Bitcoin (BTC) worth is overheating amid requires a pullback to permit recent liquidity to enter the market forward of the following rebound concentrating on highs above $40,000. The bellwether cryptocurrency has over the past 24 hours misplaced a tiny little bit of its worth to commerce at $34,370, though it’s nonetheless up 0.4% within the final seven days, 21% in a single month, and 66.6% within the final 12 months, market knowledge by CoinGecko reveals.

Whereas optimism towards the potential greenlighting of Bitcoin spot exchange-traded funds (ETFs) remains to be excessive, the hype and discussions across the matter have gone down considerably. Buying and selling quantity throughout most exchanges has additionally slumped, with BTC recording solely $13 billion, down 17% within the final 24 hours.

In the meantime, Bitcoin ETF tickers proceed to indicate up on the Depository Belief & Clearing Company (DTCC) web site with the newest coming from Invesco Galaxy Bitcoin ETF with the ticker ‘BTCO.’ The primary ticker belonged to BlackRock’s spot Bitcoin ETF, listed underneath the ticker ‘IBTC.’

A DTCC spokesperson launched a press release saying that the tickers have been a “Commonplace Follow” and didn’t in any approach level to approval by the SEC now or sooner or later.

Bitcoin Value Shaky Above $34,000 Help

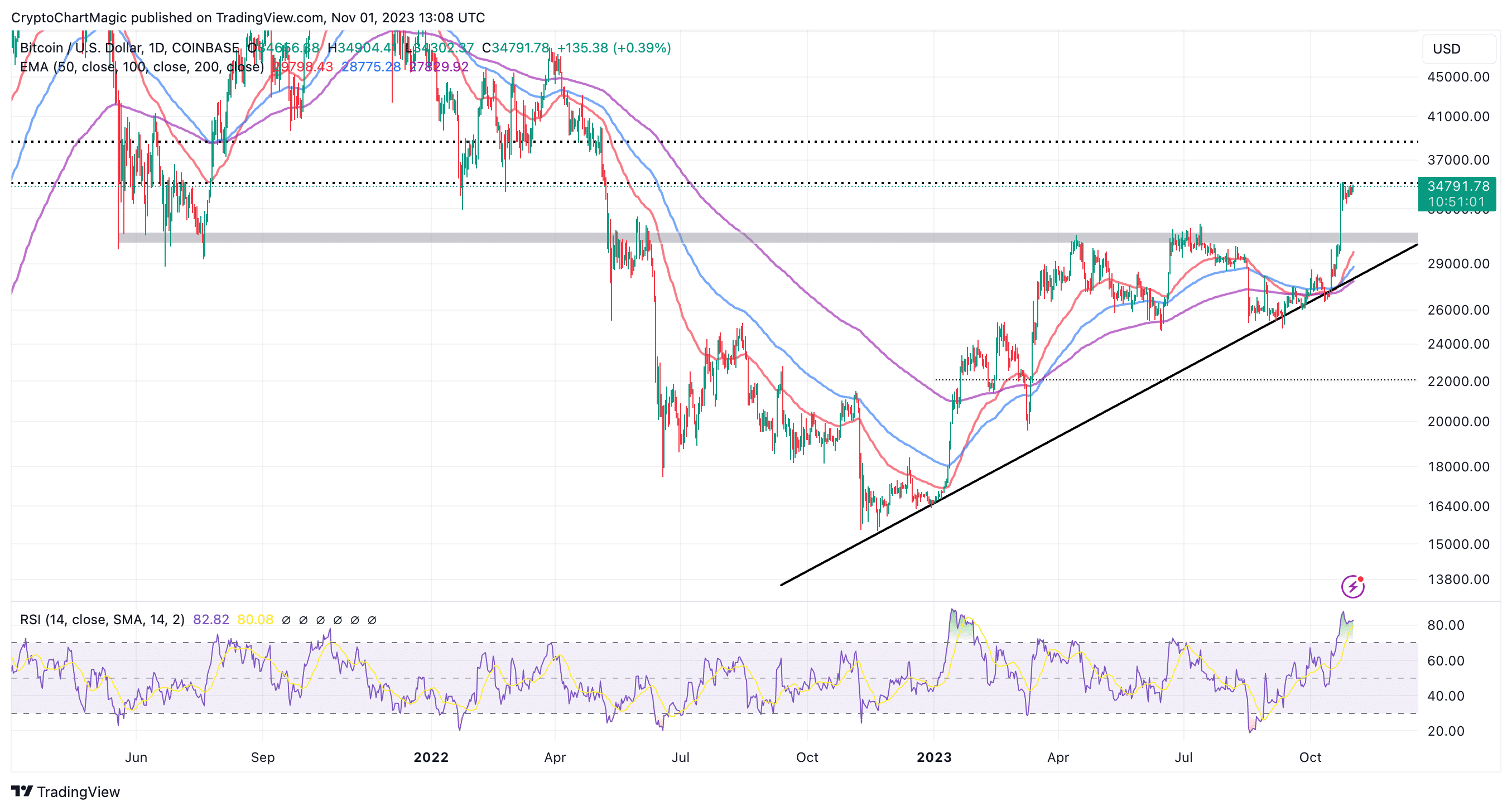

The biggest cryptocurrency is closely oversold primarily based on the outlook of the Relative Power Index (RSI). After regaining the bottom from extremely oversold circumstances in August at 18, the RSI ascended into the overbought area final week however topped out at 87.

A gradual correction seems to be gaining momentum, with the RSI anticipated to enter the impartial space beneath 70 earlier than the week ends. A number of makes an attempt made to clear resistance at $35,000 didn’t bear fruit such that Bitcoin slipped to $33,384 in some unspecified time in the future.

Crypto analysts and investor Rekt Capital agrees with the technical outlook that Bitcoin price is in consolidation beneath resistance at $35,000. He predicts that the upcoming Federal Open Market Committee (FOMC) resolution on rates of interest within the US might set off a minor dive to brush liquidly as Bitcoin retests $33,000 assist.

Merchants ought to contemplate making ready their new entry positions for that space as “the following goal stays to be $36.5 – 37k).”

#Bitcoin nonetheless consolidating beneath resistance.

FOMC developing, so I would not be shocked that we’ll be taking liquidity beneath us.

Retest at $33K?

General, that space is a transparent entry level, subsequent goal stays to be $36.5-37K. pic.twitter.com/AjSqItFRvf

— Michaël van de Poppe (@CryptoMichNL) November 1, 2023

Blockchain knowledge analytics platform CryptoQuant says that “BTC is approaching the overheat zone!” In different phrases, there’s a evident risk of BTC retracing earlier than the following vital enhance.

“Futures OI entered overheating territory in June ’23, and inside two months, its worth plummeted. The identical factor occurred in Oct ’22, when the OI was nonetheless within the overheating zone. In Nov’22, there was the FTX disaster, and there was a much bigger futures liquidation than in Aug ’23,” CryptoQuant mentioned through an X put up. “The OI has entered the overheating zone just lately.”

Bitcoin Stands Out As Secure Haven

The spike in geopolitical tensions because of the ongoing battle between Israel and Hamas is elevating BTC as a safe haven amid falling US Treasury bonds.

In line with Mohamed El-Erian, the chief financial advisor at Allianz, a German monetary providers firm, an increasing number of persons are “speaking about Bitcoins, about fairness and the ‘protected asset’ as a result of they’ve misplaced confidence in authorities bonds being the protected asset,” and this is because of rate of interest threat.

Bitcoin has for the reason that Israel-Hamas battle elevated by no less than 23% whereas the value of a 10-year Treasury word has fallen in the identical interval.

Discussions round Bitcoin changing into a protected haven asset are occurring forward of the Federal Reserve assembly on financial coverage later right this moment. The FOMC is predicted to maintain charges unchanged unchanged at a 22-year excessive of 5.25 to five.5 %.

Associated Articles

The introduced content material could embody the non-public opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any accountability to your private monetary loss.

✓ Share: