The crypto market has witnessed unstable buying and selling these days, with all the key cryptos like Bitcoin, ETH, SOL, XRP, DOGE, SHIB, and others costs slipping over the previous few days. In the meantime, the latest market crash displays the continuing bearish sentiment hovering over the market, whereas dampening the buyers’ confidence.

Though there’s a flurry of macroeconomic and different associated issues, let’s discover a few of the potential causes behind crypto costs’ dip right now.

Why Is The Crypto Market Falling At this time?

The broader crypto market has gone by tumultuous buying and selling thus far over the previous few weeks, over the hovering issues of inflation, the Fed’s stance with their coverage charges, and different associated issues. So, right here we discover the potential the explanation why the crypto market is witnessing a downturn momentum right now.

Bitcoin ETF Outflows Set off Crypto Market Dip

The cryptocurrency market witnessed a downturn right now, pushed by ongoing outflows from the U.S. Spot Bitcoin ETF. In response to Farside Traders information, Bitcoin ETFs have skilled outflows for 3 days this week, contrasting with two days of inflows.

During the last two days, the U.S. Spot Bitcoin ETFs registered a major outflow of $96 million, heightening investor apprehensions. Nonetheless, this comes after a promising begin to the week, with a considerable influx of $217 million into the funding instrument, which has additionally fueled optimism within the crypto market.

In the meantime, the predominant issue behind the outflow strain seems to be the persistent exodus from Grayscale GBTC, with over $146 million exiting prior to now two days alone. These consecutive outflows from Bitcoin ETFs and the continuing Grayscale exodus have contributed to the prevailing damaging sentiment within the crypto sector.

Inflation Issues

At this time’s crypto market dip is attributed to heightened inflation issues following latest financial information. For context, the College of Michigan’s shopper sentiment index plummeted from 77.2 in April to 67.4 in Might, marking a six-month low and lacking expectations.

As well as, inflation expectations for the 12 months forward surged to three.5%, reaching a six-month excessive, whereas the five-year outlook rose to three.1%. In the meantime, Federal Reserve officials’ cautious remarks additional fueled investor nervousness.

As CoinGape Media reported earlier, Fed’s Lorie Logan highlighted vital upward inflation dangers, advocating for coverage flexibility and ruling out fast charge cuts. Concurrently, Fed Governor Bowman emphasised the necessity for sustained coverage stability.

These developments have left buyers apprehensive concerning the financial outlook, prompting a downturn within the crypto market as they search readability amid unsure monetary situations.

Additionally Learn: Dogecoin (DOGE) Price Eyes ‘Golden Cross’, A Mega Rally ahead?

Anticipation of Subsequent Week’s Financial Information

Traders are bracing for subsequent week’s financial information launch, inflicting a pause within the crypto market right now. With latest bleak financial indicators impacting sentiments, anticipation looms over the U.S. Producer Value Index (PPI) and Core PPI information set to be unveiled on Tuesday, Might 14, alongside Fed Chair Jerome Powell’s handle.

Following this, the focus shifts to the U.S. Consumer Price Index (CPI) information and Core CPI information, in addition to U.S. retail gross sales information, scheduled for launch on Wednesday, Might 15. Notably, these pivotal financial figures maintain vital weight for crypto market buyers, providing insights into the present financial panorama and inflationary pressures.

In the meantime, as anticipation builds, market members are exercising warning, resulting in a short lived downturn within the crypto market as they await essential indicators to navigate future funding methods.

A Nearer Look Into The Market Traits

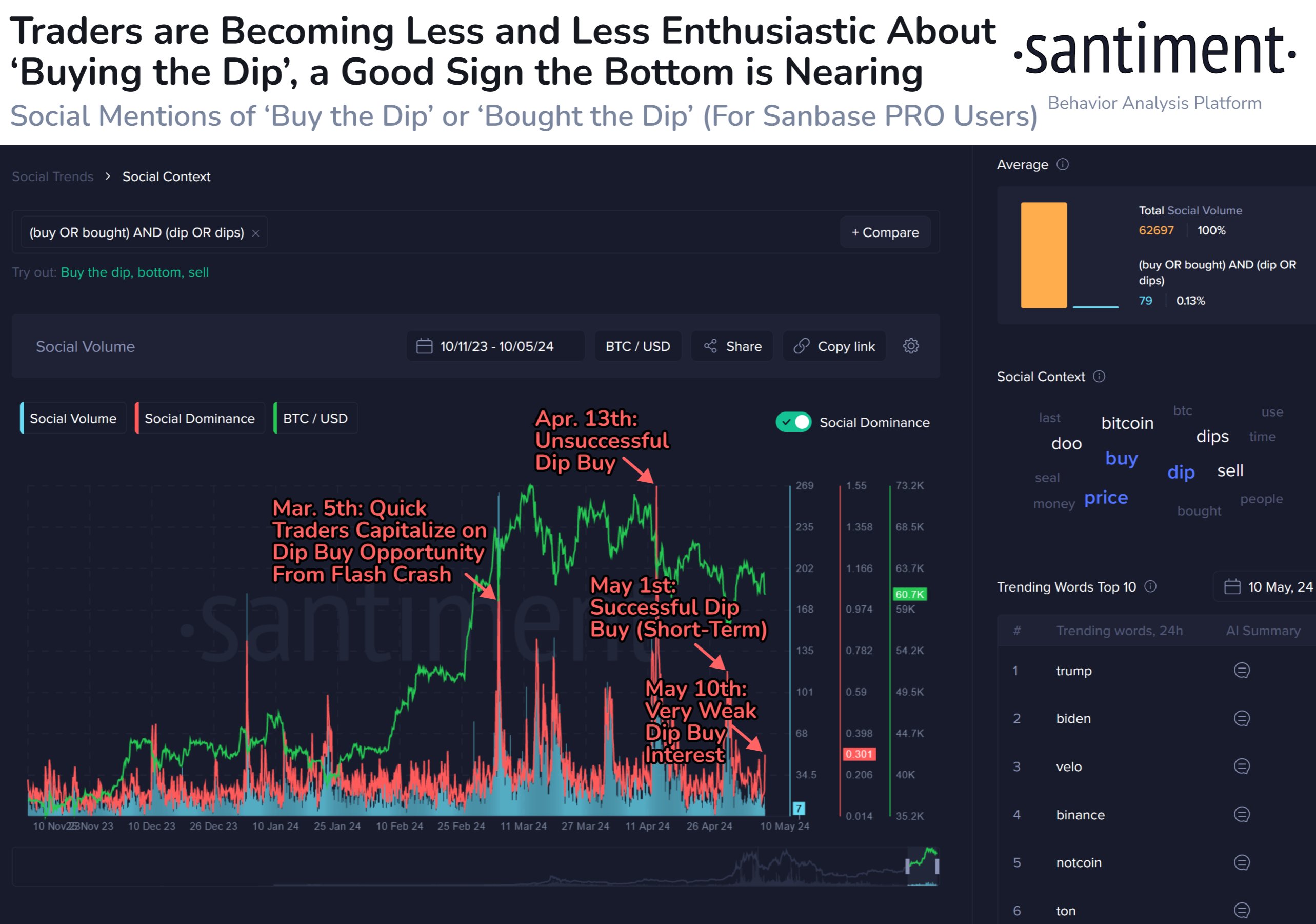

The latest discussions over the crypto market dip have been additional intensified by the most recent report of Santiment. In a latest X submit, Santiment mentioned that this downward development coincided with a regarding lack of enthusiasm amongst merchants to capitalize on the dip by the “purchase the dip” technique.

In the meantime, the report means that the prevailing sentiment amongst merchants signifies a insecurity, signaling that the cryptocurrency’s value could also be nearing a backside. This hesitancy to purchase in the course of the dip displays a broader sentiment of uncertainty amongst buyers, contributing to the downward strain on costs throughout the market.

Then again, CoinGlass reported a major surge in crypto liquidations, with 58,000 merchants going through liquidation, totaling $156.53 million within the final 24 hours. Notably, the most important single liquidation occurred on Binance, involving the BTCUSDT pair, with a worth of $3.56 million.

Crypto Costs & Efficiency

The worldwide crypto market fell 3.42% to $2.26 trillion as of writing, indicating the bearish sentiment hovering out there. On the identical time, the Bitcoin price slipped 3.26% and traded at $61,033.64, whereas the Ethereum price plunged 4.00% to $2,922.99.

Equally, the Solana price famous a hunch of 5.65% to $145.72, whereas the XRP price plummeted 2.31% to $0.5058. The state of affairs within the meme coin sector was additionally bearish amid the broader market retreat. The main meme coin, Dogecoin price fell 5.15% to $0.1445, whereas the Shiba Inu price decreased by 3.80% to $0.00002262.

Additionally Learn: PEPE Investors Accumulate 650 Bln Pepe Coin, More Steam Left?

The offered content material might embrace the non-public opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any accountability on your private monetary loss.

✓ Share: