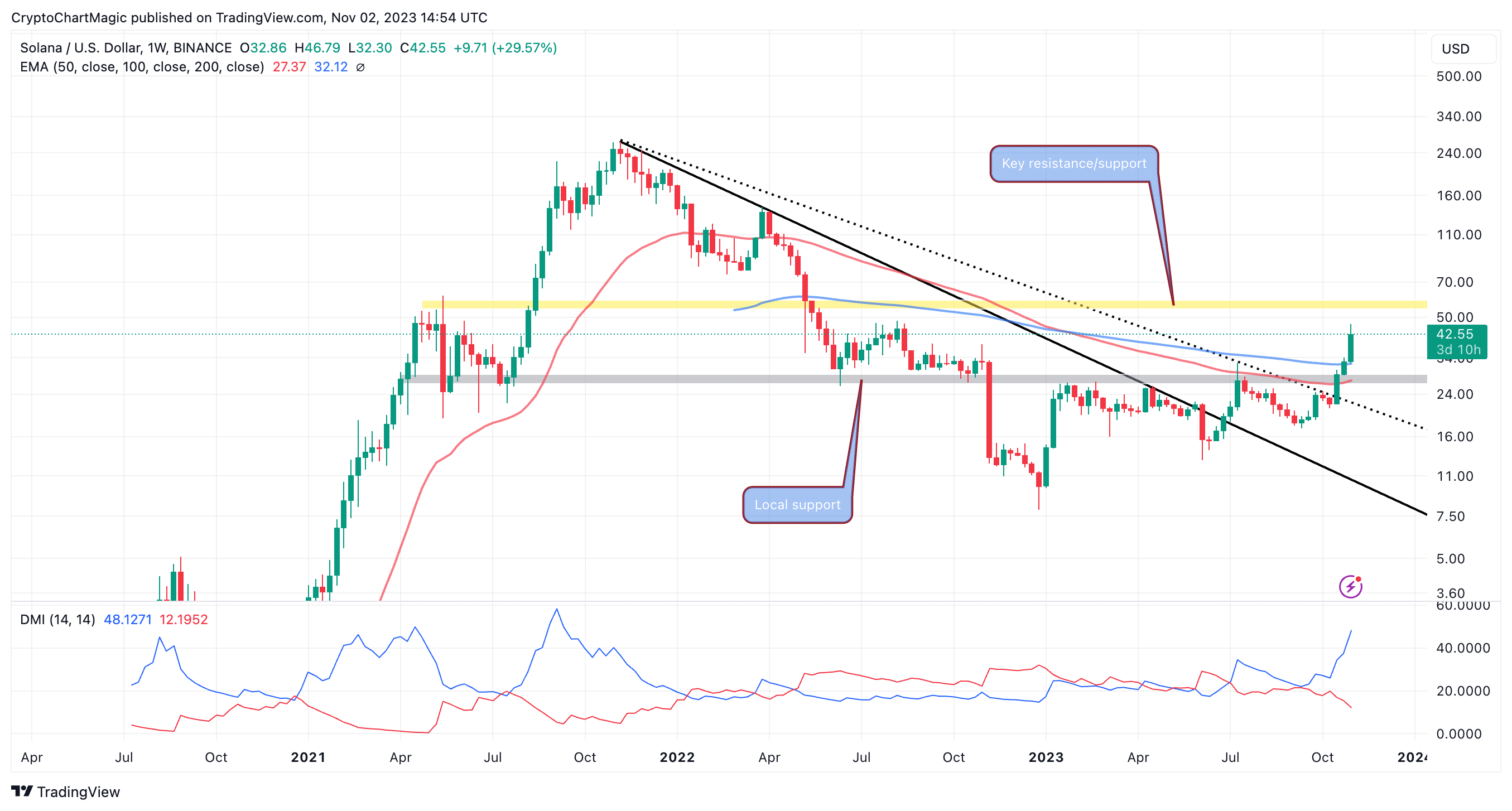

Altcoins within the decentralized finance (DeFi) are flying excessive and Solana (SOL) is on the forefront of this impeccable rally, up 13% within the final 24 hours to $43.41. The good contracts token might be mentioned to be at the start of a prolonged climb, with many traders and analysts questioning if SOL can mimic the earlier bull run to the all-time excessive of $260.

The beginning of a bull run is commonly characterised by a persistent uptrend with minimal pullbacks. Solana price efficiency since mid-September has proven related sentiments.

If SOL upholds increased help, the bullish outlook depicted particularly in October, may propel it above $50. This spectacular surge offers merchants with loads of scalping alternatives.

Nonetheless, as they purchase and promote, they need to achieve this cautiously, realizing that Solana is closely overbought and should have to consolidate or right for liquidity at lower cost factors.

The Crypto Winter Is Over For Solana

Precisely a yr in the past, the crypto market confronted what went down in historical past as one of many largest crashes attributable to the collapse of Sam Bankman-Fried’s crypto empire. The domino impact landed on the empire in full pressure after CoinDesk revealed an article that exposed Alameda Analysis, Fried’s buying and selling agency, was siphoning buyer funds from the crypto alternate FTX.

To chop the lengthy story brief, FTX filed for chapter, leaving collectors counting losses. Fried is in court docket preventing to remain out of jail whereas chapter proceedings proceed with the hope of creating collectors entire.

As for Solana, the token plunged massively to $8 attributable to its relationship with FTX and Alameda. It’s estimated that FTX holds roughly 55.8 million SOL tokens.

In some unspecified time in the future, individuals referred to Solana as a lifeless ecosystem. Nonetheless, it has proven resilience within the final 12 months—greater than doubling its worth since final month.

If Solana retains up with the uptrend to $50 and $60, FTX prospects who declare $10 billion could also be absolutely reimbursed. In the intervening time, they will solely recuperate as much as 80% of their claims towards the bankrupt FTX.

What’s Subsequent For Solana, Chart Evaluation

The Directional Motion Index (DMI) reveals on the every day chart that bulls have the larger say for the time being and can proceed to affect the direction Solana price takes.

Nonetheless, traders ought to keenly observe the indicator as a correction will observe swiftly if the +DI line in blue begins to retreat whereas the -DI line in purple climbs.

For brand new purchase entries, merchants should have to attend for Solana to substantiate increased help, ideally above $40. This may enable for the gathering of liquidity for the subsequent transfer to $50.

On the draw back, shedding help at $40 could encourage bears to push for lower cost ranges. Buyers could think about closing their positions to lock within the features, thus creating extra promoting stress. In that case, it might be prudent to count on a sweep at $35 but when push involves shove, Solana may drop to retest $30.

Associated Articles

The introduced content material could embody the private opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any accountability in your private monetary loss.

✓ Share: