Ethereum (ETH) worth ran out of momentum barely above $1,800 dampening investor optimism for a run-up above $2,000. Whereas declines have been minor beneath the instant assist/resistance at $1,800, bulls lack the momentum to renew the uptrend.

In the meantime, a report of the co-founder of Ethereum, Vitalik Buterin, transferring 100 ETH to Coinbase is elevating issues over the way forward for the ecosystem, with some anticipating headwinds. Chinese language reporter was the primary to say the transaction price round $181,000 on the time of switch.

The Vitalik holding deal with vitalik.eth transferred 100 ETH ($181,000) to Coinbase immediately. Beforehand, Vitalik acknowledged that he had not bought ETH for private profit since 2018, primarily donating it to a charity or non-profit group or different initiatives.https://t.co/jmuDIPOOTM

— Wu Blockchain (@WuBlockchain) November 1, 2023

Why Is Buterin Shifting Ethereum

This isn’t the primary time the co-founder has transferred his Ethereum holdings. He lately addressed related issues, saying that he had not bought any Ether since 2018 a minimum of not for enterprise or private achieve.

Buterin primarily donates his ETH holdings to charity, non-profit organizations, and different initiatives.

Nonetheless, the group accepted Buterin’s assertion with a grain of salt, with some like @JasonWavesRider (a consumer on X (previously Twitter) elevating extra issues that one thing larger could possibly be coming.

Fascinating to see Vitalik shifting ETH, particularly since he stated he hadn’t bought ETH for private profit since 2018. Marvel what he is as much as. #ethereum #vitalikbuterin

— Maket Waves Rider (@JasonWavesRider) November 1, 2023

He could also be shifting ETH on account of private causes or it could possibly be that he’s financing one other mission. Both means, the true cause behind these frequent transfers stays unknown.

The place Is Ethereum Heading Amid Uncertainty

The uncertainty across the lack of transparency concerning transactions made by Buterin isn’t serving to the token which should regain the bottom above $1,800 to make sure investor confidence within the uptrend isn’t misplaced.

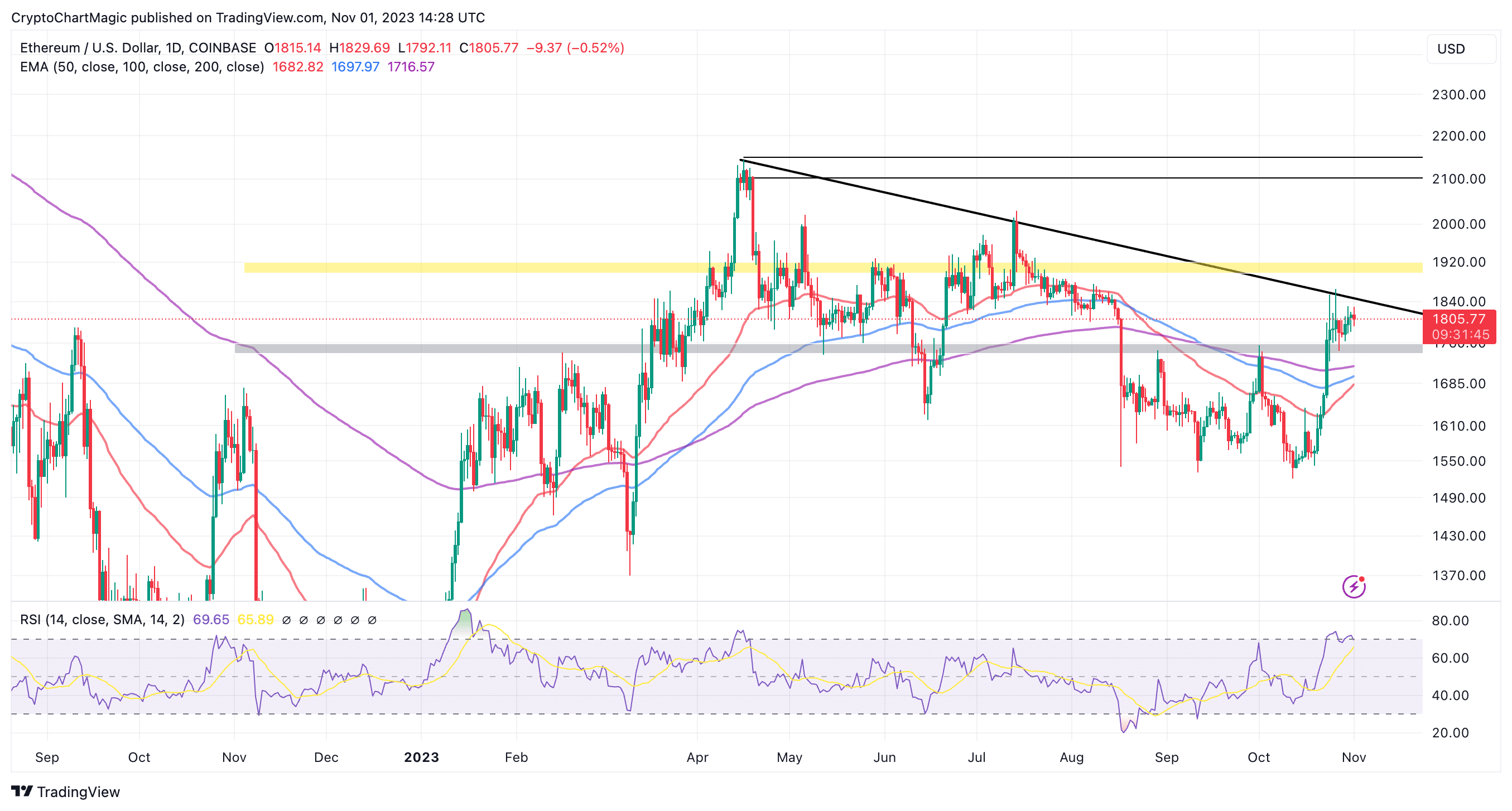

Primarily based on the Relative Energy Index (RSI) retreating from the overbought area, the price of Ethereum is prone to slide considerably beneath $1,800. Assist at $1,740 could present the required liquidity to create the momentum for a bigger breakout towards $2,000.

As Ethereum rebounds above $1,800 merchants will begin to determine vital ranges such because the descending trendline that stopped the bullish social gathering in October. A profitable breakout is required at this worth level to affirm the constructive outlook in addition to the uptrend.

The subsequent key stage can be the vendor congestion at $1,900 which can both pave the way in which for the climb to $2,000 or delay the breakout for a interval of consolidation, to not point out, the potential for a correction again to $1,800 or a decrease assist space like $1,740.

Associated Articles

The introduced content material could embody the private opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any accountability in your private monetary loss.

✓ Share: