On-chain information exhibits each the Bitcoin leverage ratio and the futures open curiosity has spiked up just lately, an indication which will become bearish for the crypto’s value.

Bitcoin Estimated Leverage Ratio And Open Curiosity Surge Up

As identified by an analyst in a CryptoQuant, the BTC futures market appears to have been heating up through the previous day.

To know the leverage ratio, two different metrics have to be checked out first. They’re the “open curiosity” and the “derivatives alternate reserve.”

The open interest is an indicator that measures the entire quantity of contracts presently open on the Bitcoin futures market. The metric contains each quick and lengthy positions.

The opposite indicator, the derivatives alternate reserve, tells us in regards to the whole variety of cash presently current within the wallets of all derivatives exchanges.

Now, the previous metric divided by the latter provides us the “estimated leverage ratio.” What this indicator signifies is the typical quantity of leverage utilized by customers on derivatives exchanges.

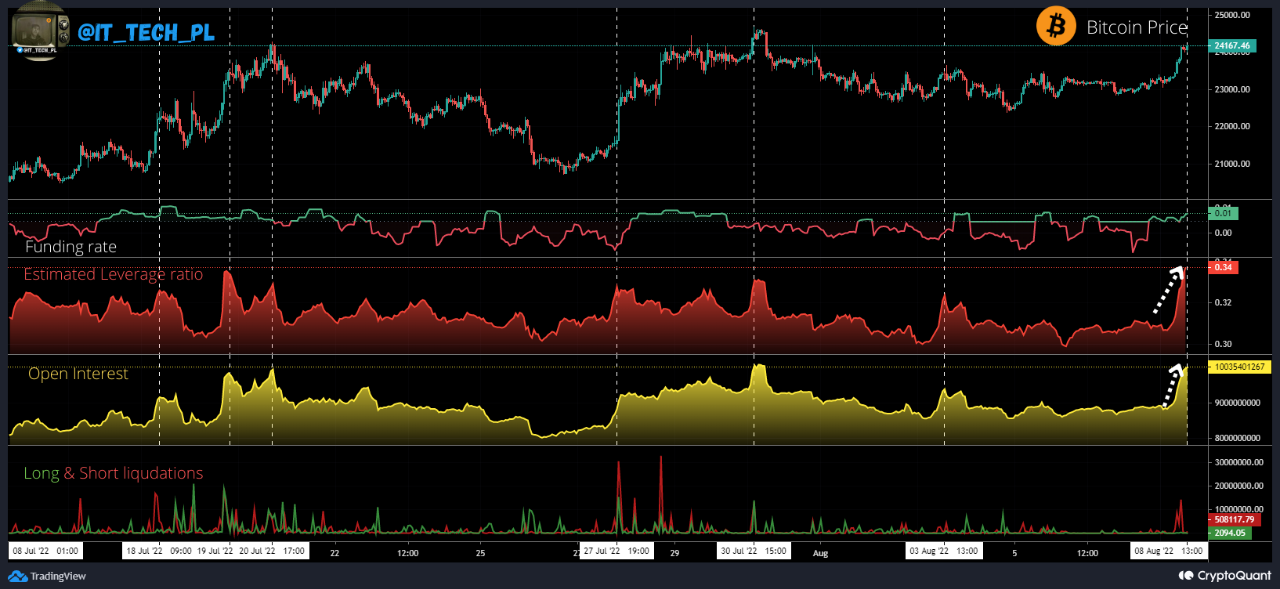

Here’s a chart that exhibits the development within the Bitcoin leverage ratio, in addition to the open curiosity, over the previous month:

The worth of the 2 metrics has sharply risen just lately | Supply: CryptoQuant

As you possibly can see within the above graph, each the Bitcoin leverage ratio and the open curiosity have spiked up over the past 24 hours as the worth of the coin has additionally noticed a surge.

Which means proper not solely is the typical leverage very excessive, but in addition the entire variety of positions are fairly huge.

The chart additionally contains information for the funding rate, one other indicator that tells us in regards to the ratio between lengthy and quick positions. It appears like presently its worth is constructive, suggesting that longs are extra dominant.

Traditionally, such a setup has usually result in increased volatility available in the market. It’s as a result of a excessive leverage means any value transfer will result in a large number of liquidations, which can additional enlarge the transfer in query.

This stretched value transfer in flip results in extra liquidations. When liquidations cascade collectively on this means, the occasion is named a “squeeze.”

Since there are extra lengthy positions available in the market proper now and the leverage is excessive, a protracted squeeze might occur. If it does happen, the most recent bullish momentum for Bitcoin could also be slowed down.

BTC Worth

On the time of writing, Bitcoin’s value floats round $23.9k, up 3% prior to now week.

Seems to be like the worth of the crypto has spiked up over the past day | Supply: BTCUSD on TradingView

Featured picture from Natarajan sethuramalingam on Unsplash.com, charts from TradingView.com, CryptoQuant.com