The altcoin market entered the third week of August within the purple. Market capitalization (TOTAL3) dropped 7%, from over $1.1 trillion to $1.03 trillion. This correction has fueled a short-selling sentiment amongst derivatives merchants.

How a lot liquidation danger does this pose? The liquidation heatmap highlights a number of altcoins going through excessive publicity.

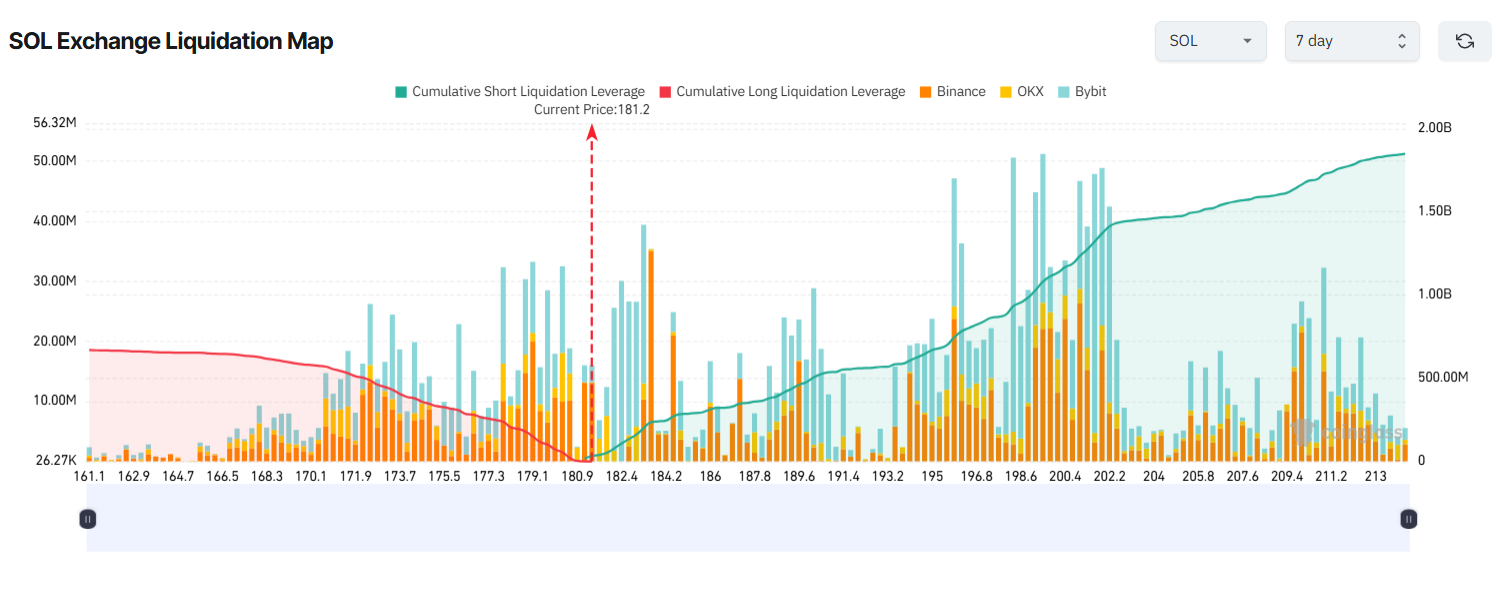

1. Solana (SOL)

Solana’s 7-day liquidation map exhibits that brief liquidation quantity (inexperienced on the best) dominates lengthy positions beginning within the third week of August. Nevertheless, brief positions might face dangers as Solana advantages from a number of bullish developments.

Particularly, Solana is reviewing a brand new governance proposal, SIMD-0326, which introduces the Alpenglow Consensus protocol to hurry up block finalization.

As well as, Solana announced a brand new document. The community processed over 104,000 transactions per second.

If SOL’s value recovers above $200 this week, greater than $1.1 billion briefly positions could possibly be liquidated. Then again, if SOL drops to $161, about $646 million in lengthy positions face liquidation.

Analysts warn of a extra regarding state of affairs. They predict SOL might fall beneath $170 earlier than bouncing again above $200 inside the identical week. This implies each lengthy and brief merchants might face liquidation dangers.

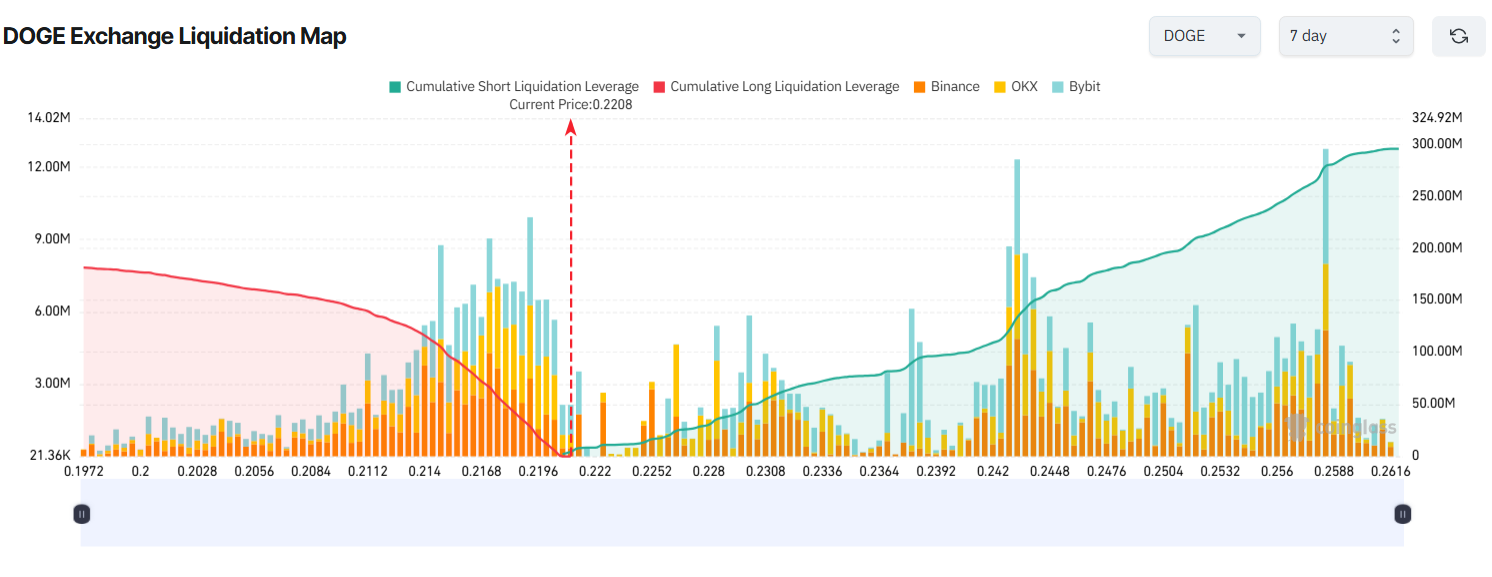

2. Dogecoin (DOGE)

Dogecoin (DOGE) is within the highlight in August as whales and buyers accumulate heavily.

As well as, Grayscale has filed with the US SEC to transform its $2.5 million Dogecoin Belief right into a spot ETF. In the meantime, crypto bettors on Polymarket now assign over a 70% probability that US regulators will approve a DOGE ETF by the top of the yr.

Regardless of this bullish information, DOGE’s liquidation map exhibits that brief positions dominate amassed liquidation quantity. Merchants appear to anticipate a correction. DOGE has already gained over 30% this month, climbing from $0.188 to $0.255.

If DOGE drops beneath $0.20 this week, amassed lengthy liquidations might exceed $176 million. Conversely, if DOGE climbs again to $0.26, round $290 million price of shorts can be liquidated.

Dealer Tardigrade argued that now is just not the time to stay bearish on DOGE. He predicted the coin could possibly be nearing a robust rally.

“Dogecoin’s ascending triangle units its mid-term goal at $1.8,” Dealer Tardigrade forecast.

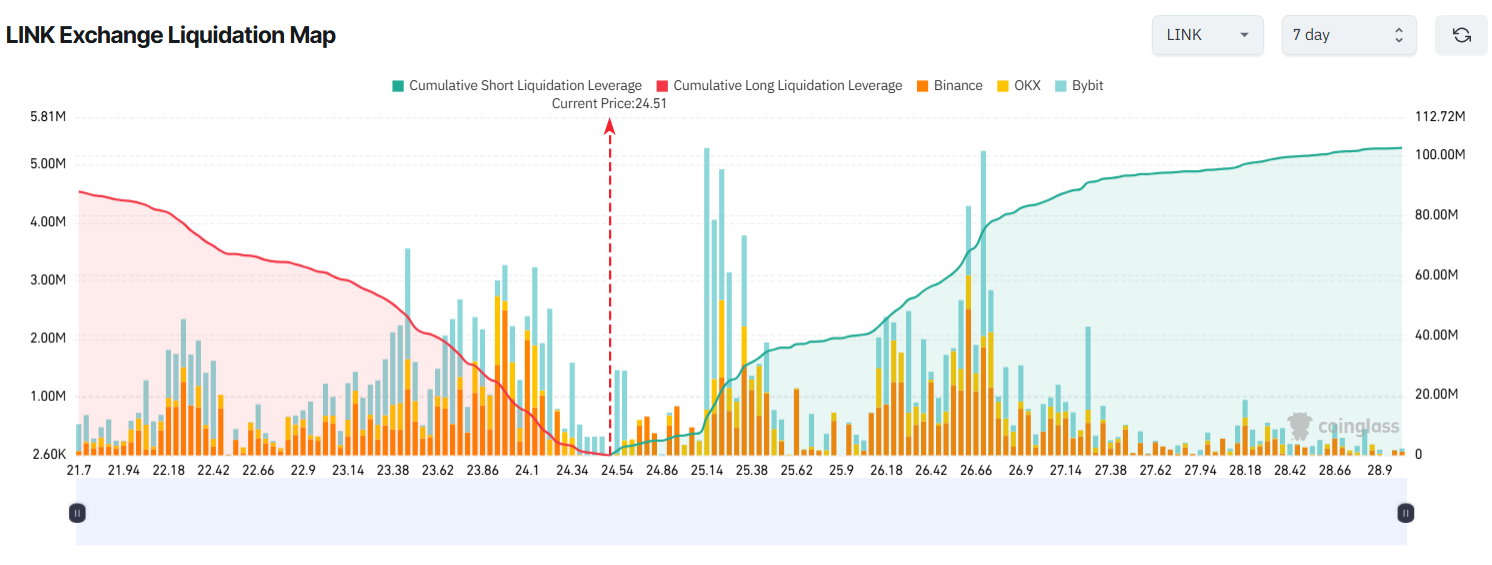

3. Chainlink (LINK)

Chainlink (LINK) is gaining mindshare in August. Buyers are excited concerning the Chainlink Reserve initiative introduced earlier this month.

A recent BeInCrypto report famous that whale wallets added greater than 1.1 million LINK up to now seven days.

Nevertheless, the identical report additionally revealed that LINK exchange reserves are rising again. This implies buyers are starting to take income after LINK’s greater than 50% rally because the begin of the month.

LINK’s liquidation map appears comparatively balanced as a result of each bulls and bears have robust incentives.

If LINK drops beneath $22, about $85 million in lengthy positions could possibly be liquidated. If LINK rallies to $27, round $85 million in shorts would face liquidation. The worth vary is identical, and the liquidation quantity is sort of equivalent.

In the meantime, market sentiment stays greedy on the time of writing, whereas the altcoin season index stands at 51 points.

The publish 3 Altcoins at Risk of Major Liquidations in the Third Week of August appeared first on BeInCrypto.