The crypto market has returned to the inexperienced with Ethereum (ETH) main the restoration. The second crypto by market cap has seen bullish momentum on the again of a possible full transition to a Proof-of-Stake (PoS) consensus. The date for this occasion was introduced two days in the past.

Associated Studying | TA: Ethereum Outpaces Bitcoin, Why ETH Could Rise To $1,500

This course of might be accomplished with “The Merge”, an occasion set for September 19, 2022, with the target of mixing Ethereum’s execution layer with its consensus layer. ETH core builders have efficiently carried out this course of on the community’s principal testnet.

As uncertainty round “The Merge” mitigates, crypto buyers, develop more and more bullish. On the time of writing, Ethereum (ETH) trades at $1,480 with a ten% revenue within the final 24 hours and a 27% revenue prior to now week.

Within the crypto high 10 by market cap, solely ETH’s worth information such a rise. Bitcoin information a 7% revenue prior to now week, whereas XRP and Solana report a 12% and 15% revenue over the identical interval.

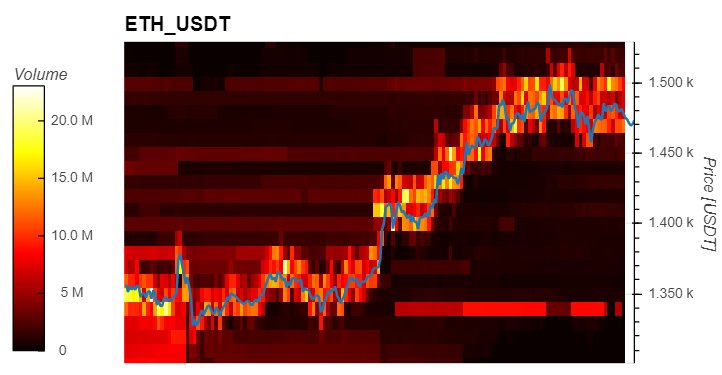

Knowledge from Materials Indicators exhibits liquidity for the ETH/USDT buying and selling pair has been trending upwards with the value of the cryptocurrency. When ETH’s worth broke above $1,350 it was in a position to shortly transfer into the $1,400 space.

This means that $1,300 has been flipped from resistance to assist making it a key stage in case of future draw back worth motion. As seen under, bids have been shifting up with ETH’s worth with over $7 million purchase orders at round $1,450 hinting at sustainable bullish worth motion.

Analyst Ali Martinez believes ETH printed a bullish four-hour candlestick when it broke under $1,300. At the moment, the cryptocurrency broke from a multi-month consolidation gaining sufficient momentum to reclaim ranges above $1,650.

The analyst believes ETH’s worth is heading in direction of this space with the potential to hit $1,670. The subsequent space to look at if ETH sees comply with by into this space is $1,700.

Why The $1,700 Are Essential For The Value Of Ethereum?

Further data offered by JarvisLabs hints at an vital shift in Ethereum market dynamics. The cryptocurrency noticed a flipped in its 30-day returns, used to measure the short-term revenue and loss for crypto buyers on this interval.

This metric has been trending in direction of 0% after shifting in detrimental territory for a number of months. In response to Jarvis Labs, a flip above 0% for Ethereum’s 30D returns might current buyers with a promoting alternative.

Associated Studying | XRP Must Breach This Key Level To Avert The Downturn

Prior to now, and through a bear market, at any time when ETH’s 30D returns skilled a interval of consolidation with a subsequent constructive flip within the metric, the cryptocurrency noticed extreme crashes. Under there’s a chart on what has occurred to ETH’s worth when it sees an identical efficiency, Jarvis Labs added:

If this fractal had been to replay itself all pumps as much as the $1700 stage will set off sell-offs for the subsequent 1 yr. Conversely, a flip of 1700 from resistance again to assist can be equal to summer season 2020’s flip of ~$350 and will sign the beginning of a model new bull run.