The worldwide crypto market cap fell greater than 5% to $1.66 at this time. Prime cryptocurrencies Bitcoin, Ethereum, BNB, Solana, XRP, Cardano, and others tumble 5% in simply an hour. BTC value fell 7% to under the $41,000 stage, erasing the positive aspects on after New Yr’s Day. However, Ethereum (ETH) value fell 8% to successful of $2,200.

The crypto market noticed over $600 million in liquidation within the final 24 hours, with $500 liquidated in simply an hour. Coinglass information point out large longs liquidation of over $$561 million at this time, January 3. Greater than 176K merchants had been liquidated within the final 24 hours, with the biggest single liquidation order on Huobi’s BTCUSDT price $14.26 million.

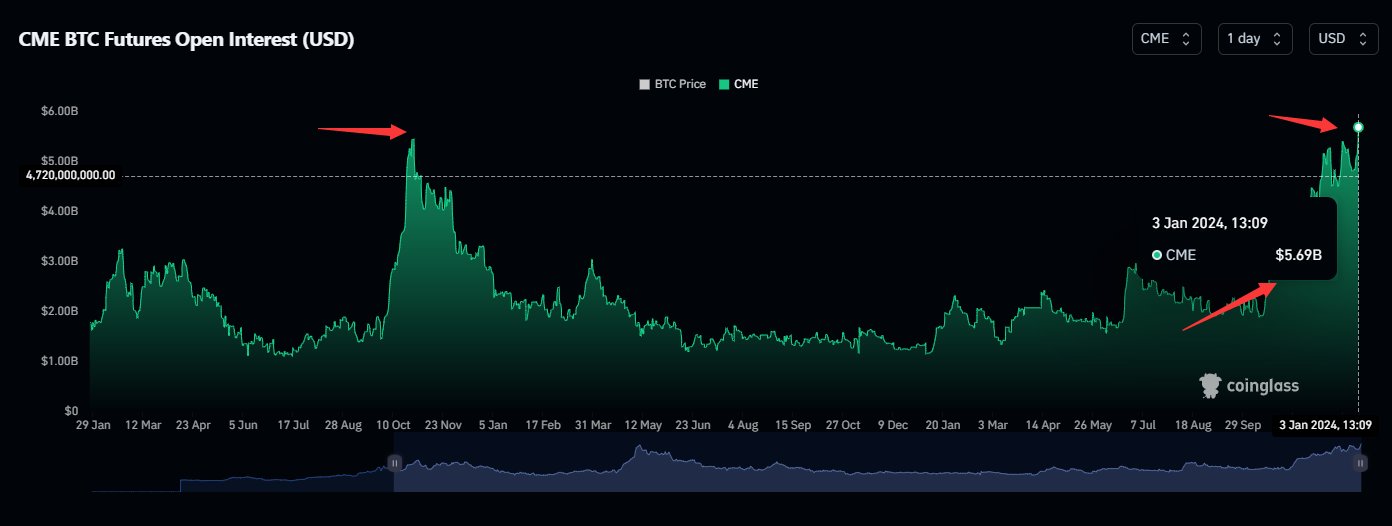

CME Bitcoin Futures OI Slips From Hit Document Excessive

International derivatives market Chicago Mercantile Alternate (CME), which overtook crypto trade Binance when it comes to Bitcoin futures buying and selling in November final 12 months. CME Bitcoin futures open curiosity (OI) hit a report excessive of $5.69 billion on Wednesday amid spot Bitcoin ETF approval hype and FOMO after BTC value.

Coinglass on January 3 reported Bitcoin futures open curiosity (OI) on CME hitting a brand new excessive of $5.69 billion. The final time CME Bitcoin futures open curiosity hit an all-time excessive was in October 2021 when BTC value was buying and selling above $60,000. Within the subsequent two months, BTC value tumbled under $40,000.

As well as, the whole Bitcoin futures OI on all exchanges dropped by 9% to $18.17 billion from $20.23 billion. Within the final 4 hours, CME BTC OI fell by 6% and 16% on Binance. Additionally, BTC choices information signifies that places are regularly rising within the final 24 hours, indicating a promoting by choices merchants.

In the meantime, Matrixport has shaken the crypto neighborhood with a daring forecast on Bitcoin value and SEC’s resolution on Bitcoin Spot ETF. In keeping with the newest report, the U.S. Securities and Alternate Fee (SEC) is anticipated to reject all Bitcoin spot ETFs in January, probably triggering a pointy decline in Bitcoin’s worth to as a lot as $36,000.

Additionally Learn: Bitcoin Bull Cathie Wood’s Ark Invest Extends Coinbase And Robinhood Selling Spree

The introduced content material could embrace the private opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any accountability to your private monetary loss.

✓ Share: