The Bitcoin value hit a three-month excessive at $19,104 yesterday. After the Client Value Index (CPI) for December 2022 was announced at 6.5% as anticipated, the market initially reacted cautiously and confirmed a pullback to beneath $17,900. Nevertheless, the bulls took over after that and posted the most important day by day candle in over 6 months.

Nevertheless, warning is suggested. Buyers ought to ask themselves if it is a bull entice or actually the start of a brand new bull run. To evaluate this, specialists are at the moment recommending varied information factors.

The Fed Guidelines It All

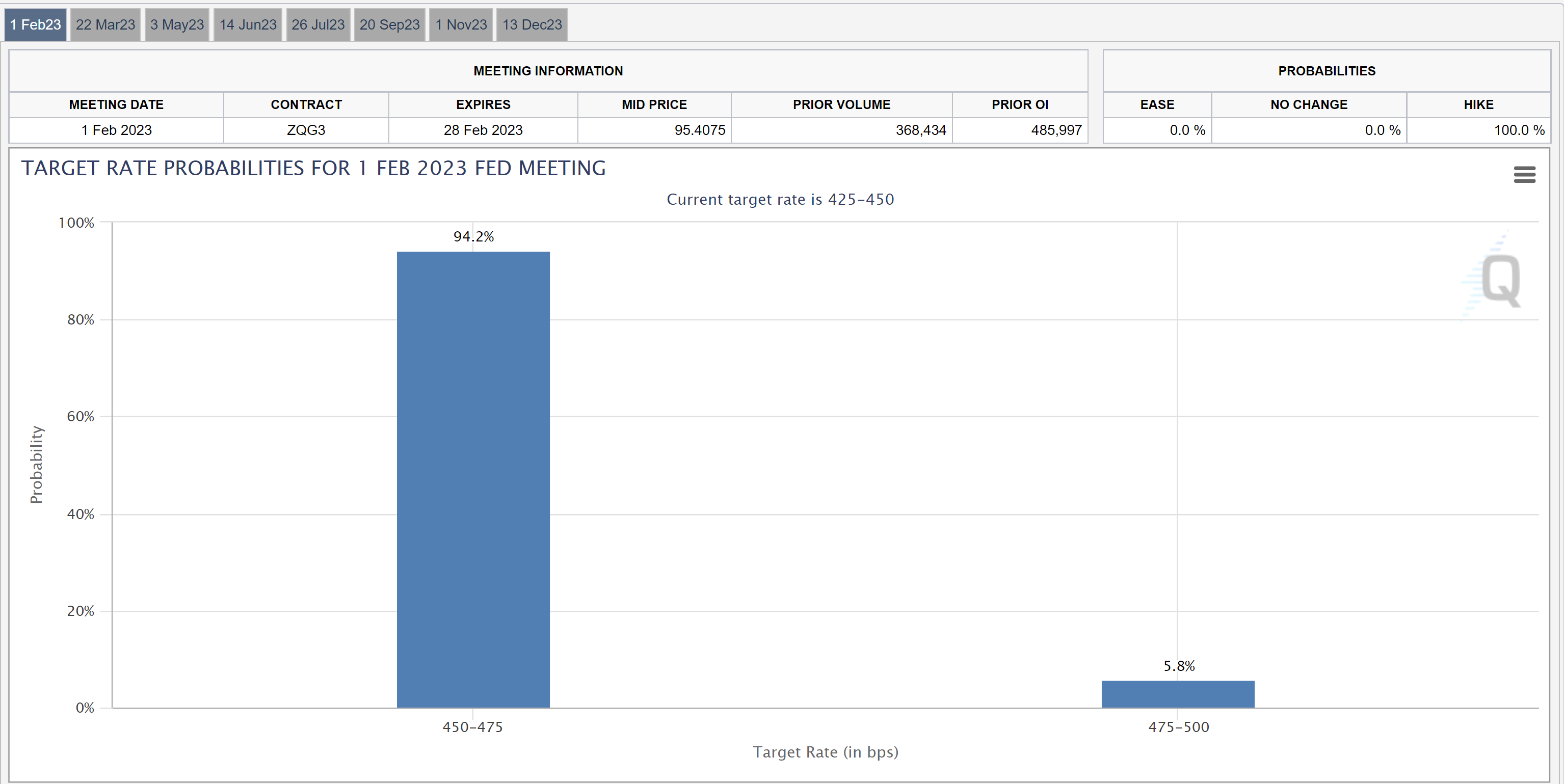

With December CPI information being within the books, the main target turns to February 1, when the Fed’s subsequent FOMC assembly is scheduled to happen. And in keeping with the FEDWatch device, specialists’ projections are exceedingly bullish. A whopping 94% anticipate the Fed to proceed to reduce its charge hike tempo and solely add 25 bps.

On that be aware, Carl Quintanilla, a journalist for CNBC and NBC Information, points to a Fundstrat World Advisors evaluation that “a whopping 59% of CPI parts at the moment are in outright deflation, a leap of 800bp in a single month… the bond market obtained it proper. Inflation is undershooting the Fed and consensus view.”

As well as, Fundstrat factors to the most recent Atlanta Fed wage tracker. 12 months-over-year, the studying fell to five.5% in December, the bottom degree since January 2022, which the monetary agency says is one other information level confirming that wage inflation has slowed sharply in latest months. Due to this fact, Fundstrat concludes:

We expect buyers will more and more come to the conclusion the Fed can declare ‘mission completed’ on inflation. And that is organising 2023 to be the other of 2022, the place inflation expectations fall quicker than EPS danger.

Even the Fed’s “mouthpiece”, chief economics correspondent of Wall Avenue Journal Nick Timiraos tweeted yesterday that December’s shopper value index is prone to preserve the Consumed course to cut back the speed hike to 1 / 4 of a share level.

Timiraos additionally quoted James Bullard, president of the St. Louis Fed, who mentioned that each one issues thought of, it might be higher to get to the utmost charge as quickly as attainable. However he additionally added, “in macroeconomic phrases, whether or not that’s accomplished at one assembly or one other might be not as necessary.” Till then, Bitcoin buyers can monitor extra information factors.

Bitcoin Value Going North? Watch This

Arguably, an important indicator is likely to be the U.S. Greenback Index (DXY). It’s well-known that Bitcoin’s value actions are strongly inversely correlated with the DXY. When the DXY is rising, Bitcoin is trending down. When the DXY falls, BTC exhibits a rally.

This was the case yesterday because the DXY continued to fall whereas Bitcoin posted sturdy beneficial properties. Nevertheless, the DXY is in a traditionally necessary help zone.

On this respect, it stays to be seen whether or not danger belongings like Bitcoin run right into a bull entice or whether or not the DXY falls beneath 101 within the weekly chart and turns help into resistance. If sure, BTC is greater than prone to rally.

Alistair Milne, CIO of the Altana Digital Forex Fund, additionally pointed out one other essential information level in Bitcoin’s weekly chart, sharing the chart beneath:

[Bitcoin] value displaying enormous divergence from growing relative power. When the weekly RSI goes oversold, it has beforehand a historic alternative earlier than a big transfer, signalling the top of the bear. Look what occurred Oct/Nov 2015 and Mar/Apr 2019.

Featured picture from iStock, Charts from TradingView.com