The Enter-Output International (IOG), the group that maintains and develops the Cardano community alongside different foundations behind Solana (SOL) and Polygon (MATIC) is up in arms with the USA Securities and Alternate Fee (SEC) following final week’s allegations.

In line with the regulator, ADA, SOL, and MATIC alongside different crypto tokens are securities. Per week after the allegations, ADA is reeling in large losses of roughly 25%, whereas SOL and MATIC are each down by roughly 29%.

The statements launched by the foundations over the previous couple of days have primarily inclined towards enhancing investor confidence with the founders declaring that they’re able to combat the allegations till the tokens are cleared.

Beneath No Circumstances Was ADA a Safety – Cardano’s IOG

The IOG has explicitly said that the allegations made by the SEC comprise “quite a few factual inaccuracies” and that they “won’t influence IOG’s operations in any manner.

“Not at all is ADA a safety underneath U.S. securities legal guidelines,” the IOG said in its response to the SEC filings. “It by no means has been. Understanding how decentralized blockchains function is a elementary part in creating accountable laws.”

The inspiration insists that the SEC is misguided with its “regulation via enforcement” method which deprives the trade of the much-needed readability and certainty.

The Cardano “blockchain is clear, auditable, immutable and truthful.” The inspiration guarantees to proceed advocating “for regulation that is smart and honors the clear and decentralized nature of blockchain.”

By all of the noise, keep in mind that the forges of innovation proceed each place you look. One of many papers that I’m most pleased with is Minotaur. It’s the spine of the following era of cryptocurrencies https://t.co/9jk5GvWLLO

— Charles Hoskinson (@IOHK_Charles) June 10, 2023

Cardano Value Ignites Restoration After Large Dip to $0.22

Famend market analyst, Benjamin Cowen has warned his many subscribers, primarily crypto buyers that they need to brace for an altcoin shakedown within the wake of the renewed SEC market crackdown.

In line with Cowen, altcoins are but to see the underside and the potential of additional declines is evident. The analyst refers back to the potential declines as an “altcoin reckoning” which might final till the Bitcoin dominance vary excessive is breached.

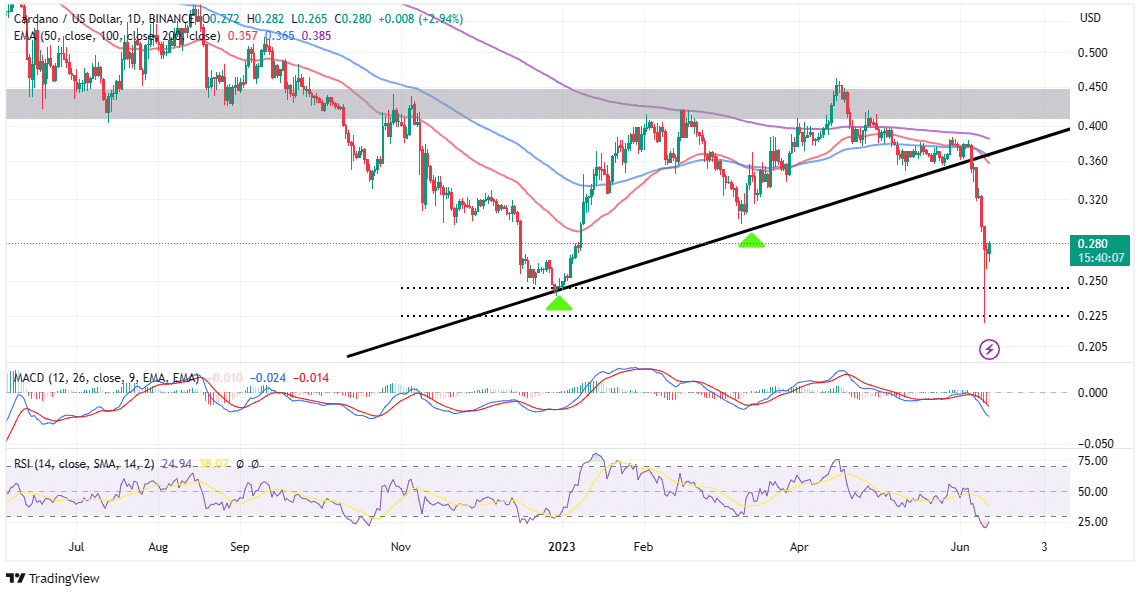

In the meantime, Cardano price has recovered to trade at $0.281 on Monday, boating a formidable 6% uptick in 24 hours. With the Relative Power Index (RSI) at present oversold, bulls make good on the enhancing technical outlook to shut the hole to $0.36 and $0.4, respectively.

Merchants trying ahead to getting into new lengthy positions can be in search of a day by day shut above $0.28. From right here, they’ll goal to money out at $0.32 whereas the stubbornly bullish could wish to wait till ADA breaches resistance at $0.36 and presumably $0.4.

Nonetheless, it could be prudent to tread with warning now that Cardano worth is buying and selling under all the key utilized transferring averages – that’s the 200-day Exponential Transferring Common (EMA), the 100-day EMA, and the 50-day EMA.

On the identical time, a promote sign noticed with the Transferring Common Convergence Divergence (MACD) could invalidate the restoration, forcing ADA to wobble between $0.22 and $0.28.

The following purchase sign from the momentum indicator will manifest with the MACD line in blue crossing above the sign line in pink.

Some key ranges for merchants to remember embody short-term assist at $0.25 and main assist at $0.22. Holding above these purchaser congestion areas provides bulls a combating probability for beneficial properties past $0.4 and towards $1.

Beneficial Articles:

The offered content material could embody the non-public opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any duty to your private monetary loss.