The crypto market lastly succumbed to strain as traders contemplated the Federal Reserve’s decision to depart rates of interest unchanged for September whereas wanting ahead to a tighter financial grip over the approaching months. Bitcoin value slid beneath $27,000 help following a rejection from $27,200.

Makes an attempt to regain management over the $27,000 went down the drain with losses at the moment stretching to $26,600. Down 0.5% within the final 24 hours, Bitcoin price is buying and selling at $26,606. Information that fallen trade Mt. Gox would delay payouts helped to regulate the coin’s draw back amid speculations of one other sweep on the $25,000 main help.

Bitcoin Worth Correlation With US Greenback Index Hits New Milestone

In line with the on-chain analytics platform IntoTheBlock (ITB), the correlation between Bitcoin price and the US Dollar Index has hit a brand new milestone – zero, which can indicate that the strongest forex on the earth has no impression on BTC.

Moreover, “there’s at the moment virtually no correlation with any of the key indices,” ITB mentioned by way of X. As Bitcoin tries to form the development towards the halving in 2024, the query is, is that this lack of correlation a bullish or bearish sign?

Has Bitcoin Worth Bottomed?

Combined sentiments amongst traders query whether or not BTC has bottomed or will it must retrace additional earlier than aligning the uptrend for the following bull market tied to the miner reward halving in April 2024.

Based mostly on the short-term outlook, additional declines are seemingly earlier than the following vital bounce to the outstanding hurdle at $31,000. The vendor congestion at $27,000 means that though the market construction improved in September, the uptrend lacked the momentum to be sustainable.

If ~$31000 was the High for 2023…

Then the following time we see these costs will likely be months from now, simply after the Halving (pink field)

Solely distinction between from time to time?

On this Pre-Halving interval, $BTC may nonetheless retrace from right here

However after the Halving, BTC would… pic.twitter.com/jz8rzGjGkz

— Rekt Capital (@rektcapital) September 21, 2023

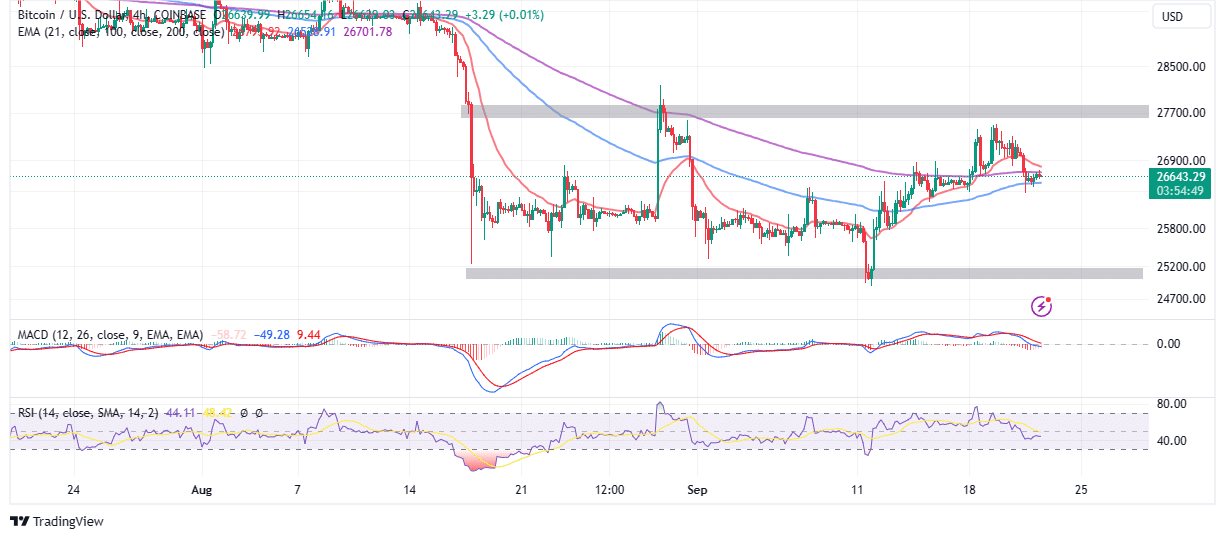

The 200-day Exponential Shifting Common (EMA) (purple) stands in the way in which of features hoping to make it above $27,000. If this downward strain on Bitcoin continues, the quick help by the 100-day EMA (blue) would possibly budge and let BTC freefall to $26,000, or to $25,000 if push involves shove.

The Shifting Common Convergence Divergence (MACD) reveals {that a} sell-off from the present value degree is the most certainly final result. Extra merchants may quickly be prepared to brief Bitcoin, particularly with the blue MACD line staying beneath the pink sign line.

The Relative Energy Index (RSI) in the identical brief time-frame, upholds the bearish outlook. Watching BTC’s response to key ranges at $27,000, the 200-day EMA, the 100-day EMA, and the help space at $26,000 and $27,000 could be instrumental in foretelling the place Bitcoin is headed.

Crypto dealer and analyst, @rektcapital instructed by way of X that based mostly on the 2018 bear market backside, Bitcoin value is but to backside. He opined that earlier than the earlier bull run in 2021, Bitcoin revisited a macro greater low in March 2020.

If historical past is to repeat itself, “the 2022 Bear Market Backside has additionally very equally fashioned a Macro Increased Low that could possibly be revisited sooner or later.”

The 2018 Bear Market Backside fashioned a Macro Increased Low that was then revisited in March 2020

The 2022 Bear Market Backside has additionally very equally fashioned a Macro Increased Low that could possibly be revisited sooner or later$BTC #Crypto #Bitcoin pic.twitter.com/NfyA0uWJp4

— Rekt Capital (@rektcapital) September 22, 2023

The current Bitcoin price doldrums would possibly pressure Bitcoin value to shutter help at $25,000 for one more sweep at $20,000 earlier than the development into the 2024/2025 bull market begins to construct.

Associated Articles

The introduced content material could embrace the private opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any duty on your private monetary loss.

✓ Share: