A debate arose about the potential for Ethereum changing into laborious cash and ended up highlighting extra downsides to the digital asset than anything.

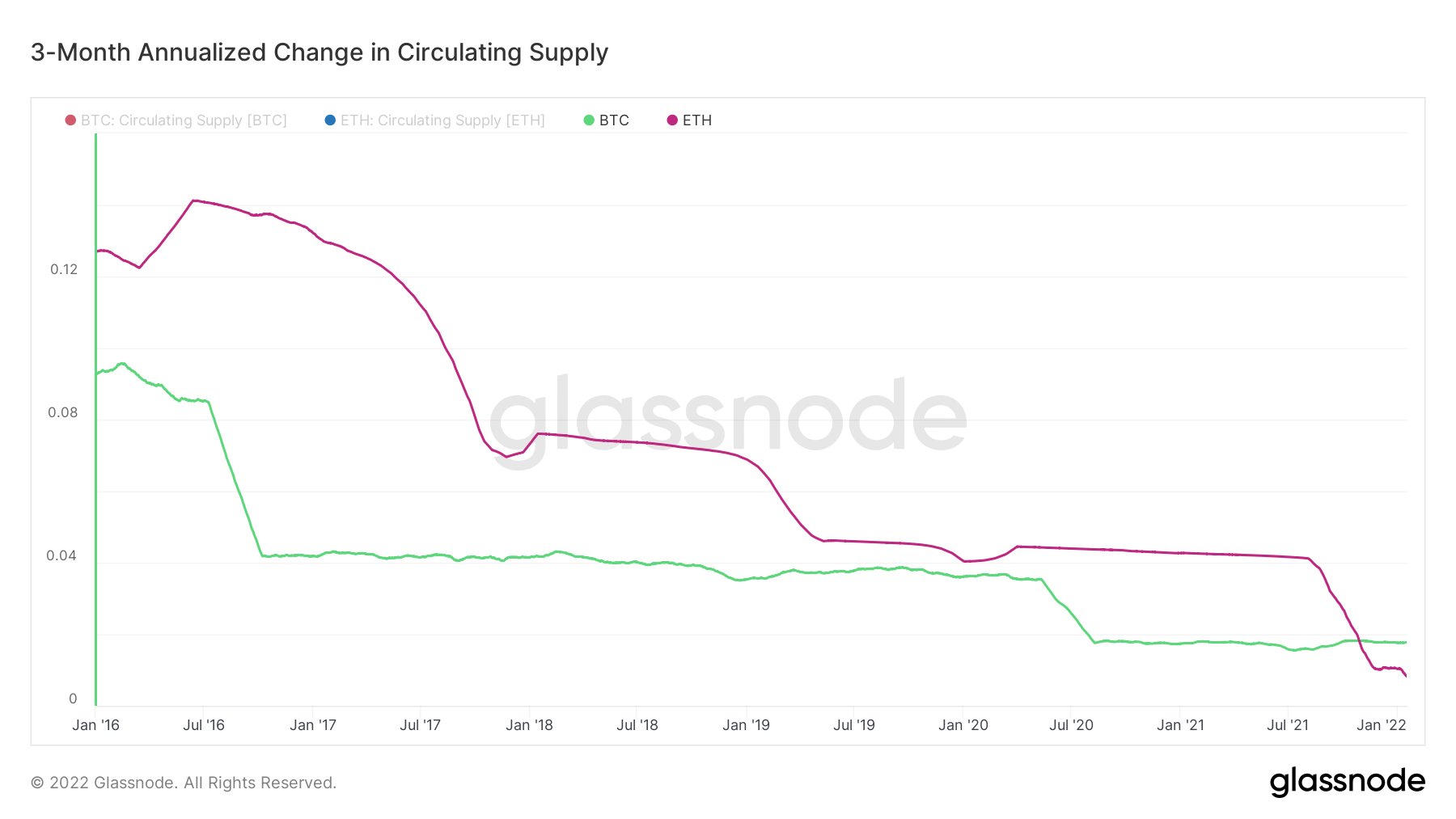

The founding father of a Bitcoin investmentsCharles Edwards, shared a chart that confirmed the circulating provide exercise of Ethereum and Bitcoin and argued that “Ethereum has entered the laborious cash recreation. For the previous 3 months, Ethereum’s inflation charge has been decrease than Bitcoin.”

“Exhausting cash just isn’t solely about low inflation of provide, additionally it is about immutability of inflation – oil just isn’t suddely laborious cash even when OPEC decides that provide charges are throttled.”

-Twitter consumer @alpha_authority

Associated Studying | Solo Ethereum Miner Hits The Jackpot With 170 ETH For Mining A Block

Exhausting Money Or Exhausting Charges?

Within the quick historical past of the cryptocurrency increase, many have debated the chance for cryptocurrencies to surpass fiat currencies in some unspecified time in the future. It’s a possible future situation for Bitcoin, however different digital cash can solely dream of it.

As Investopedia explains, “Exhausting cash maintains a secure market worth relative to actual items and companies and a powerful alternate charge relative to foreign currency,” and its makes use of contain “decrease transaction prices and dangers”

Within the case of cryptocurrencies, laborious cash would imply {that a} sure coin couldn’t be topic to arbitrary modification. Reverse to Bitcoin, Ethereum’s guidelines will be –and have been– modified. Its provide schedule has been modified greater than as soon as, which signifies it could possibly hold altering.

The burnings of ETH make it quickly deflationary, looking for the next market cap. However because the protocol and issuance schedule of Ethereum are malleable, the chart above doesn’t show that the digital coin may even get near being laborious cash.

Moreover, there are the inescapable excessive fuel charges, anticipated to decrease considerably by 2023 with layer 2, however almost certainly not low sufficient for client spending, commerce, and mainstream adoption. The charges can incentivize holding ETH, however not transacting, and different centralized blockchains like Cardano are already proving to be extra economical.

Regardless that Ethereum exhibits a decrease inflation charge than Bitcoin, the provision additionally units the digital coin under Bitcoin’s requirements.

Bitcoin has a finite provide of 21 million BTC. 80% of all cash have already been mined, however it could take the brand new provide of cash over 100 years to be exhausted. That is stated to create digital shortage. On Ethereum’s finish, the circulating provide is unknown, it doesn’t have an general cap.

Some customers additionally consider that “a deflationary base asset just isn’t good for Ethereum apps” and that it’s going to really develop into an issue for its progress sooner or later.

Associated Studying | TA: Ethereum Topside Bias Vulnerable If It Continues To Struggle Below $3.2K

Ethereum In The DeFi Area

Just lately, Analysts at JPMorgan, who’ve favored Ethereum over Bitcoin earlier than, claimed that ETH is shedding its dominance within the Decentralized Finance (DeFi) area because of rising sturdy rivals like Terra, Avalanche, and Solana.

Its share of whole worth locked in DeFi lowered from virtually 100% in 2021 to 70% by the tip of it and will proceed to drop. The analysts from the Wall Avenue banking big suppose the required scaling of the community “may arrive too late,” Bloomberg reported.

“In different phrases, Ethereum is presently in an intense race to keep up its dominance within the utility area with the result of that race removed from given, in our opinion,”

The specialists suppose that this lack of dominance might deliver a downtrend for ETH’s value.

Ethereum Worth

Ethereum trades at $3120 on the time of writing, down 1.75% within the final 24 hours.