Bitcoin (BTC) staged a powerful restoration over the past weekend taking pictures all the way in which to $66,000 after going through some promoting stress final week. Analysts are clearly watching as to by which path the Bitcoin worth would see a formidable momentum forward. Nonetheless, a big a part of the Bitcoin provide remains to be in revenue, which places some stress on the upside from right here.

Bitcoin (BTC) Revenue Provide

In current on-chain information, it’s been reported that the share of Bitcoin provide presently in revenue stands at 88.8%. Though this determine stays comparatively excessive, it has notably decreased from its peak earlier within the 12 months.

The final occasion the place the share reached this degree was on February seventh, 2024, when the value of Bitcoin was recorded at $44,000. Analysts are actually intently watching to see if Bitcoin can maintain its present momentum or if an extra cooldown interval is important for the market.

The % of the Bitcoin Provide in Revenue is now at 88.8%

That is nonetheless elevated however has cooled down for the reason that highs of earlier this 12 months

The final time at this degree was February seventh, 2024, when the value was $44K

Let’s examine if BTC has legs right here or if it wants an extra settle down pic.twitter.com/ZOBSU9RdDj

— On-Chain Faculty (@OnChainCollege) April 21, 2024

BTC Worth Backside

Some market analysts like Nebraskagooner believe that ought to Bitcoin surge to $75,000 from its present place, it might point out that the market has reached its backside. Nonetheless, if the value falls under $58,000, it means that the underside has not but been reached.

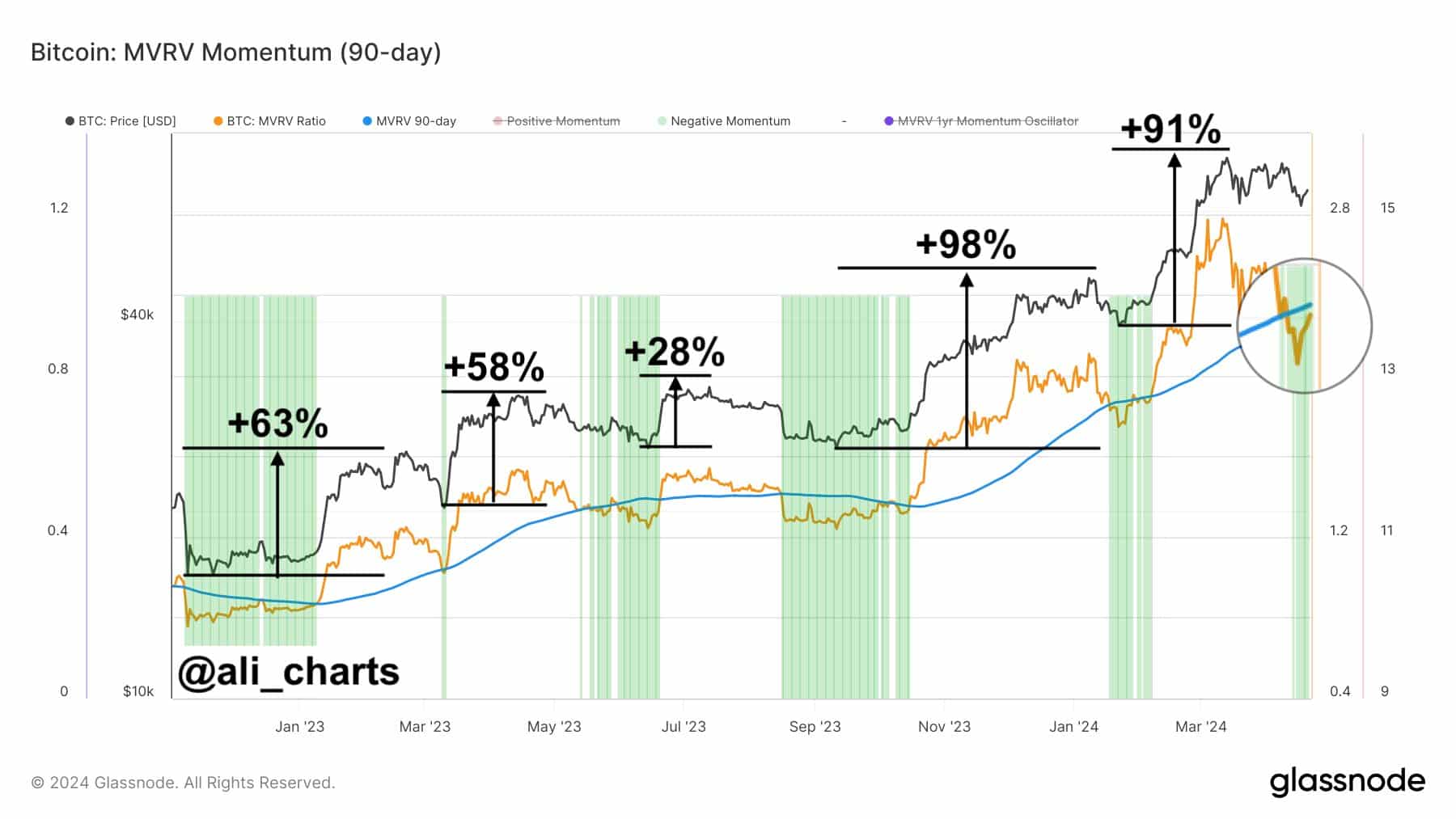

Additionally, the Bitcoin MVRV ratio hints at a main shopping for alternative at this level. In response to crypto analyst Ali Martinez, at any time when the Bitcoin MVRV Ratio dips under its 90-day common since November 2022, it suggests a good BTC shopping for probability, traditionally yielding a mean acquire of 67%! This sample has emerged as soon as extra, hinting that now might be a super second to buy $BTC.

Ali Martinez notes that Bitcoin’s correlation with the International Liquidity Index remained sturdy till 2024. Nonetheless, this 12 months, the correlation has damaged. Martinez emphasizes the need of a liquidity enhance earlier than the US elections to maintain the continuing BTC bull market. Regardless of charges paid to Bitcoin miners spiking to 1,258 $BTC, the creation of recent BTC addresses has dwindled, registering solely 260,838. The current surge within the Bitcoin transaction fees has been majorly as a result of Runes protocol.

The introduced content material might embrace the private opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any duty in your private monetary loss.

✓ Share: