Bitcoin (BTC) got here near breaking above $35,000 on Wednesday this week however retreated to substantiate assist at $34,000. The most important cryptocurrency rally broke out final week following rumors of the US Securities and Trade Fee (SEC) greenlighting a BTC spot exchange-traded fund (ETF) proposal by BlackRock.

Since then, crypto markets have been within the inexperienced with altcoins becoming a member of within the bullish occasion. Ethereum, the most important good contracts token and the second-largest crypto is up 16.7% in seven days to $1,811. Solana (SOL), XRP, Dogecoin, Cardano, Chainlink, and Polygon to say a couple of, are a few of the best-performing altcoins.

In the meantime, Bitcoin worth is up 20% during the last seven days, 28% in 14 days, and 30% in 30 days to commerce at $34,313, in accordance with market knowledge by CoinGecko.

JP Morgan Foresees A number of Lawsuits If The SEC Rejects Spot ETFs Proposals

Sentiment continues to construct for an additional breakout bolstered by optimism for the approval of the primary BTC spot exchange-traded fund (ETF) within the US. Analysts throughout the board seem to agree that greenlighting the ETF might pump Bitcoin worth to $45,000 earlier than the tip of 2023.

Whereas most indicators level towards the approval of the spot ETF, the choice lies with the SEC.

In the meantime, analysts at JP Morgan led by Nikolaos Panigirtzoglou stated in a report on Wednesday that the SEC might face a number of lawsuits if it declines to approve the BTC ETF proposals.

“Any rejection might set off lawsuits towards SEC creating extra authorized troubles for the company,” the analysts wrote within the the report.

In an announcement to the Block, Panigirtzoglou stated that though the choice to reject is extremely unlikely, “it’s doable.”

He believes that the SEC could not need to be entangled in one other authorized battle, not to mention a number of lawsuits, particularly after the company misplaced a associated case towards Grayscale Investments, which had sought to transform its Bitcoin Belief (GBTC) product to a spot ETF.

The choice by the SEC to not attraction the ruling, which favored Grayscale, has inspired many to imagine the time for spot Bitcoin ETFs within the US has arrived.

JP Morgan in one other report final week, stated that it expects a number of BTC ETF approvals within the coming few months. In line with the funding financial institution, fund managers are making technical preparations and amending filings to clear points concerning market manipulation and commingling of buyer funds forward of the approvals.

Bitcoin Value Prediction: BTC Rally Takes A Breather At $35,000

Bitcoin price retested resistance at $35,000 for the second time this week on Wednesday. Whereas a breakout failed, dips have turn out to be noticeably minor suggesting that consumers have the higher hand.

Analysts are additionally pushing the narrative that these are the early levels of a bull run whereas advising buyers to be affected person and make the most of dips each time they happen. Altcoin Sherpa, an analyst and dealer with 197k followers on Twitter (now X) stated “You additionally have to be cognizant about what the beginning of a very sturdy rally seems like.” He was referring to the massive swings, with no pullbacks, witnessed throughout many digital belongings together with LUNA and AVAX.

Though I at all times attempt to preach endurance, you additionally have to be cognizant about what the beginning of a very sturdy rally seems like. I am not saying that is something near 2021 however it’s nonetheless good to notice what this spark seems like

Verify $LUNA $AVAX: no pullbacks, simply large strikes pic.twitter.com/ay5he7KQac

— Altcoin Sherpa (@AltcoinSherpa) October 26, 2023

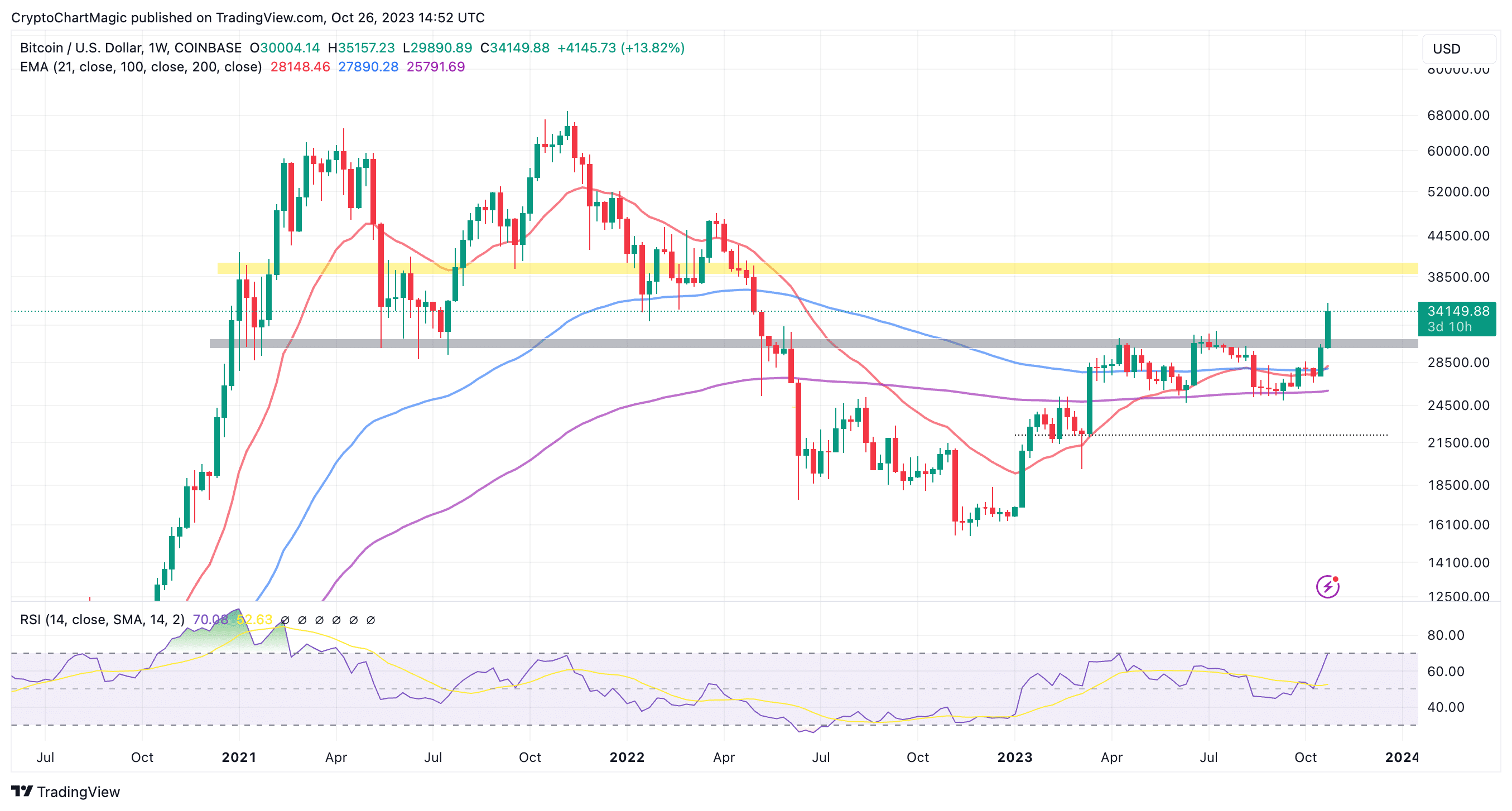

In the meantime, Bitcoin price is buying and selling above all of the bull market indicators on the weekly chart, together with the 21-week Exponential Shifting Common (EMA) (purple), the 100-week EMA (blue), and the 200-week EMA (purple).

The following breakout above $35,000 might push Bitcoin to the next hurdle of $38,000. Motion above this degree would function affirmation for the bull market, the place FOMO might take over and set off bigger worth rallies towards the all-time excessive close to $70,000.

Nonetheless, merchants ought to pay attention to the virtually overbought Relative Energy Index (RSI) which might indicate {that a} correction is looming. Due to this fact, a pullback into the impartial space might sign them to lock within the positive factors and make new entries at a lower cost level.

Associated Articles

The introduced content material could embody the non-public opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any accountability on your private monetary loss.

✓ Share: