A well-liked crypto analyst has supplied a bullish outlook for Bitcoin worth as BTC’s meteoric rise continues smashing by the $71,000 barrier, setting yet one more document excessive. Notably, the analyst predicts a staggering excessive of $337,000 for the flagship cryptocurrency. With optimism hovering and institutional curiosity intensifying, Bitcoin’s trajectory has traders on the sting of their seats.

Analyst Predicts Bitcoin Value To Hit $337,000

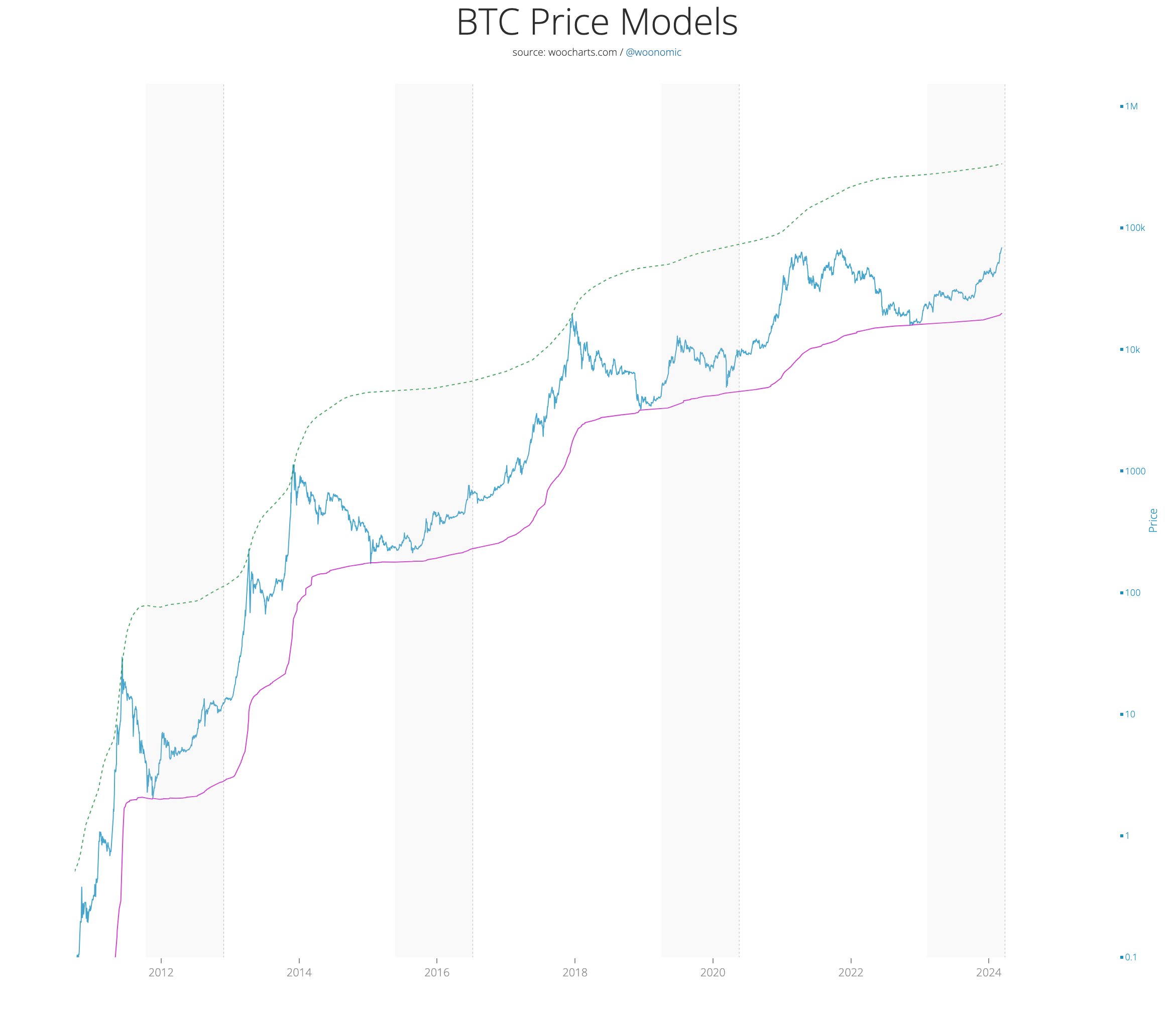

Famend Bitcoin analyst Willy Woo, managing associate at CMCC Crest, has shared an optimistic outlook for Bitcoin’s worth trajectory. Woo’s chart on the X platform illustrates a possible upper-bound mannequin, projecting a exceptional $337,000 peak for Bitcoin.

Notably, he attributes a flurry of things behind his bullish momentum for Bitcoin. This features a vital inflow of capital into the community in addition to the emergence of a full-fledged fundamentals-driven bull market.

Nonetheless, backing his forecast, Woo emphasizes the Bitcoin Macro Index (BMI), a composite of 17 macro indicators, signaling a full-blown bull market. As well as, he highlights the inflow of $1.8 billion per day into the community, hinting at robust investor confidence.

Nonetheless, regardless of the latest constructive momentum, he urged traders to tread cautiously amid the rally. Notably, he warned in opposition to potential profit-taking alternatives by the traders, as measured by the Spent Output Revenue Ratio (SOPR), suggesting an impending interval of consolidation.

Additionally Learn: Mudrex Offers Indian Retail & Institutional Investors Access to US Spot Bitcoin ETFs

Potential Elements Behind The Rally

The bullish sentiment surrounding Bitcoin’s worth surge has injected renewed optimism into the market. Buyers are buoyed by the anticipation of the upcoming Bitcoin Halving occasion, traditionally related to vital worth rallies.

As well as, institutional curiosity, as evidenced by strong inflows into U.S. Bitcoin Spot ETFs, additional underscores confidence in Bitcoin’s long-term potential. With institutional gamers more and more coming into the crypto area, Bitcoin’s ascent to new highs appears more and more believable. Moreover, the latest announcement from the London Stock Exchange (LSE) for accepting Bitcoin & Ethereum ETN requests has additionally fuelled the boldness of traders.

In the meantime, as of writing, the Bitcoin price was up 2.45% during the last 24 hours and traded at $71,703.25, whereas its one-day buying and selling quantity soared 71.98% to $48.18 billion. During the last 24 hours, the BTC has touched a excessive of $71,830.99 and a low of $67,194.89.

Alternatively, the Bitcoin Open Curiosity (OI) during the last 24 hours rose 4.10% to 491.65K BTC or $35.36 billion, CoinGlass data confirmed. The CME change topped the record with a 2.41% surge to $10.63 BTC, adopted by Binance’s 5.08% surge to $8.07 billion.

Additionally Learn: Metis Price Soars 27% Ahead of Binance Listing

The introduced content material could embrace the private opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any accountability on your private monetary loss.

✓ Share: