-

The IMF says Bitcoin’s excessive correlation with shares means it’s extra of a threat asset.

-

The monetary establishment requires higher international regulation of the ecosystem to cut back potential dangers to the remainder of the market.

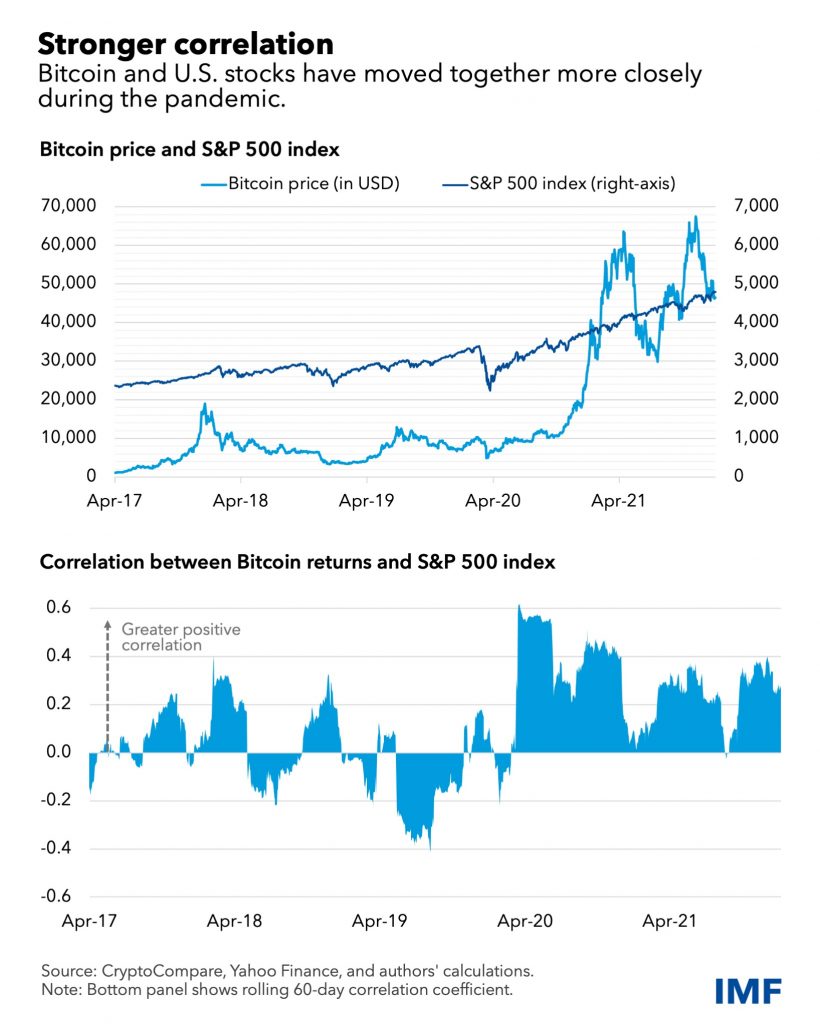

Bitcoin has outperformed the S&P 500 since 2017, with little to no correlation to the inventory indexes earlier than 2019 when the Covid-19 pandemic hit.

Since then, Bitcoin and different cryptocurrencies have largely moved in sync with the foremost shares on Wall Avenue.

After plummeting in March 2020, crypto and equities started to surge as traders returned to dangerous belongings, a state of affairs that now sees the Worldwide Financial Fund (IMF) say may pose contagion dangers to the broader monetary markets.

“The correlation coefficient of their each day strikes was simply 0.01[before 2020], however that measure jumped to 0.36 for 2020–21 because the belongings moved extra in lockstep, rising collectively or falling collectively,” the Washington DC-based monetary establishment mentioned.

Chart exhibiting a correlation between Bitcoin and the S&P 500. Supply: IMF blog

Chart exhibiting a correlation between Bitcoin and the S&P 500. Supply: IMF blog

Whereas the IMF report published on 11 January states that cryptocurrencies “are not on the perimeter of the monetary system,” it takes a unfavourable view of the correlation with shares.

The report claims that Bitcoin’s elevated adoption and the rising correlation it’s exhibiting with shares limits the supposed “threat diversification advantages” that see many traders choosing it over conventional protected have belongings similar to gold.

The correlation between Bitcoin and the S&P 500 is proven to be means increased than seen between shares and gold and main international currencies.

And the IMF says the lockstep buying and selling seen with the inventory market suggests Bitcoin is extra of a dangerous asset and never a hedge asset.

Based on the IMF, this places the markets at risk- particularly saying it threatens “contagion throughout monetary markets.”

In its evaluation, the establishment says any sharp declines throughout the Bitcoin market threaten threat aversion amongst traders. This, it provides, would possibly see traders aver from investing in shares.

“Spillovers within the reverse route—that’s, from the S&P 500 to Bitcoin—are on common of an identical magnitude, suggesting that sentiment in a single market is transmitted to the opposite in a nontrivial means,” the report added.

Pointing to systemic issues, IMF suggests the adoption of a worldwide regulatory framework focused at oversight and doubtlessly serving to to stem dangers to the monetary system.

In December, CNBC’s “Quick Cash” dealer Brian Kelly said Bitcoin and Nasdaq have been buying and selling in lockstep. He pointed to the 30-day correlation as having been round 47% on the time, with Bitcoin normally a number one indicator for the shares index.