The 2 most outstanding cryptocurrencies Bitcoin (BTC) and Ethereum (ETH) are nonetheless sluggish, with the previous pivoting round $30,000. Buying and selling at $29,950, the BTC worth stays unchanged during the last 24 hours, with the buying and selling quantity shrinking to $11 billion from $13 billion recorded on Wednesday.

Bitcoin boasts $582 billion in market capitalization, with the digital asset’s cumulative losses within the final seven days amounting to 1.2%.

Bitcoin Worth Strikes In Tandem With Momentum and Narrative Merchants

Other than a choose group of altcoins which have been rallying together with XRP, XLM, ADA, and SOL, the crypto market is quiet and torpid. These tokens are outperforming their friends as buyers search publicity following Ripple’s partial win in the long-standing legal battle with the Securities and Trade Fee (SEC).

“Briefly, we’re seeing a return of buyers that had beforehand been spooked by current regulatory measures,” Markus Levin, co-founder of XYO Community mentioned in a written assertion to CoinDesk.

In keeping with the managing Companion of Web3 funding fund Generative Ventures, Lex Sokolin, the lethargy being witnessed is the cyclical nature of the most important crypto. He argues that Bitcoin price often experiences ‘run-ups’ in anticipation and response to the information, after which a sell-off as soon as the constructive information has been integrated into the worth.”

“Bitcoin strikes in cycles primarily on account of momentum and narrative – “the market animal spirits,” as Sokolin describes them.

What’s Subsequent As Bitcoin Worth Lengthens Consolidation?

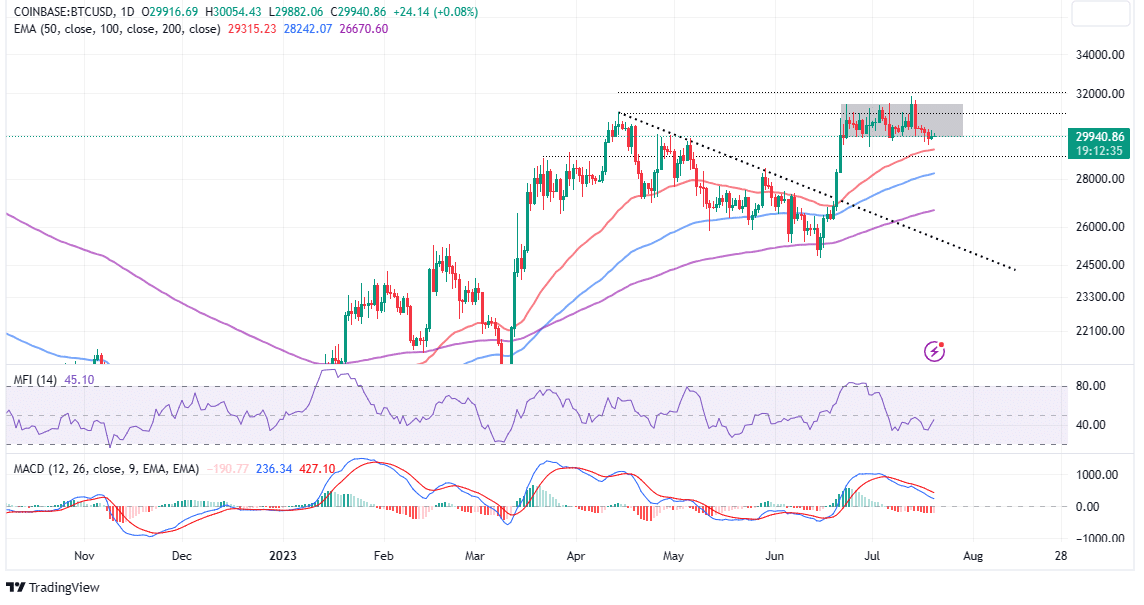

Bitcoin price continues to be doddering in the identical rectangle sample, with bulls presenting a legitimate case at $30,000. Though there have been dips beneath this stage, they haven’t been important to trigger panic-selling amongst merchants and buyers who’re nonetheless betting on a possible rally to $35,000 and $38,000.

If declines ensue beneath $30,000, the 50-day Exponential Shifting Common (EMA) could be the primary help to confront the sellers. Some market watchers foresee a drop to $28,000, a help bolstered by the 100-day EMA (in blue), the place Bitcoin worth would sweep new liquidity for the much-awaited rally.

Bulls are doing all they’ll to maintain Bitcoin around $30,000 with minor dips in the upper $29,000 range, contemplating the Shifting Common Convergence Divergence (MACD) has since July 5 been pushing a bearish narrative emphasised by a promote sign.

Holding above $30,000 is now not possible for the resumption of the uptrend, Bitcoin should construct momentum to interrupt out from the bullish rectangle sample to maintain bears suppressed and with out a lot say within the course the coin takes subsequent.

That mentioned, the up and down actions might proceed till BTC blasts via resistance at $31,500 and purpose for the following hurdle at $32,000.

Is This The Begin of a New Macro Uptrend

The spike within the variety of corporations fascinated by providing a spot Bitcoin exchange-traded fund (ETF) in June fueled the sharp climb from lows barely beneath $25,000 in early June to highs round $31,500.

That uptrend may very well be attributed to momentum and narrative merchants who purchased the information however are nonetheless holding on to their BTC in anticipation of an prolonged rally. Subsequent information and occasions have been scarce in July, with Bitcoin markets witnessing a stoop in actions.

Nonetheless, the Cash Stream Index (MFI) reveals that extra funds are beginning to movement into the market. If the influx quantity continues to outpace the outflow quantity, Bitcoin worth will probably start a macro uptrend.

#BTC is now within the post-breakout Upward Acceleration Section

The Macro Downtrend is over

And a brand new Macro Uptrend has begun$BTC #Crypto #Bitcoin pic.twitter.com/fOjjXQaHeM

— Rekt Capital (@rektcapital) July 15, 2023

Analysts at Rekt Capital are assured that “Bitcoin is now within the post-breakout upward acceleration part.” This suggests that the macro downtrend is lengthy gone and a brand new uptrend has began. In different phrases, buyers might wish to critically think about stuffing their wallets forward of the following bull run more likely to start in 2023.

Associated Articles

The offered content material might embody the non-public opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any accountability in your private monetary loss.