On-chain knowledge exhibits that Bitcoin buyers have shifted in the direction of aggressive accumulation just lately, one thing which will assist maintain the rally longer.

Bitcoin Accumulation Pattern Rating Has Tended In the direction of 1 Just lately

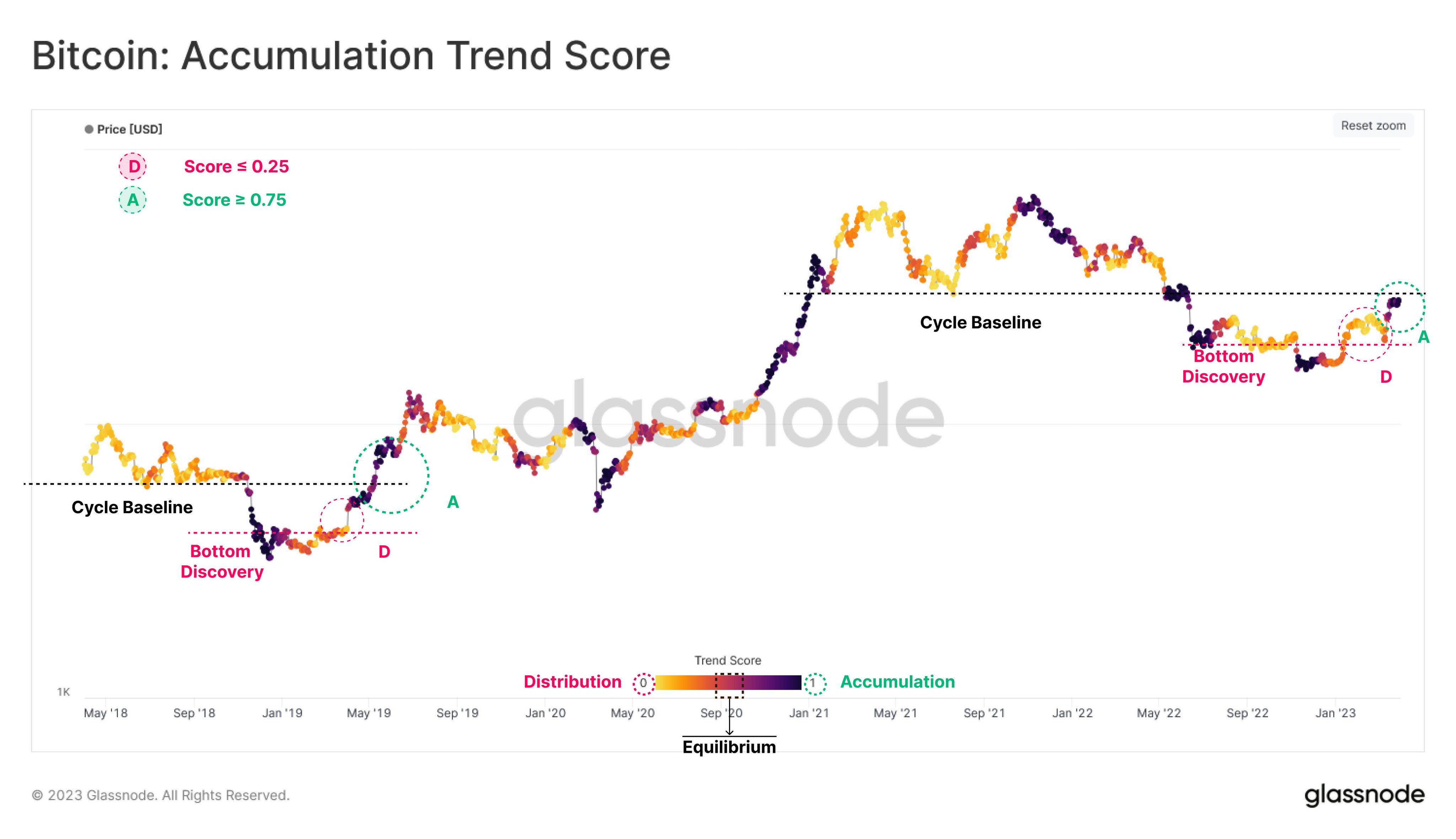

In accordance with knowledge from the on-chain analytics agency Glassnode, there’s a structural similarity forming between the present and 2018-2019 BTC cycles. The indicator of curiosity right here is the “accumulation trend score,” which tells us whether or not Bitcoin buyers have been accumulating or distributing over the previous month.

This metric’s worth represents not solely the variety of cash that the holders are promoting or shopping for but additionally the pockets sizes of the entities which are collaborating within the accumulation or distribution developments.

When the buildup pattern rating has a price close to the 1 mark, it means the big entities (or an enormous variety of small buyers) are accumulating the asset at present.

Alternatively, the indicator having values near the 0 ranges suggests holders are distributing (or alternatively, simply not accumulating a lot) in the meanwhile.

Now, here’s a chart that exhibits the pattern within the Bitcoin accumulation pattern rating over the previous few years:

The worth of the metric appears to have been near the one mark just lately | Supply: Glassnode on Twitter

As displayed within the above graph, the Bitcoin accumulation pattern rating had assumed yellow/orange shades in the course of the first couple of months of the newest rally. Which means that the metric had values near 0 then, implying a considerable amount of distribution was happening from the big entities.

This implies that the buyers might not have thought this rally would go on for too lengthy in order that they had been harvesting their earnings whereas they nonetheless might. The pattern, nonetheless, has modified in the course of the newest stretch of the rally, which has taken the worth near the $30,000 degree.

Apparently, the pattern that the present rally is following appears to be much like what was seen in the course of the April 2019 rally. This different rally began out of bear market lows, identical to the present one (if certainly the worst of the bear is behind the asset for this cycle), and it additionally confronted heavy distribution in its preliminary phases.

When the April 2019 rally neared the “cycle baseline” (a value that supported the asset a number of occasions all through that cycle), the investor conduct shifted in the direction of heavy accumulation because the indicator turned darkish purple (values very near 1).

From the chart, it’s seen that the April 2019 rally gained some sharp upwards momentum after this accumulation started. As talked about earlier than, the newest Bitcoin rally has additionally shifted in the direction of accumulation just lately as the worth has approached the $30,000 mark.

The $30,000 degree occurs to be the baseline of the present cycle, which implies that this construction that the market is observing proper now’s paying homage to what was seen within the 2018-2019 cycle.

If the remainder of the rally additionally exhibits an identical sample to the April 2019 one, then the newest shift in the direction of accumulation from the buyers might be optimistic information for the worth surge.

BTC Worth

On the time of writing, Bitcoin is buying and selling round $28,300, up 1% within the final week.

BTC has principally moved sideways just lately | Supply: BTCUSD on TradingView

Featured picture from Kanchanara on Unsplash.com, charts from TradingView.com, Glassnode.com