On-chain knowledge reveals that cash from GBTC has been flowing into the newly launched spot Bitcoin ETFs amid very low payment buildings.

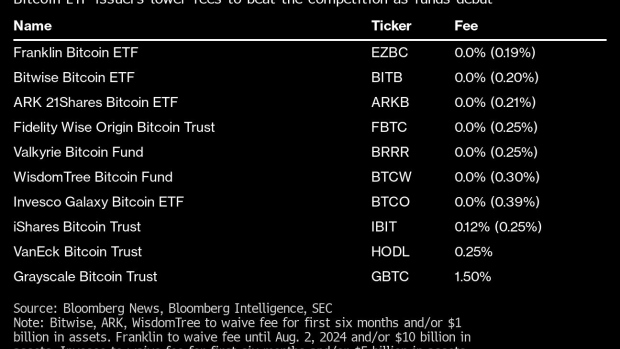

In an unique interview with Bloomberg Tv from Davos on Wednesday, January 17, Grayscale Investments Chief Government Officer Michael Sonnenshein defended the 1.5% administration payment charged for the Grayscale Bitcoin Belief (GBTC). This payment is presently the best amongst spot Bitcoin ETFs available in the market. Sonnenshein justified the payment, citing the corporate’s important dimension, excessive liquidity, and confirmed monitor file.

“As an investor, when you find yourself selecting amongst these merchandise, charges are a consideration, the asset supervisor, the issuer behind it are a consideration, however so needs to be dimension, liquidity and that monitor file,” acknowledged Sonnenshein in the course of the interview.

The cryptocurrency market has not too long ago witnessed the launch of 9 rival exchange-traded funds, a few of that are attracting buyers with incentives reminiscent of zero charges. Nonetheless, Grayscale’s Bitcoin Belief has skilled roughly $1.2 billion in outflows since its conversion to an ETF following regulatory approval final week, in response to knowledge compiled by Bloomberg Intelligence. In distinction, excluding Grayscale’s Bitcoin Belief, all different spot Bitcoin ETFs have recorded round $1.9 billion in web inflows.

VanEck’s not too long ago launched spot Bitcoin ETF boasts a administration payment that stands because the second-highest among the many newest ETF choices. Nonetheless, it’s considerably more cost effective compared to GBTC, with a payment set at 0.25%. However, BlackRock’s iShares spot Bitcoin ETF, witnessing the best inflows amongst all Bitcoin ETFs since its current market debut, options an preliminary payment of 0.12%. This introductory payment is more likely to enhance to 0.25% after 12 months for accounts holding lower than $5 billion in belongings.

-

- Picture: Bloomberg

- GBTC Outflows Shifting Into Bitcoin ETFs

The Grayscale Bitcoin Belief (GBTC) has witnessed notable outflows within the wake of the current launch of spot Bitcoin ETFs. These ETFs current a extra regulated and safe technique of holding Bitcoins. Market analysts recommend that almost all of the outflows from GBTC have resulted in substantial inflows into the ETFs.

Bloomberg strategist James Seyffart has noticed a major switch of funds from Grayscale Bitcoin Belief ($GBTC) to rival ETFs, underscoring the potential significance of this pattern. Seyffart estimates a considerable outflow of round $594 million from $GBTC, totaling $1.173 billion in outflows.

Assuming the information is appropriate it backs up one thing i wrote about yesterday. A variety of these $GBTC outflows are probably discovering a house in competing ETFs https://t.co/Bj8HZAOkXa pic.twitter.com/qcVBnbdnX5

— James Seyffart (@JSeyff) January 17, 2024

Sooner or later after the approval of spot Bitcoin ETFs by the US Securities and Change Fee, Grayscale Investments filed for a lined name ETF. Based on the N-1A type submitted final Thursday, the corporate goals to supply present revenue and allow participation within the worth return of Grayscale Bitcoin Belief.

The submission of the lined name signifies a possible lower in volatility inside the crypto markets sooner or later. Nonetheless, Sonnenshein clarified that the first driving power behind the lined name submitting was investor curiosity, not volatility. Sonnenshein said:

“With the ability to supply a lined name technique permits buyers to have passive lengthy GBTC publicity but in addition earn some extra revenue. I don’t suppose it’s for us a lot a measure of volatility however as a substitute that we’ve heard from buyers that they need to be passively lengthy of that asset class.”

Learn different market news on Coinspeaker.