A number of altcoins have caught the eye of analysts this July. These cash have acquired constructive information, however their value efficiency has not but mirrored that momentum.

They could be undervalued or just missing a small push in investor sentiment to set off a powerful rally. This text highlights three such altcoins, based mostly on the most recent information and knowledgeable opinions.

1. Theta Community (THETA)

Michaël van de Poppe, a well known crypto analyst, believes that THETA, the native token of Theta Network, is considerably undervalued regardless of the mission’s sturdy fundamentals.

He famous that THETA is presently in an accumulation zone on the long-term chart. If the constructive pattern continues, he predicts the token may climb as a lot as 280%, a considerable achieve for traders.

Michaël emphasised the current constructive information about Theta Community’s strategic partnership with FC Seoul. This soccer membership is the primary within the Okay League to undertake next-gen AI Brokers powered by Theta Community.

“It’s one other reminder that tasks are considerably undervalued as they’re essentially growing a lot. From a TA perspective, THETA is consolidating on the next timeframe help degree. That is essential, because it signifies that that is the place consumers are stepping in,” Michaël van de Poppe said.

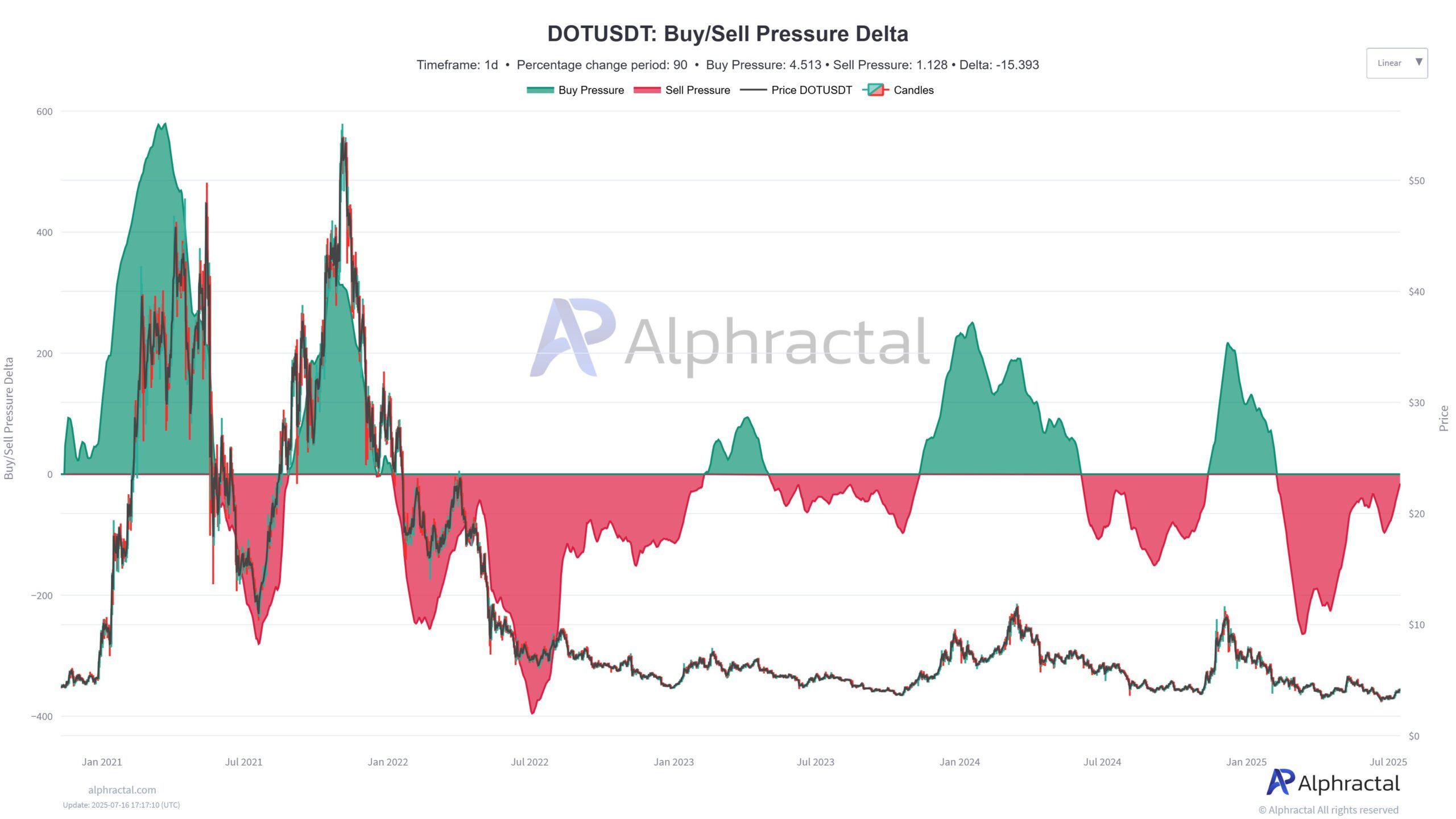

2. Polkadot (DOT)

Polkadot (DOT) is one other altcoin below shut watch, particularly after Grayscale removed it from its Digital Large Cap Fund in July 2025. This choice triggered damaging sentiment amongst traders and restricted DOT’s restoration momentum.

Nonetheless, analyst Joao Wedson believes DOT is within the ultimate stage of its accumulation part and should escape quickly.

By monitoring the Purchase/Promote Stress Delta, Joao noticed that this metric is shifting from damaging towards zero. This suggests that promoting strain is weakening whereas shopping for strain is beginning to dominate.

“DOT is about to exit an accumulation part quickly. Disregard the upcoming volatility or undesirable lengthy liquidations. I don’t see some other path for Polkadot than going up!” Joao Wedson predicted.

One other analyst on X, Hardy, agrees with this outlook. He believes DOT is undervalued, is near breaking out of its accumulation zone, and that now is an efficient time to purchase earlier than it probably rallies to $10 or past.

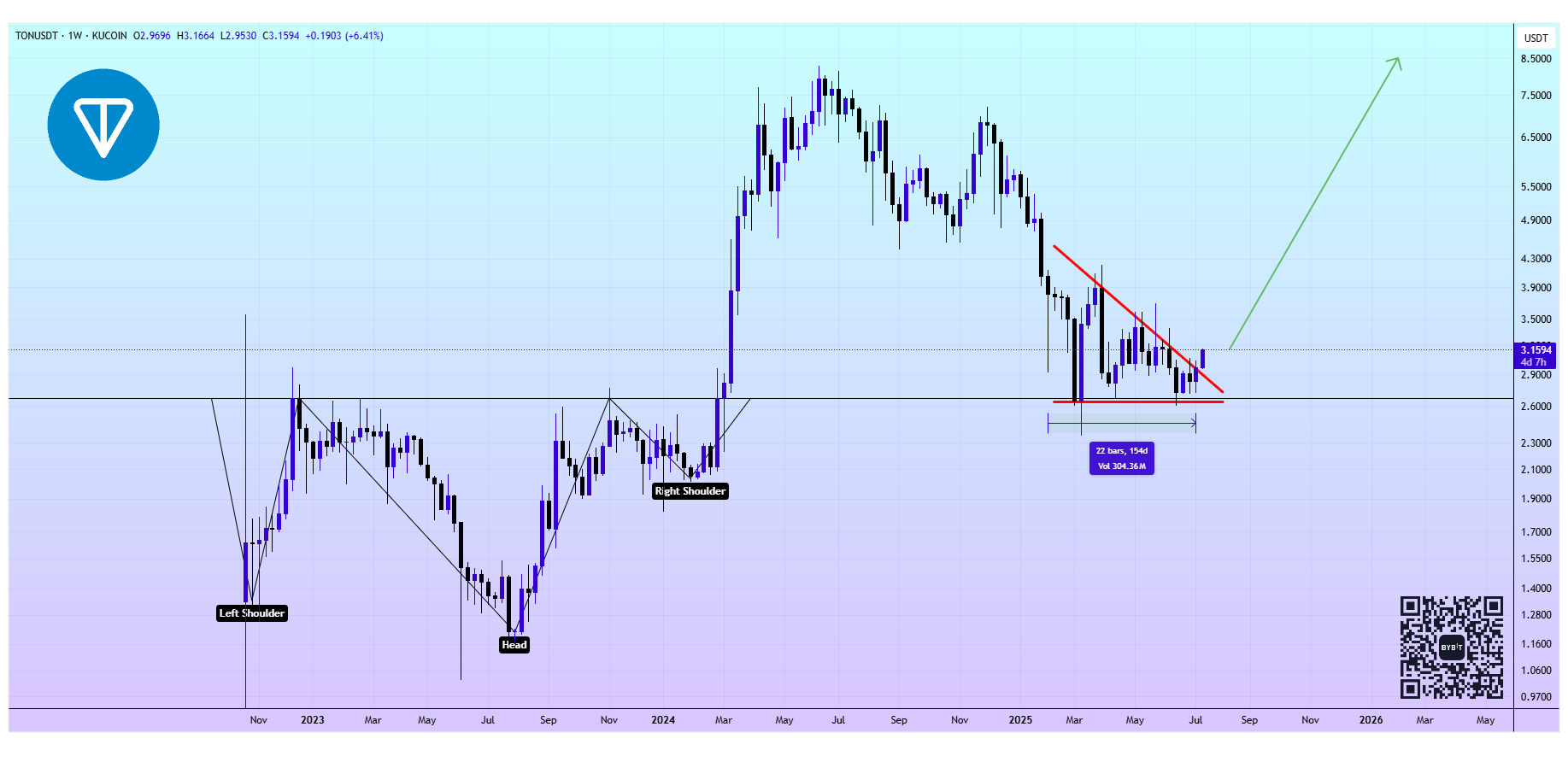

3. Toncoin (TON)

The most recent constructive growth for TON got here on July 15, when the TAC blockchain launched its mainnet on the TON network.

TAC is a blockchain designed to combine decentralized purposes (dApps) utilizing the Ethereum Digital Machine (EVM) with the TON ecosystem and Telegram. This integration leverages Telegram’s person base of over 1 billion individuals, which is useful to either side.

TON’s value efficiency has been lackluster to date this 12 months. Nonetheless, investor Alex Clay believes the coin is breaking out from a descending triangle sample to the upside.

“It’s backside for TON. 154 Days of Accumulating within Triangle above the Key Stage,” Alex Clay predicted.

Regardless of the gradual progress, TON has held above $2.7 and hasn’t shaped decrease lows. Glassnode’s Price Foundation Distribution information shows that most of TON’s supply was accrued beneath $3.

With the value surpassing $3 in July, many analysts believe the buildup part is sort of full, suggesting that TON could also be poised for a powerful rally within the second half of the 12 months.

As of this writing, Bitcoin Dominance has dropped to 62.4%, its lowest since Could. A falling dominance fee is a key sign for an incoming altcoin season, supporting the possibility of broader altcoin recovery this month.

Disclaimer

In adherence to the Trust Project pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed info. Nonetheless, readers are suggested to confirm details independently and seek the advice of with an expert earlier than making any choices based mostly on this content material. Please observe that our Terms and Conditions, Privacy Policy, and Disclaimers have been up to date.