Crypto market crash began in the course of the early Asia hours on Monday, with the highest three cryptocurrencies Bitcoin (BTC), Ethereum (ETH), and XRP plunging 7-12%. The worldwide crypto market cap additionally tumbled greater than 7% from $3.61 trillion to $3.35 trillion, that’s $260 billion erased from the crypto market in slightly below 24 hours.

Furthermore, the Crypto Worry & Greed Index has dropped from Greed to Impartial at 55 immediately, indicating a slight adverse sentiment amongst buyers.

Crypto Market Crash: Causes Why Bitcoin, ETH, XRP & Altcoins Falling Sharply

Bitcoin price today at present trades at $98K, down 7% in the previous few hours. Different the opposite hand, ETH worth has tumbled to $3000 and XRP corrects 12% to $2.78. The crypto market crash sees no indicators of slowing as specialists predicted additional dropdown in costs.

1. China Releases DeepSeek – A Rival to OpenAI’s ChatGPT

Chinese language startup DeepSeek’s AI assistant overtook rival ChatGPT to grow to be the top-rated free software on Apple’s App Retailer in the USA, reported Reuters on January 27. The DeepSeek-V3 mannequin used Nvidia’s H800 chips for coaching, spending lower than $6 million.

DeepSeek has left a deep impression on Silicon Valley. Because of this, US inventory futures tied to S&P 500 slipped 1.30%, the Nasdaq 100 misplaced 2.3%, and the Dow Jones industrial common is down 0.80% on account of panic immediately forward of quarterly outcomes on account of be launched this week by 4 of the “Magnificent 7” shares.

Forbes predicts that NVIDIA inventory might fall as DeepSeek’s AI mannequin problem AI management of the USA with OpenAI’s ChatGPT.

2. FOMC Assembly and Donald Trump’s Tariff

Merchants have gotten extra cautious amid rising inflation and robust jobs knowledge indicated a strong United States financial system. Considerations over inflationary tariffs beneath President-elect Donald Trump have additionally fueled a cautionary outlook. This has given the Federal Reserve extra room to delay additional charge cuts throughout its rate of interest resolution on Wednesday.

At the moment, CME FedWatch tool signifies there’s a 99.5% likelihood of the Fed conserving the rate of interest unchanged at 4.25%-4.50% in the course of the January 29 assembly. The US Federal Reserve’s financial coverage resolution and Jerome Powell’s feedback would be the key for the inventory and crypto markets.

In the meantime, the US greenback index (DXY) has jumped to 107.74 indicating a strengthening greenback. Additionally, the 10-year Treasury yield decreased barely to 4.569%. Notably, BTC worth often strikes in reverse to DXY and US Treasury yields.

3. Crypto Market Crash: $1 Billion In Bitcoin, ETH, XRP and Crypto Liquidated

Coinglass data signifies over $800 million in crypto liquidations, with 290K merchants liquidated within the final 24 hours. The most important single liquidation order of BTCUSDT valued at $98.46 million occurred on crypto alternate HTX.

Almost $900 million lengthy and $100 million brief positions have been liquidated, with BTC, ETH, SOL, DOGE, XRP, UNI and ADA are main the liquidations. Within the final 12 hours, $800 million in longs have been liquidated inflicting the crypto market crash.

4. $9.5 Billion in Bitcoin and Ethereum Choices Expiry

As per Deribit, 78K BTC choices with a notional worth of $7.7 billion are set to run out on Friday, with a put-call ratio of 0.70. The max ache level is $98,000, indicating excessive odds of additional crash. The month-to-month BTC choices expiry all the time recorded excessive volatility and shift adjustments in market sentiments.

Furthermore, 565K ETH choices with a notional worth of virtually $1.8 billion are set to run out, with a put-call ratio of 0.41. The max ache level is $3,400, which is increased than the present worth of $3,073. Merchants should keep watch over drastic adjustments in buying and selling volumes because the crypto market crash may end up in an additional fall in ETH costs.

5. On-Chain Knowledge Exhibits Non permanent Bearish Indicators

BTC on-chain knowledge alerts weak point because the 30-day MVRV ratio metric reaches the hazard zone. BTC worth is extra prone to fall and consolidate as MVRV ratio rises, indicating trades that it’s time to guide income.

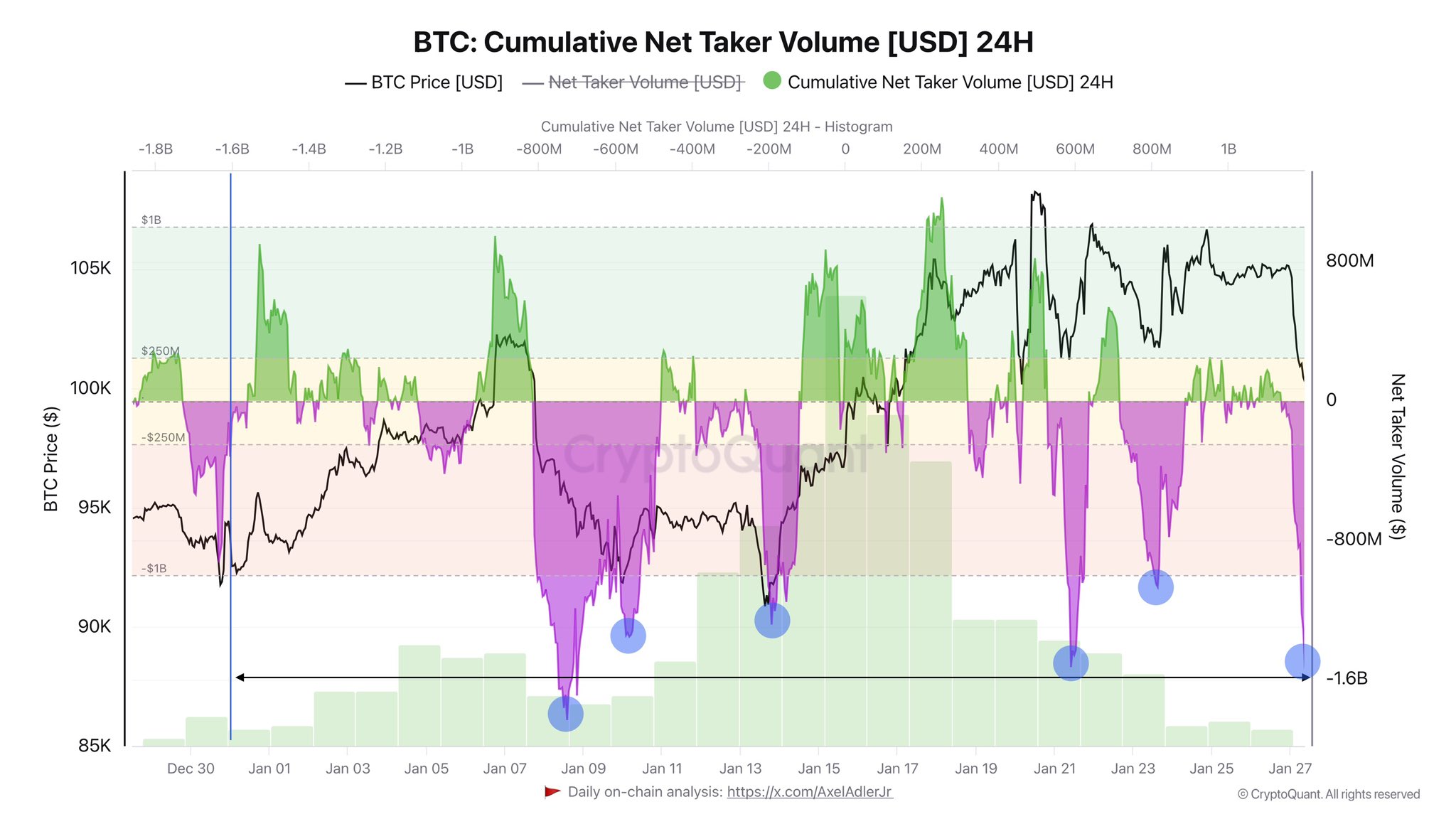

Furthermore, on-chain analyst Axel Adler Jr revealed the Taker order bearish stress stands at $1.6 billion over the previous 24 hours, which is an especially excessive degree for the previous month. He added that the final time it was increased at $1.8 billion in early January.

Disclaimer: The introduced content material might embrace the private opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any accountability to your private monetary loss.

✓ Share: