Solana is again within the inexperienced after ‘strolling’ on eggshells since late final week. At the least half of the features accrued from June’s low of $12.80 washed down the drain with SOL extending the rout from the July excessive of $32.24 to the present help in August at $20.

Buying and selling at $21.74 on Thursday, the good contracts token has seen $412 million in buying and selling quantity rush in whereas the market cap ticks barely as much as $8.8 billion.

A number of adoption developments involving Solana Pay could possibly be the reason for this uptick. Nevertheless, the crypto market has typically been trending north on Thursday led by Bitcoin reclaiming $26,000 and lifting to touch $26,800.

SOL Worth Nurturing Rebound Above $20

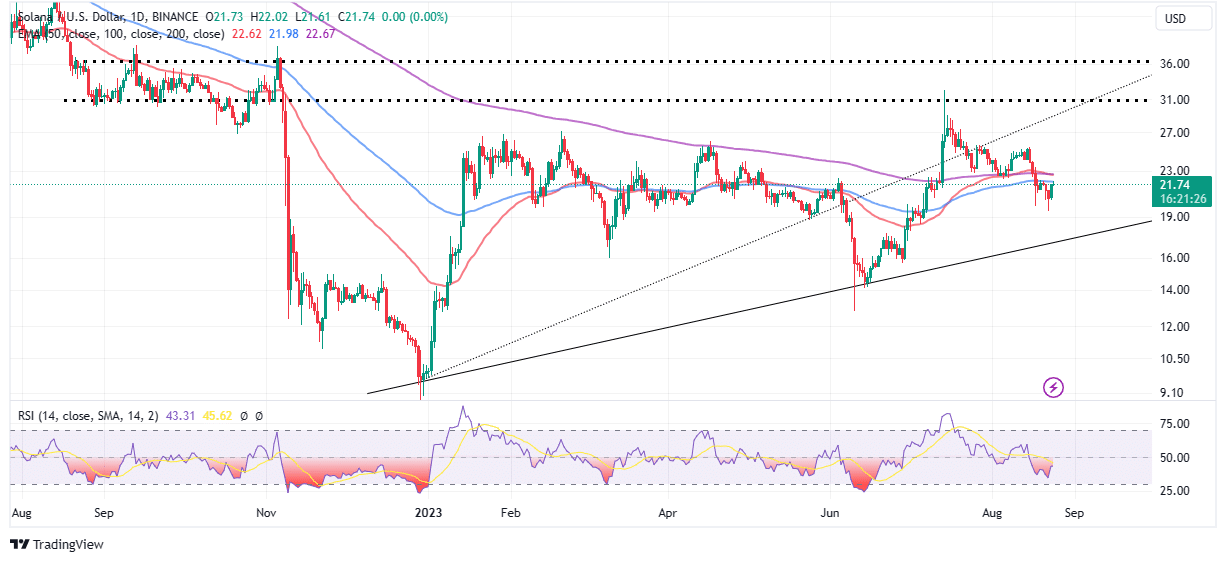

Solana is on monitor to a major restoration following the dip to $20. Bulls are able to push the present value of $21.74 per token to the psychological resistance between $30 and $32, nevertheless, they need to first take care of the rapid hurdle at $21.98, highlighted by the 100-day Exponential Shifting Common (EMA) (blue).

This constructing bullish momentum also needs to be robust sufficient to disperse the vendor congestion close to $23 which is a confluence resistance created by the 50-day EMA (crimson) and the 200-day EMA (purple), in any other case, Solana risks tumbling under the essential $20 help, with a goal of $17.5 as supplied for by the decrease ascending trendline.

Though the Relative Power Index (RSI) didn’t make it to the oversold area under 30, the pattern power indicator reveals the rising affect bulls have on SOL value. A restoration is underway with the RSI more likely to cross into the higher half of the impartial zone and high this up with a flip above the transferring common.

That mentioned, extra conservative merchants could wish to wait till Solana breaks and holds above the $23 hurdle. This manner they’d be in a greater place to keep away from sudden rollbacks, particularly if SOL value fails to rise above the rapid resistance on the 100-day EMA.

Shopify Integrates Solana Pay for USDC Funds

Solana Labs’ Solana Pay will based on a latest announcement via TechCrunch, be used to help USDC funds on Shopify, a platform that brings collectively tens of millions of retailers.

Launched in February 2022, Solana Pay is hosted on the Solana blockchain, a layer 1 protocol. USDC, then again, is the second-largest stablecoin after Tether (USDT) boasting $26 billion in market capitalization.

Though USDC is the primary token to be built-in, it won’t be the primary, as Shopify plans to help different altcoins like SOL and BONK sooner or later. Shopify is without doubt one of the largest e-commerce platforms on this planet, accounting for 10% of the US market along with $444 billion in international financial exercise.

Solana Pay has thus far achieved 11.5 million energetic consumer accounts due to its adoption by main crypto gamers resembling Circle and Phantom.

“Some folks argue the killer app for crypto hasn’t arrived, but it surely has: it’s funds,” Josh Fried, enterprise growth and partnerships at Solana Basis mentioned. “[Everyone] ought to be doubling down on this.”

Bank card funds are expensive for consumers however Fried says the swap to Solana Pay guarantees considerably decrease transaction charges, averaging at $0.00025.

This adoption on Shopify, though beginning with USDC would sooner or later embody tokens within the Solana ecosystem like SOL and BONK. Such an adoption would imply publicity to tens of millions of customers globally, thus creating demand and ultimately driving their costs up.

Associated Articles

The offered content material could embody the private opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any duty on your private monetary loss.