The Bitcoin STH-SOPR (EMA-30) has now returned above a price of 1 for the primary time in 4 months, an indication that might show to be bullish for the value of the crypto.

Bitcoin Quick-Time period Holder SOPR Has Damaged Above 1 Not too long ago

As identified by an analyst in a CryptoQuant post, the BTC STH-SOPR is presently forming a sample that has traditionally been bullish for the coin.

The “Spent Output Profit Ratio” (or the SOPR briefly) is a Bitcoin indicator that tells us whether or not cash out there are promoting at a revenue or at a loss proper now.

The metric works by wanting on the historical past of every coin being offered and checking whether or not the value it final moved at was lower than the present a number of than it.

When the worth of this indicator is above one, it means buyers are, on common, promoting their Bitcoin at a revenue proper now.

Associated Studying | Possible Timelines For Bitcoin To Hit $100k: Why CEOs See Bullish Signs

However, SOPR values beneath one indicate general losses are being realized within the BTC market in the mean time.

A modified model of this indicator takes into consideration solely these buyers who held their cash for lower than 155 days earlier than promoting them. This group of buyers is named the short-term holders (STH).

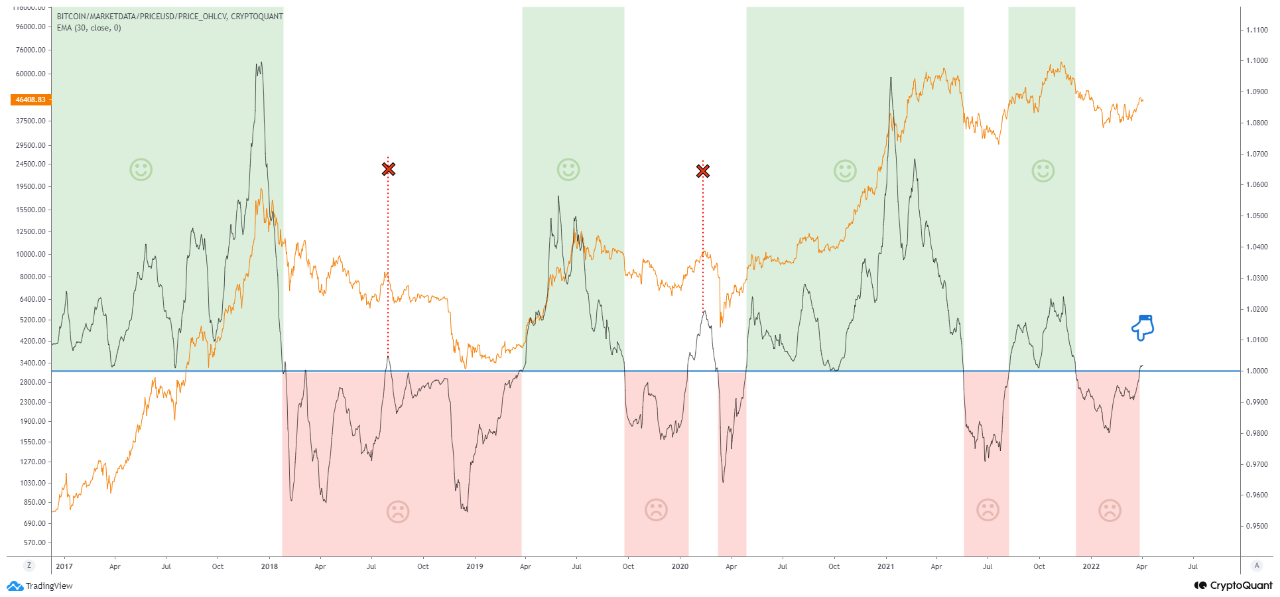

Now, here’s a chart that reveals the development within the Bitcoin STH-SOPR (EMA-30) over the previous few years:

Seems to be like the worth of the metric has risen above one just lately | Supply: CryptoQuant

As you’ll be able to see within the above graph, the Bitcoin STH-SOPR (EMA-30) appears to have adopted a sample during the last 5 years.

It appears to be like like throughout bearish intervals, the indicator has all the time had a price lower than one. Whereas bullish traits have occurred whereas the metric has had a price larger than one.

Not too long ago, the STH-SOPR has damaged above 1 as soon as once more after staying beneath the brink for practically 4 months since December of 2021.

Associated Studying | Data Shows Bitcoin Investors Afraid To Take Risk As Leverage Remains Low

If the sample from earlier than holds true now as properly, then this breakout could recommend that Bitcoin will rally in the direction of not less than an area prime quickly.

Nonetheless, such an uptrend could not final too lengthy. Within the chart, there are two areas the place the metric did break above 1 and the value rallied some, earlier than persevering with the bearish development and the STH-SOPR returned to loss values.

BTC Value

On the time of writing, Bitcoin’s price floats round $46.1k, down 2% previously week. The beneath chart reveals the current development within the worth of the coin.

BTC's value appears to have moved sideways over the previous few days | Supply: BTCUSD on TradingView

Featured picture from Unsplash.com, charts from TradingView.com, CryptoQuant.com