XRP value has began to provide again a part of the features it has accrued this week. The token, native to Ripple’s fee system, exploded spectacularly following final week’s ruling which favored Ripple within the lawsuit towards the US Securities and Alternate Fee (SEC).

The judge ruled that XRP sales, particularly on exchanges usually are not securities, a call that noticed traders rush to hunt publicity to the worldwide cash remittance token with the hope of a rally ensuing, probably above $1 and towards the all-time excessive of $3.40 in January 2018.

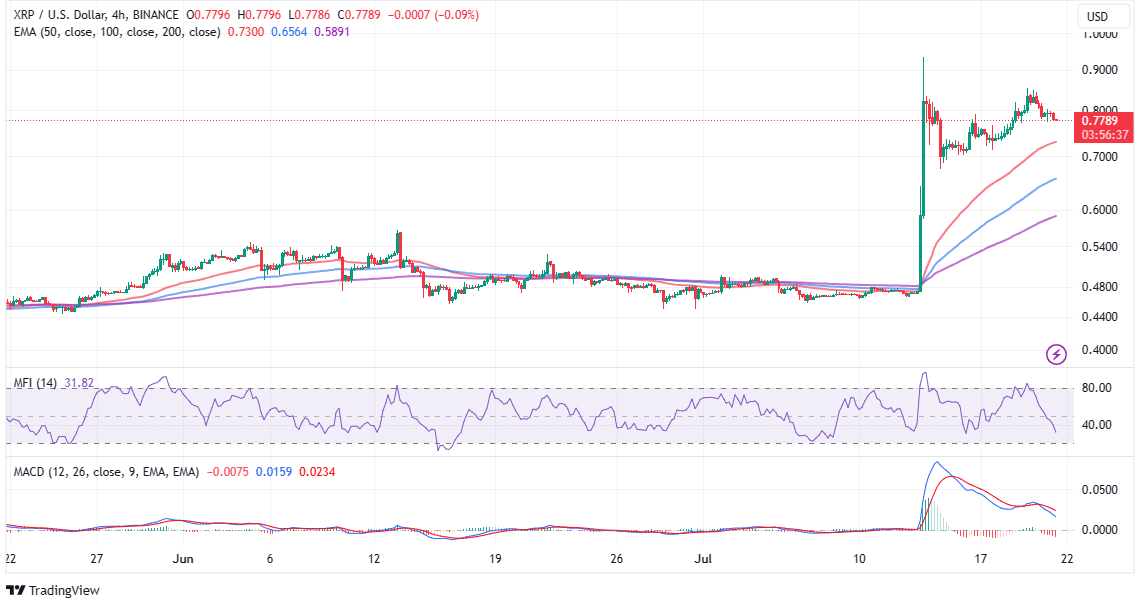

Following the preliminary breakout from the prolonged sideways value motion within the vary between $0.45 and $0.55 to highs not seen since December 2021 at $0.93, XRP price rolled again to affirm help at $0.7.

Within the earlier evaluation, XRP price had regained the ground above $0.8 however resistance at $0.85 curtailed the renewed bullish momentum. Now, XRP is dealing with a doubtlessly huge retracement because it trades at $0.7785, down 5% on Friday.

What’s Subsequent As XRP Worth Abandons $1-Certain Rally

The Shifting Common Convergence Divergence (MACD) has reaffirmed the strengthening bearish grip, flashing the second promote sign in per week. Shorts merchants relying on this momentum indicator look out for bearish crosses, which manifest with the MACD line in blue flipping under the sign line in purple.

The Cash Stream Index (MFI), an indicator that measures the quantity of cash flowing into and out of XRP markets, reveals that sellers have the higher hand. If traders proceed with this rout, XRP might realign with its peers – Bitcoin and Ethereum, which have typically been range-bound because the breakout in early June.

A consolidation interval will seemingly ensue between the help at $0.7 and the resistance at $0.8. The 50-day Exponential Shifting Common (EMA) (in purple) is in line to dampen the promoting stress at $0.73 and scale back stress on the first help at $0.7.

XRP Worth Fractal Dangers 65% Breakdown – Cointelegraph

In response to a fractal evaluation carried out by Cointelegraph, XRP value could possibly be liable to a large 65% decline by September. Among the cues the analysts thought of are the overbought Relative Energy Index (RSI) and “the multiyear descending trendline resistance.”

The XRP value uptrend has since 2018 been capped below the descending trendline resistance. On prime of this, a horizontal resistance line round $0.93 complicates the state of affairs additional for the four-largest crypto.

Contemplating the resistance traces and the overbought RSI, XRP value could also be heading right into a market correction, focusing on help at $0.52 by September, implying a 40% drop from the present market worth.

The 50-week EMA (purple) reinforces help at $0.52 which might lead to a bounce. The identical help performed a vital position within the XRP value restoration in Q2 2021. For now, XRP is still one of the best-performing cryptos in July, up 57% in 30 days.

Associated Articles

The offered content material might embrace the private opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any accountability in your private monetary loss.