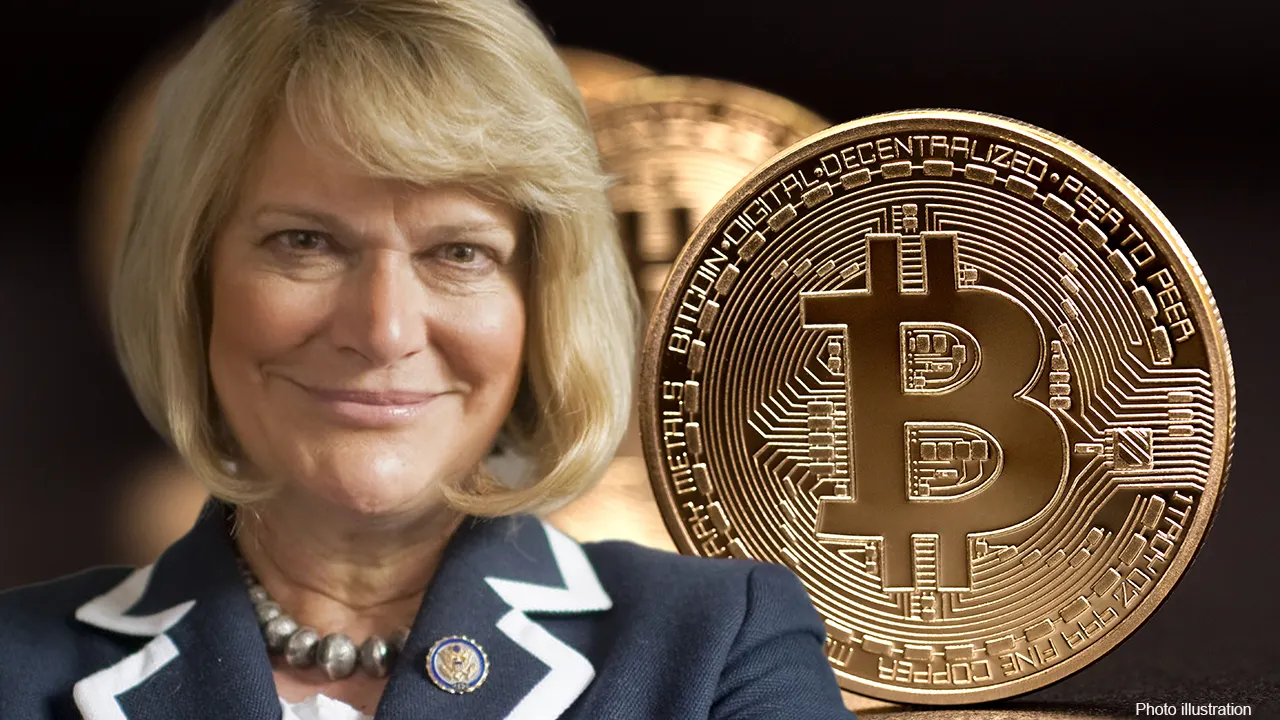

Crypto Information: In a major transfer applauded by the broader crypto group on Twitter, US Senator Cynthia Lummis on Saturday took to social media to announce her ongoing efforts to determine a regulatory framework that will allow people and firms to personal and commerce digital property inside america.

Lummis Goals For Crypto Regulation In US

Working alongside Senator Kirsten Gillibrand, Lummis has been engaged on a revamped bipartisan effort to introduce complete rules for cryptocurrencies. This legislative endeavor is anticipated to achieve traction on Capitol Hill later this 12 months, paving the way in which for a much-needed framework for the quickly evolving digital asset area.

Learn Extra: Hong Kong Legislator Invites Coinbase To Establish Crypto Operations

Whereas highlighting the truth that the opposition efficiently thwarted the inclusion of a 30% digital asset mining tax within the latest debt ceiling deal, Lummis emphasised that the combat to determine a transparent regulatory panorama for the crypto sector is much from over.

We efficiently prevented @POTUS‘ 30% digital asset mining tax from being included within the debt ceiling deal however the combat is much from over.

I’m engaged on a regulatory framework that may permit people and firms to personal and commerce digital property in America.

Keep tuned…

— Senator Cynthia Lummis (@SenLummis) June 10, 2023

Crypto Invoice Anticipated Ro Handle Token Definitions

Earlier, throughout a digital property symposium, Senator Gillibrand said that the revised model of the invoice could be extra detailed, significantly by way of defining tokens and the processes required to acquire them. In accordance with the senators, this transfer would goal to supply the much-needed readability and tackle current ambiguities within the cryptocurrency panorama.

In accordance with latest stories, the forthcoming invoice primarily seeks to outline cryptocurrencies whereas doubtlessly eradicating the “safety” tag related to them. Moreover, the proposed laws will supposedly impose a common ban on algorithmic stablecoins though additional deliberations are crucial to find out the entities approved to challenge stablecoins and the necessities related for his or her USD reserves.

Additionally Learn: Bitcoin Exchange Outflow Hits 1-Month High, BTC Price Pump Incoming?

The offered content material might embrace the non-public opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any duty to your private monetary loss.