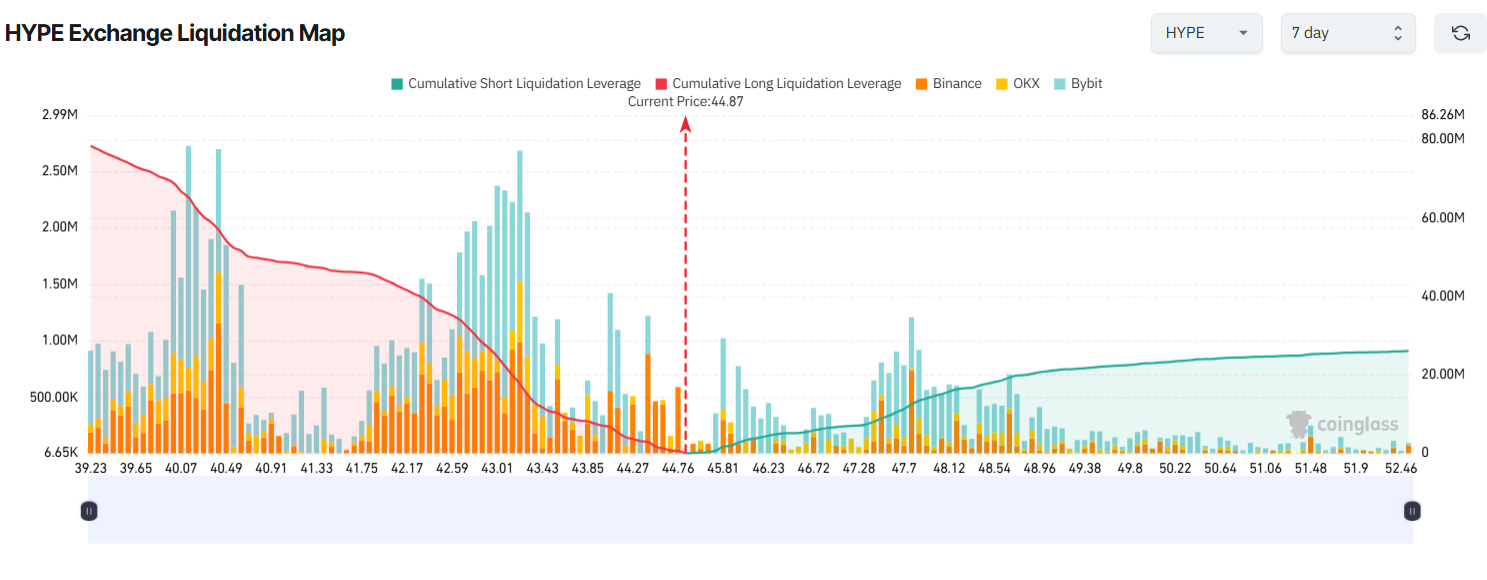

Hyperliquid’s (HYPE) liquidation map reveals a transparent imbalance, with lengthy liquidations closely outweighing shorts.

If HYPE drops to $39 this week, almost $80 million in lengthy positions could possibly be liquidated. Then again, a breakout above $50 might liquidate about $24 million in shorts.

This implies many merchants are betting on continued upside for HYPE. BitMEX founder Arthur Hayes even forecast a 126x worth enhance.

In the meantime, a brand new report from Syncracy highlighted a surge in Bitcoin spot buying and selling on Hyperliquid, surpassing volumes on main exchanges.

“Simply now, BTC spot on Hyperliquid did extra 24H quantity than Coinbase and Bybit mixed,” Syncracy Capital co-founder Ryan Watkins, said.

These components clarify why merchants stay closely skewed towards bullish bets on HYPE, creating a robust imbalance on its liquidation map.

The submit 3 Altcoins at Risk of Major Liquidations in the Last Week of August appeared first on BeInCrypto.