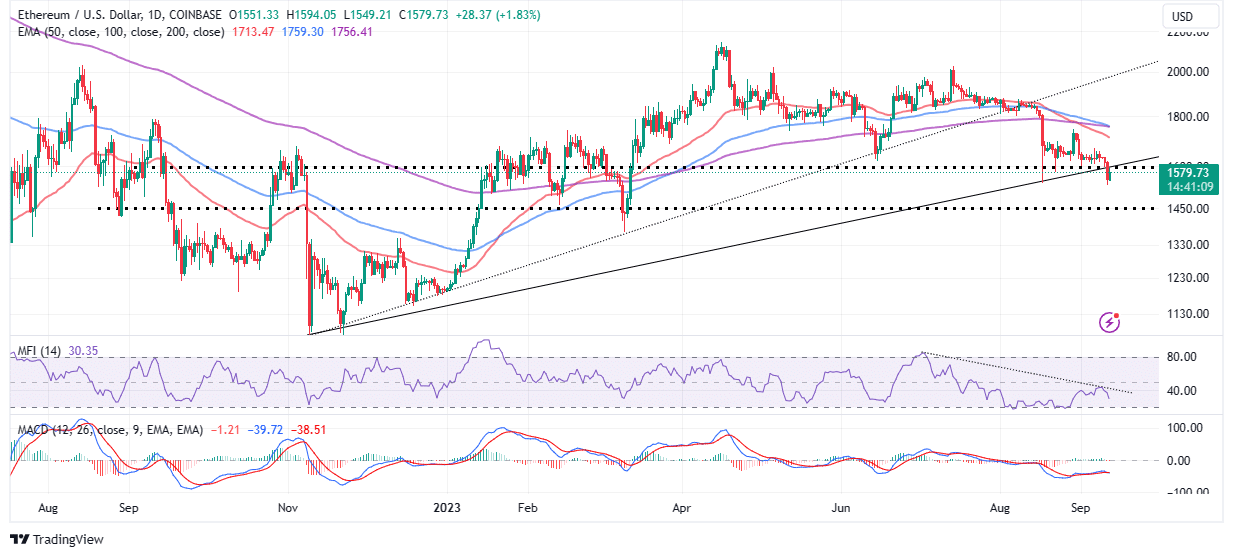

Ethereum worth prolonged the down leg under the earlier assist at $1,600 – a transfer that noticed declines sweep by means of ranges seen final in March. The main good contracts token traded new weekly lows of $1,540 earlier than launching an ongoing rebound searching for to reclaim the bottom above $1,600.

Dormant ETH Lastly On The Transfer

The sell-off on Monday additionally coincided with a spike within the motion of beforehand dormant tokens away from previous wallets. In response to the Age Consumed on-chain metric by Santiment, there was a noticeable enhance in essentially the most dormant ETH over three months.

“A continued dip in imply $ age whereas costs drop is a capitulation signal, which foreshadows reversals.”

The rollback to March worth ranges may entice extra lengthy merchants, who by making the most of the dips, are concentrating on short-term income as ETH worth rebounds to shut the hole to $2,000. This uptake of Ethereum means recent momentum is brewing for the subsequent rally, first above $1,600 then to $1,800, and later to $2,000.

A sustained break previous $2,000 may sign the beginning of a much-awaited bull market in 2024 going into 2025.

This present bullish outlook can’t be trusted till ETH price clocks highs above the decrease ascending trendline or closes the day past the pivotal $1,600 degree.

Upholding assist at $1,600 may assist ease the potential promoting strain prone to observe the affirmation of a dying cross sample. This bearish chart formation happens with a short-term transferring common such because the 50-day EMA (pink) crosses under a long-term one just like the 200-day EMA (purple).

The dying cross provides credence to the bearish outlook, implying that sellers have the higher hand and the continuing downtrend is way from over.

Except traders put the worry of uncertainty apart and rally behind Ethereum, the Cash Circulate Index (MFI) will drop into the oversold area, which can validate one other sell-off to $1,450.

Will ETH Worth Drop To $1,000 Earlier than The Bull Market?

Analysts at Matrixport in their latest report on the efficiency of altcoins, mentioned that “with Ether being near the psychologically necessary $1,600 degree, a break may carry costs decrease, particularly as income development disappoints.”

The longer the worth stays under the $1,600 degree, the upper will enhance the possibilities of one other sell-off trimming beneficial properties and forcing traders to capitulate. Matrixport believes it’s too early to rule out a possible drop to $1,000 – “a degree that would seem justified primarily based on the income projection from the Ethereum ecosystem.”

Associated Articles

The introduced content material might embody the private opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any accountability to your private monetary loss.

✓ Share: