Terra’s indigenous stablecoin, the TerraUSD (UST), was as soon as touted to be an engineering marvel within the blockchain sector. With its distinctive, twin token system–it behaved like another stablecoin which tracked the worth of the U.S. greenback–however with none precise money held in a reserve to again it. Nonetheless, current revelations inform a special story altogether.

Leap Buying and selling Propping UST Peg?

In response to a Securities and Exchange Commission (SEC) grievance submitted on Thursday, TerraUSD (UST) was backed at the very least as soon as in Could 2021 not by its algorithm however reasonably by the intervention of a “third celebration,” which dedicated to purchasing sizable quantities of UST to revive the $1 peg.

Learn Extra: Check Out The Top 10 DeFi Lending Platforms Of 2023

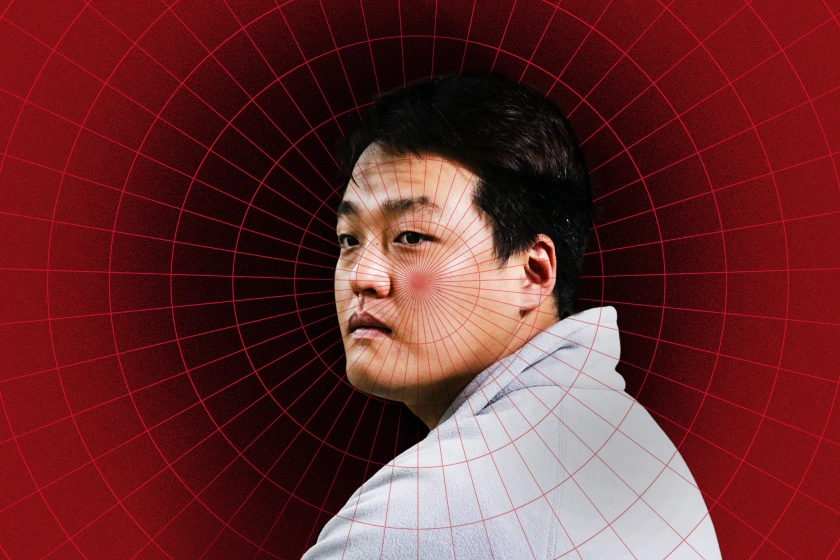

The latest data factors to Jump Trading as being the third celebration. Nonetheless, on the time of writing, the SEC has not filed any fees in opposition to Leap nor has it accused it of violating any rules. TerraUSD, generally referred to by its ticker UST, skilled a catastrophic failure in Could 2022, inflicting traders to lose tens of billions of {dollars}. Nonetheless, these claims from the SEC pertain to a de-pegging that took occurred one yr earlier. The assertion that Terraform Labs used human merchants to prop up its worth reasonably than the software program algorithm which claimed to again the system was on the middle of those allegations.

In its official complaint, the SEC was quoted as saying:

In Could 2021, when the worth of UST grew to become ‘unpegged’ from the U.S. greenback, Terraform, by way of Kwon, secretly mentioned plans with a 3rd celebration, the ‘U.S. buying and selling agency,’ to purchase giant quantities of UST to revive its worth.

It additional alleged that when UST’s worth moved again up because of these makes an attempt, the defendants erroneously and misleadingly represented to the general public that UST’s algorithm had successfully re-pegged UST to the greenback.

Luna As Compensation

Terrraform Labs, nevertheless, allegedly promised to repay within the type of LUNA tokens in alternate for Leap’s large buy of greater than 62 million UST to prop up the stablecoin. Even when the cryptocurrency was buying and selling for greater than $90 on the crypto market, Terraform Labs would promote it to Leap for under $0.40, which resulted in a revenue of virtually $1.28 billion for the company. However, the phrases of the settlement had been enhanced much more by Terraform with the intention to help in sustaining TerraUSD, based on the SEC. The buying and selling firm would now routinely accumulate tokens at a mere LUNC price (earlier LUNA) of forty cents.

The inefficiency of the algorithm that underpinned UST grew to become obvious roughly one yr later when, within the absence of intervention by Leap, the stablecoin de-pegged and went on a dying spiral, destroying each UST and its sister altcoin LUNA within the course of.

Additionally Learn: New AI Chatbot Emerges As Potential Rival, Sparks Debate Over ChatGPT’s Future

The introduced content material could embrace the non-public opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any accountability in your private monetary loss.