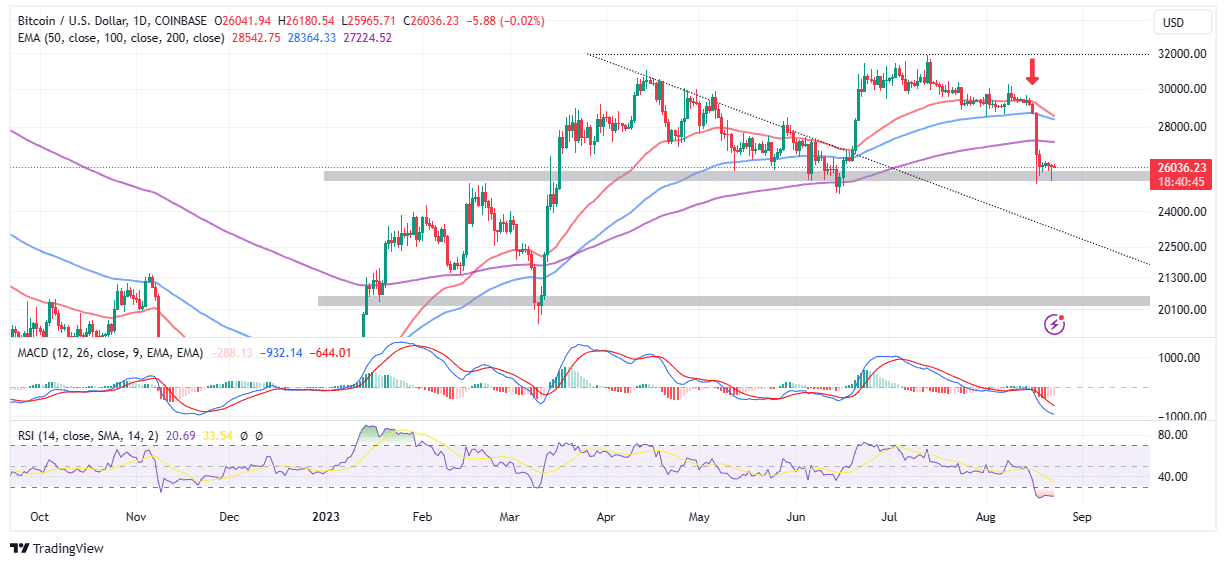

Bitcoin, down 11% in every week, is hovering at $26,000 with restricted motion to the upside. Quick-term holders whose provide was already buying and selling in unrealized loss earlier than final week’s deleveraging occasion in BTC futures are more likely to be confronted by a dark future, contemplating the potential of declines extending towards $20,000.

BTC Value Bulls Transfer To Defend $25k S/R

With out sufficient momentum, bulls courageous sufficient to remain within the dilapidated market have resolved to defend assist/resistance at $25,000. Bitcoin is again to buying and selling at $25,981, barely under the pivotal $26,000 following a couple of days of loss consolidation.

$BTC #Bitcoin Bulls are Defending the 25k S/R degree..!! pic.twitter.com/nPSDTnNPtj

— Captain Faibik (@CryptoFaibik) August 23, 2023

Most indicators, together with the Relative Power Index (RSI), present that the trail with the least resistance is caught to the draw back, with Bitcoin expected to dip further. Holding at 20, the RSI is at its lowest degree since March 2020, when crypto crashed as a result of Covid pandemic.

Specialists imagine that BTC worth can pull a shock breakout, contemplating it launched itself right into a bull run from lows round $3,800 to the present all-time excessive of virtually $70,000.

Nonetheless, the each day chart with the Transferring Common Convergence Divergence (MACD) indicator affirms the bearish outlook. The promote sign at hand implies that quick positions in BTC might stay worthwhile till bulls construct sufficient momentum to reverse the pattern.

Bitcoin Quick-Time period Holders Really feel The Pinch

Based on on-chain analytics firm Glassnode, Friday’s deleveraging occasion within the BTC futures market noticed the most important single-day sell-off in 12 months. The ache in line with on-chain insights, shouldn’t be over, contemplating short-term holders had 88.3% of the provision they maintain in unrealized loss.

Buyers who bought Bitcoin as it rallied to $32,000 are along with the provision that was beforehand in revenue, counting losses. The rise in BTC provide dealing with unrealized loss got here on account of the “top-heavy market,” a phrase used to explain the state of affairs the place buyers purchase Bitcoin close to or above the present market worth.

“Sharp upticks in STH Provide in Loss are inclined to comply with ‘prime heavy markets’ reminiscent of Might 2021, Dec 2021, and once more this week,” Glassnode opined. “Out of the two.56M BTC held by STHs, solely 300k BTC (11.7%) continues to be in revenue.”

If short-term holders proceed to purchase close to the highest, there’s the potential of the market changing into top-heavy for prolonged durations. Glassnode believes final week’s fall is one to concentrate to as a result of historic knowledge particularly on what occurred in Might and December 2021 exhibits that such a drop is commonly adopted by “extra violent downtrends.”

Regardless of the detrimental outlook of the market, @AltcoinSherpa, a famend dealer and analyst encourages buyers to remain the course and concentrate on surviving the bear market.

He argues that “the worst of it has already occurred, $BTC went from 70k->15k. Should you’ve survived this lengthy, don’t fumble the remainder of your bag earlier than the bull market really comes.”

Associated Articles

The offered content material might embody the private opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any accountability on your private monetary loss.