Cause to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade specialists and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Ethereum has confronted large promoting stress and volatility over the previous month as the complete crypto market developments downward, pushing ETH towards essential demand ranges. With uncertainty dominating the market, merchants stay cautious as Ethereum struggles to reclaim misplaced floor.

Associated Studying

Analysts anticipate much more volatility following US President Trump’s govt order on Thursday, which established a Strategic Bitcoin Reserve. Whereas the announcement was anticipated to spice up market sentiment, it launched extra uncertainty, leaving traders not sure of its long-term influence on the crypto house.

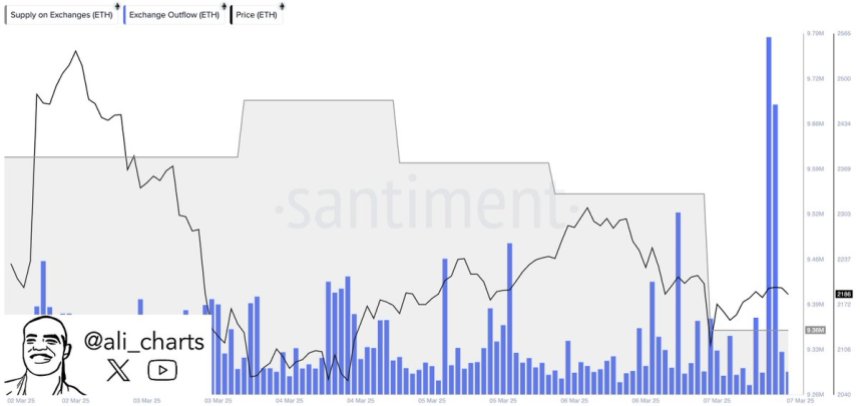

Regardless of the continued decline, on-chain knowledge from Santiment reveals a bullish sign—330,000 Ethereum have been withdrawn from exchanges previously 72 hours. Such giant outflows usually point out traders shifting ETH into personal wallets, suggesting decreased promoting stress and attainable long-term accumulation.

With Ethereum hovering at key assist ranges, the approaching days shall be crucial in figuring out whether or not ETH stabilizes or faces additional draw back. If market sentiment improves and trade outflows proceed, Ethereum may see a powerful restoration. Nevertheless, if promoting stress persists, one other leg down stays a risk, maintaining merchants on excessive alert.

Ethereum Faces A Important Check

Ethereum has misplaced over 50% of its worth since late December, triggering large concern and panic promoting throughout the market. As soon as a number one drive in crypto rallies, ETH is now struggling to regain momentum, leaving traders questioning whether or not the long-awaited altseason will materialize this yr. Many analysts speculate that it gained’t, as Ethereum and most altcoins proceed to wrestle, unable to reclaim bullish settings or set up a transparent restoration development.

Regardless of the bearish sentiment, there may be nonetheless hope for a rebound, as on-chain knowledge suggests potential bullish catalysts. Ali Martinez shared Santiment knowledge, revealing that 330,000 Ethereum have been withdrawn from exchanges previously 72 hours. This important outflow may point out that traders are shifting ETH into personal wallets, lowering fast promoting stress and probably setting the stage for a provide squeeze.

A provide squeeze happens when the out there provide of an asset on exchanges decreases, making it more durable for sellers to push costs decrease. If Ethereum continues to carry key demand zones and shopping for stress will increase, the decreased trade provide may drive a powerful restoration towards greater worth ranges.

Associated Studying

For now, merchants are watching whether or not ETH can stabilize and reclaim crucial resistance ranges. If bulls regain momentum, Ethereum may begin a restoration development within the coming weeks. Nevertheless, if promoting stress persists, one other wave of downward motion stays a risk, maintaining the market on edge. The following few days shall be essential in figuring out Ethereum’s short-term path and whether or not the current trade withdrawals sign a turning level for ETH.