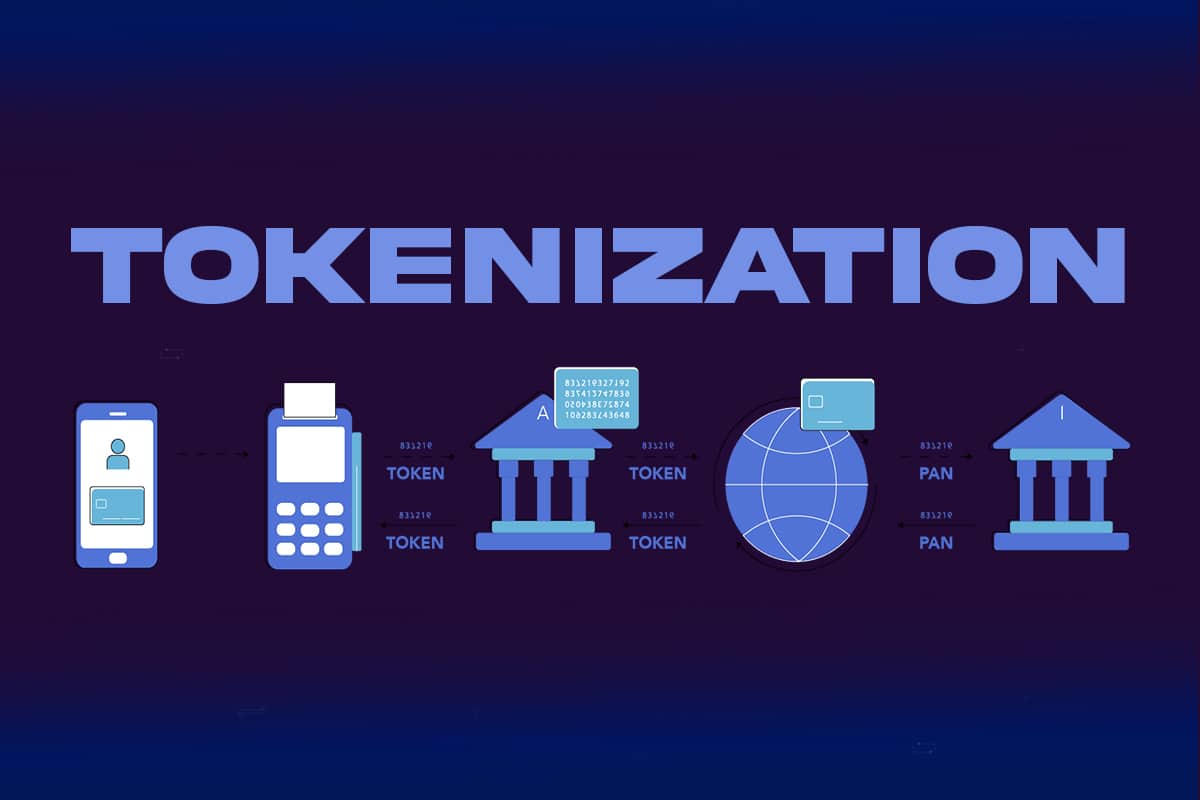

The Society for Worldwide Interbank Monetary Telecommunication (SWIFT) has just lately articulated its imaginative and prescient for integrating with a tokenized future, emphasizing the essential position of a messaging layer inside tokenized cost methods. This strategy is designed to merge the strong strengths of the messaging companies of SWIFT with the artistic potential of shared ledger know-how.

CB⚡DC DAILY: 🤘🏼#Swift promotes the idea of a common shared ledger. However primarily based on messaging

I respect Swift, however the future won’t seem like the previous.#CBDC #FinTech@efipm@Kiffmeister@sonjadav@Jonas__Gross@conrad_kraft@JoshuaLipskyhttps://t.co/lo2fPfBicK

— Richard Turrin (@richardturrin) March 22, 2024

SWIFT’s Stance on Tokenization and Shared Ledgers

SWIFT has noticed speedy developments in fintech, significantly within the space of tokenization and the event of shared ledger fashions. The group, consequently, acknowledges the flexibility of shared infrastructure to ship reside steadiness updates to all contributors in a shared ledger.

SWIFT, nonetheless, additionally highlights the drawbacks of shared ledgers in processing big information volumes. This limitation illustrates the necessity for a messaging layer that’s able to supporting transactions and data-intensive latter-day monetary companies, together with compliance, anti-money laundering (AML) measures, and sanctions screening.

Position of Messaging in a Unified Ledger

The proposal from SWIFT presents a possibility to make the most of its already-in-place ISO-20022 messaging know-how as the inspiration of a brand new sort of cost mannequin that merges the perfect of each centralized and decentralized methods. This mannequin assumes a state machine that may dynamically mirror the transaction and steadiness statuses inside a number of establishments, that’s, presumably constructed on a blockchain technology or centralized platform equivalent to SWIFT Transaction Supervisor.

This sort of hybrid strategy seeks to allow a clean change to the tokenized cost methods whereas additionally caring for the regulatory wants and efficient processing of monetary transactions.

Addressing the Challenges of Adoption

SWIFT acknowledges the difficulties and coordination issues with transferring to a shared ledger system. The group argues that using the prevailing elements of the monetary system, that are already built-in, can get rid of market focus dangers. It outlines a sensible strategy to the implementation of shared ledgers by bettering present platforms and strategies to deliver wealthy, structured information rapidly.

This methodology would allow the importance of safe monetary messaging companies equivalent to these supplied by SWIFT to stay within the communication and execution of transactions in a tokenized world.

By advocating for a spot inside tokenized cost methods, SWIFT seeks to merge the hole that exists between conventional banking transactions and the brand new digital monetary infrastructure that’s gaining reputation. Of their proposal of a mannequin consisting of a messaging layer and shared ledger know-how, SWIFT goals to handle the business’s want for an revolutionary and reliable system.

Learn Additionally: 3 Lesser Known Dogecoin ‘Killers’ To Buy As Cryptos Cascade In March

The offered content material might embrace the non-public opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any accountability to your private monetary loss.

✓ Share: