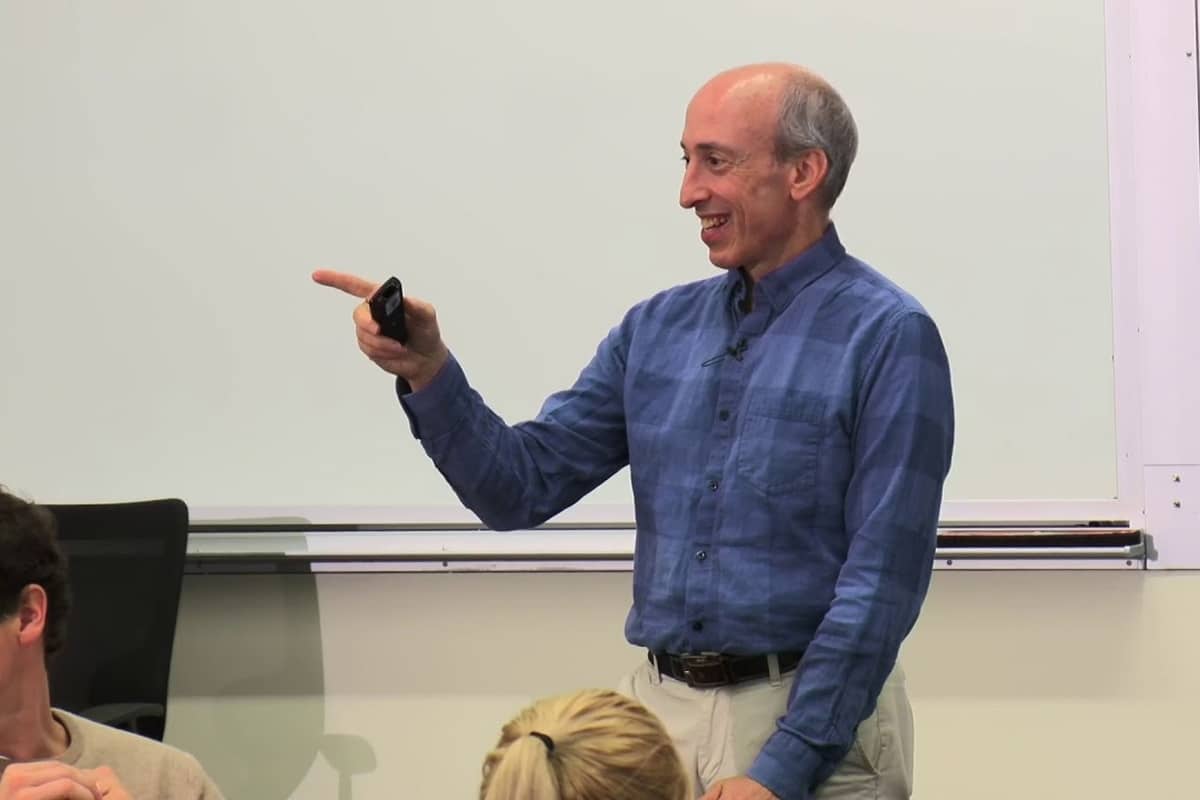

In gentle of latest court docket rulings, a bipartisan coalition of lawmakers is urging the U.S. Securities and Change Fee (SEC) Chair, Gary Gensler, to hasten the approval of spot Bitcoin exchange-traded funds (ETFs).

Courtroom Ruling Challenges SEC Stance

Moreover, Grayscale Investments, a participant within the crypto business, achieved a legal milestone final month. The U.S. Courtroom of Appeals for the D.C. Circuit instructed the SEC to reevaluate their rejection of Grayscale’s spot Bitcoin ETF proposal.

This determination highlighted the SEC’s inconsistent stance between spot Bitcoin ETFs and people pegged to futures contracts. Because of this, lawmakers argue {that a} spot Bitcoin ETF is nearly similar to its futures counterpart, rendering the SEC’s present angle unsustainable.

Consequently, Reps. Mike Flood, Tom Emmer, Ritchie Torres, and Wiley Nickel collectively penned a letter to Gensler. Their argument suggests {that a} regulated spot Bitcoin ETF would bolster investor safety. The transfer would simplify and safe entry to Bitcoin. “A spot Bitcoin ETP is indistinguishable from a Bitcoin futures ETP,” the lawmakers pressured, urging Gensler to contemplate the court docket’s findings.

Furthermore, the SEC’s hesitation appears more and more inconsistent with vital corporations like BlackRock and Constancy within the queue for approvals. Moreover, this week’s upcoming Home Monetary Companies Committee listening to offers an apt platform for these issues to be immediately addressed to Gensler.

Spot Bitcoin ETFs: The Advantages and Broader Implications

Apart from the potential authorized and consistency points, introducing a spot Bitcoin ETF can redefine cryptocurrency investments. Such ETFs supply buyers a streamlined path to delve into the crypto market. With the simplicity of buying and selling ETFs by means of brokerage accounts, the broader acceptance and understanding of cryptocurrencies can expertise a major enhance.

Nonetheless, the SEC stays silent on the matter. Regardless of the mounting pressure, the regulatory physique nonetheless must sign a inexperienced gentle for a spot Bitcoin ETF.

The world watches because the SEC navigates this regulatory maze. With the congressional push and the burden of authorized precedent behind the spot bitcoin ETFs, the ball stays firmly within the SEC’s court docket. Because the discussions progress, the importance of cryptocurrencies within the broader monetary ecosystem should be thought-about.

The introduced content material might embrace the non-public opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any accountability to your private monetary loss.

✓ Share: