Though Ethereum is not the one good contract enjoying within the house, it has maintained dominance available on the market. This has led to a rise in adoption within the Ethereum blockchain, with the vast majority of builders selecting to deploy their decentralized purposes (DApps) on the blockchain to achieve probably the most publicity. As such, DeFi has boomed on the blockchain.

DeFi on the Ethereum ecosystem has not proven any indicators of slowing down quickly. The business that has been booming for a few yr now has continued its sizzling streak into the final lap of 2021. On high of the expansion that has been recorded to this point within the yr, TVL (Complete Worth Locked) on the community has been on the rise.

Associated Studying | TIME Magazine Will Hold Ethereum On Balance Sheet As Part Of New Deal

Layer 2 TVL Surges To New Excessive

Layer 2 protocols have been rising in recognition among the many Ethereum neighborhood as a result of providers that they provide and the decrease price on transactions utilizing these providers. As such, extra traders have moved over to Layer 2 options like Arbitrum to entry these perks. Because the variety of customers of those options has risen, so has the variety of funds locked in them.

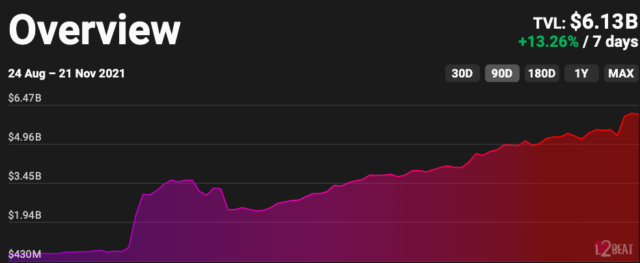

Up to now 7 days, the TVL on Ethereum Layer 2 solutions has risen to a new all-time high. The worth hit $6.16 billion after rising 13.26% within the house of every week. This represents a major enhance in funding within the options as they change into well-known.

Layer 2 TVL hits new ATH | Supply: L2Beat.com

Arbitrium primarily led the cost, accounting for 43% of the full TVL locked in Layer 2 options. DYdX advert Boba Community adopted with a complete of $975 million and $863 million respectively. Whereas Loopring positioned 4th with a complete of $580 million locked within the answer.

Ethereum Dominates DeFi House

Ethereum has maintained its place because the main DeFi platform within the crypto house. Earlier within the month, DeFi TVL had hit an all-time high of $275 billion. Most of this worth was contributed by Ethereum, which made up about 67% of the full quantity. Though different blockchains like Solana and Avalanche have tried to sneak up and steal market share from the community, it continues to dominate by a large margin.

Associated Studying | Ethereum Exchange Balances Plummet To Three-Year Lows As Market Recovers

Complete DeFi TVL has since dropped from its all-time excessive in early November however has remained near this determine. Presently, there’s a total of $260 billion in TVL in decentralized finance protocols, solely $15 billion lower than its ATH.

ETH worth struggles to carry above $4K | Supply: ETHUSD on TradingView.com

Ethereum dominates this house with a complete of $172.19 billion at the moment locked on the blockchain, representing a major market share. Others like Binance and Solana have seen considerably much less TVL. Nevertheless, these initiatives are beginning to win over the hearts of traders as a consequence of their decrease charges and quicker transaction occasions.

Featured picture from Finextra Analysis, chart from TradingView.com