Bitcoin worth bulls are coming again stronger following a rejection from resistance at $27,200 earlier within the week. Buyers are keenly watching to see whether or not BTC will settle above $27,000 and maintain rallying to $31,000 or drop looking for extra liquidity from the main help at $25,000 and if push involves shove stretch the down leg to $22,000.

How Will Bitcoin React To The FOMC Assembly?

The crypto market is looking out for the end result of the Federal Open Market Committee (FOMC) assembly on Wednesday amid issues over doable ramifications for Bitcoin worth and the remainder of the crypto market.

Economists, according to Reuters count on the Federal Reserve to pause rate of interest hikes for the second time this yr whereas holding the course open for future will increase earlier than the top of the yr. The Federal Reserve benchmark rates of interest at the moment vary between 5.25% and 5.5%.

Remarks from previous FOMC conferences confirmed that after the primary pause in June, the Fed anticipated two extra charge hikes to struggle the persistent rise in inflation earlier than the yr ends. The primary hike occurred in July with market watchers suggesting a skip over September earlier than the regulator considers the second hike.

Bitcoin has continued to regular the uptrend for the reason that launch of the August Client Value Index (CPI) knowledge, which confirmed inflation was slowing. Nonetheless, worth will increase attributed to the rise in the price of crude oil ship blended alerts with most committee members seeing “important upside danger to inflation.

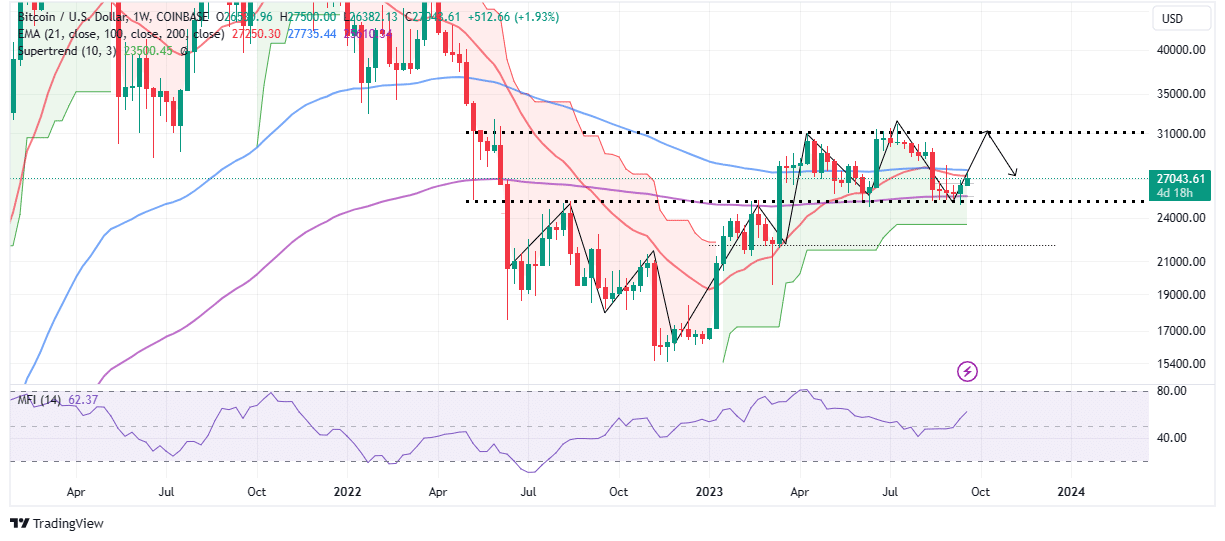

In the meantime, the weekly chart reveals the Bitcoin fractal discussed earlier in the week taking part in out. Rejection from resistance at $27,200 resulted in a fast retracement beneath $27,000 however the higher vary restrict served as help, permitting BTC worth to comb by contemporary liquidity and reclaim the $27,000 help.

The 200-weekly Exponential Transferring Common (EMA) (purple) at $25,609 is a sign that Bitcoin’s market construction is bettering. If bulls flip the 21-week EMA (pink) and the 100-week EMA (blue) into help, a breakout to $31,000 might ensue earlier than the following fractal pushes the value beneath the $30,000 degree.

Key development indicators such because the SuperTrend and the Cash Circulate Index (MFI) affirm the bullish grip. The previous gauges market volatility whereas the MFI compares the amount of cash flowing out and in of BTC markets.

So long as the SuperTrend is trailing Bitcoin price whereas offering help and the MFI upholds the uptrend towards the overbought area, the percentages can be in favor of a bigger uptrend.

Bitcoin Institutional Adoption On The Rise?

Curiosity amongst institutional traders has continued to develop regardless of the crypto winter leading to a number of capitulations. Driving this curiosity is the push for a spot Bitcoin exchange-traded fund (ETF), which has attracted main world corporations like Blackrock, Constancy Investments, and Franklin Templeton amongst others.

Santiment believes that the launch of an Adoption Fund for institutional investors by Nomura, Japan’s largest financial institution boosted Bitcoin’s ongoing worth motion above $27,000.

🏦 #Bitcoin obtained a lift to $27.2K after Japan’s largest funding financial institution, #Nomura, launched an Adoption Fund for institutional traders. That is the most recent in #crypto‘s efforts to extend publicity for events past conventional merchants. https://t.co/ylDEDG9ehY pic.twitter.com/qDau3TzlEB

— Santiment (@santimentfeed) September 20, 2023

The rise within the variety of establishments in search of publicity to Bitcoin is predicted to have a long-term optimistic impression on the value. Nonetheless, within the short-term, another insight from Santiment reveals that “whales have been dropping stablecoins” – a scenario that might stifle the uptrend since “their shopping for energy isn’t as robust as when Bitcoin was above $30k again in June.”

The stablecoin provide held by whales with a stability of greater than $5 million now stands on the lowest degree within the final six months. For a considerable upswing in Bitcoin worth to play out, these whale addresses should improve the availability they maintain.

Associated Articles

The introduced content material could embrace the non-public opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any duty in your private monetary loss.

✓ Share: