On-chain knowledge exhibits 90% of all Ethereum traders are actually in revenue following the sharp surge that the asset’s value has seen past $3,800.

Ethereum Traders Overwhelming In The Inexperienced After ETF Rally

In line with knowledge from the market intelligence platform IntoTheBlock, ETH’s newest rally has meant {that a} shift in investor profitability has occurred on the community.

To maintain observe of holder profitability, the analytics agency makes use of on-chain knowledge to seek out what the typical acquisition value or price foundation of every handle on the blockchain is.

If this value is lower than the present spot worth of the cryptocurrency for any handle, then that exact investor is taken into account to be in revenue, or “within the cash”, as IntoTheBlock defines.

Alternatively, the associated fee foundation being decrease than the asset’s value suggests the handle is holding some web quantity of loss, so its holder can be “out of the cash.”

Naturally, if the typical shopping for value of the pockets is the same as the spot value of the coin, then the investor can be thought-about to be simply breaking even (“on the cash”).

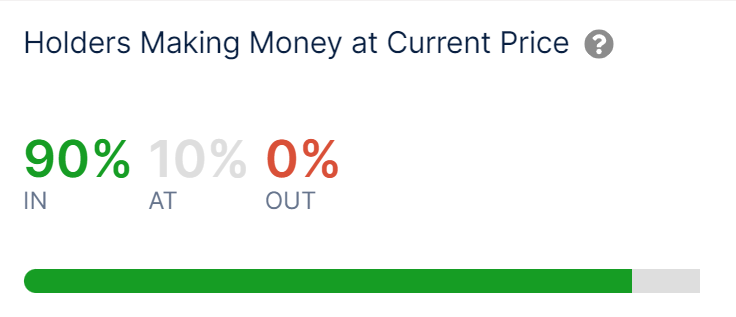

Now, here’s what the profitability breakdown of the Ethereum userbase seems to be like following the sharp rally that the asset has loved:

Seems to be like a considerable amount of traders are within the inexperienced for the time being | Supply: IntoTheBlock on X

As is seen above, 90% of the whole addresses on the Ethereum community are holding their cash at some web unrealized acquire following the sharp surge the asset’s value has seen.

Curiously, 0% of the wallets are additionally out of the cash, that means there isn’t any one on the blockchain that’s in losses anymore. 10% of the traders are nonetheless on break-even, although.

Traditionally, holders in revenue have been extra more likely to promote than these in loss. As such, each time the market has seen a big imbalance in direction of inexperienced traders, the probabilities of a selloff occurring have been notable.

Due to this motive, tops within the cryptocurrency’s value can turn out to be extra possible at excessive profitability ratio ranges. Since an amazing quantity of ETH traders are carrying positive factors now, a mass profit-taking occasion could also be more likely to happen, which may impede the present rally.

It needs to be famous, although, that in bull markets, the asset has usually been capable of maintain excessive investor income for some time, as excessive demand retains flowing in to soak up any profit-taking, earlier than a prime ultimately happens.

That mentioned, the probability of at the very least non permanent cooldowns going down can go up if profitability stays excessive for too lengthy. It now stays to be seen how the Ethereum value develops from right here on out and whether or not the hype across the spot ETFs will have the ability to counteract any selloffs available in the market.

ETH Worth

With a rally of over 22% over the previous 24 hours, Ethereum has managed to succeed in the best ranges in additional than two months as its value is now buying and selling round $3,800.

The value of the coin appears to have noticed some sharp bullish momentum previously day | Supply: ETHUSD on TradingView

Featured picture from Bastian Riccardi on Unsplash.com, IntoTheBlock.com, chart from TradingView.com