The main cryptocurrency, Bitcoin is hovering above $30,000 following a short dip to $29,592 on Monday. Ripple’s partial win in the SEC lawsuit was optimistic for the crypto market normally, however did not set off curiosity throughout the market, culminating in Bitcoin giving again the good points above $31,000.

Analysts and trade specialists are attributing Bitcoin’s failed movement above $30,000 to numerous elements, together with a sudden curiosity in XRP and tokens the SEC deemed securities in early June, together with Cardano (ADA), Solana (SOL), and Polygon (MATIC).

When Is Bitcoin Value Possible To Breakout?

The most important cryptocurrency has remained unchanged in 24 hours and buying and selling at $30,102 on Tuesday as traders bid farewell to the Asian session forward of the European session. Bitcoin has a market cap value $584 billion, with $14 billion of buying and selling quantity coming in.

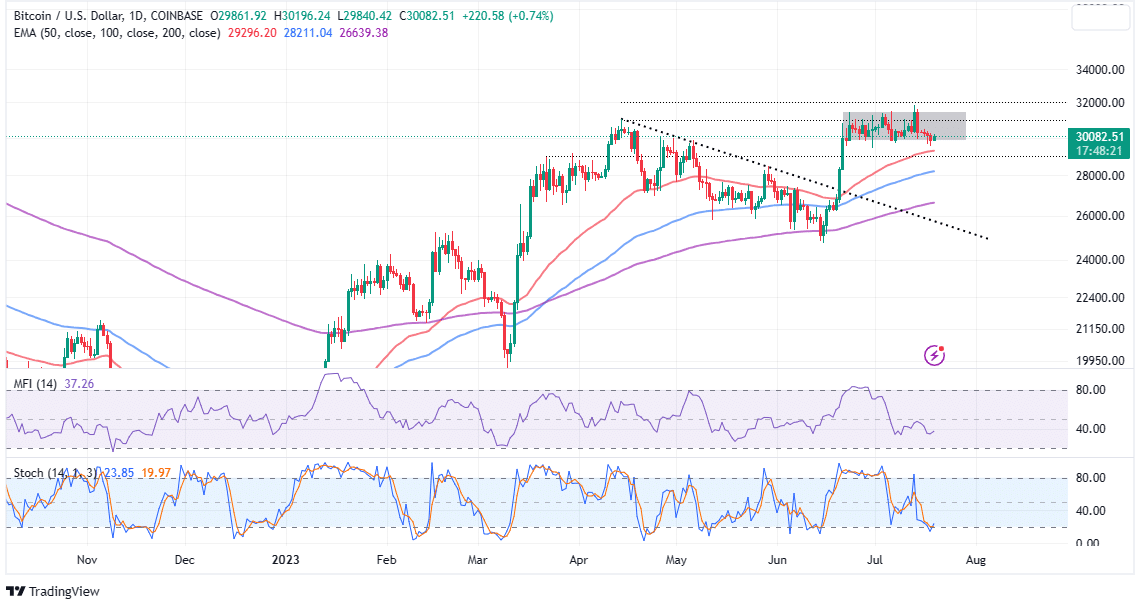

Primarily based on the every day chart, Bitcoin price just isn’t removed from a rectangle sample breakout however Jake Boyle, the CCO at Caleb & Brown, an Australian crypto trade, the continuing stagnation could last more with minor up-downs till the market encounters some key occasions.

The every day chart reveals BTC holding the bullish rectangle help, from which a breakout could set off a ten% transfer from $30,000 to $33,000. For this breakout to come back into play, bulls should defend the help at $30,000 and push for sustained value motion above $31,500, representing the rectangle resistance.

Merchants eyeing publicity to new BTC longs could wish to look forward to affirmation from quantity indicators just like the Cash Circulate Index (RSI) and the On-Stability-Quantity (OBV).

Because the MFI climbs above the midline and towards the overbought area, it reveals that traders’ danger urge for food for BTC is rising—and subsequently constructing momentum behind the world’s most distinguished crypto asset.

Though Bitcoin remains to be discovering the fitting path out of the woods, the state of affairs just isn’t that dire, particularly with the Stochastic indicators sending a bullish sign. Longs merchants can sit tight so long as the oscillator is reversing the pattern from the oversold area.

A Stoop In Investor Curiosity Means A Slippery Highway Forward

In accordance with CryptoQuant on-chain analyst Crazzyblockk, the short-term holder (STH) realized value (lower than 6 months) has witnessed a substantial drop in accumulations curiosity amongst new traders. This cohort says out there between one and three months.

Moreover, the Bitcoin price recovery is probably going depressed by each the short-term and long-term (3 – 6 months) realizes costs, which maintain at $27,200 and $25,800. If mixed, their realized costs common round $28,500.

As of July 18, each bands had recorded spectacular good points, with income standing at 9.5% and 15.5% respectively. Nonetheless, within the occasion of a value correction, it’s believable that these holders could expertise a sure diploma of promoting stress.

Notably, any sturdy indicators of promoting stress under $30,000 may set off panic amongst traders who’re betting on Bitcoin price to rally to $35,000 and $38,000. That stated, it’s nonetheless untimely to rule out declines to $28,000 and $25,000, particularly with BTC hovering at $30,000.

Associated Articles

The offered content material could embody the non-public opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any accountability to your private monetary loss.