Whereas the broader cryptocurrency market continues to consolidate, Uniswap’s native cryptocurrency UNI has made a powerful transfer rallying greater than 17% and capturing previous $10. As of press time, the Uniswap (UNI) price is buying and selling at $10.75 with its market surging to $6.5 billion. The each day buying and selling quantity for Uniswap has additionally seen a 30% leap capturing previous $510 million.

The Uniswap (UNI) Worth Rally

The main motive behind this Uniswap value rally has been that the decentralized change (DEX) has initiated a agency stand in its authorized battle with the U.S. Securities and Change Fee.

Standard decentralized exchange (DEX) Uniswap has pledged to problem the U.S. Securities and Change Fee (SEC) after receiving a Wells discover from the company, asserting that the SEC’s case is “weak.”

Alternatively, the present developments inside the Ethereum ecosystem have additionally contributed to this value surge. On-chain knowledge exhibits that there have been huge whale withdrawals from crypto exchanges after the spot Ethereum ETF information.

One other contemporary pockets withdrew 213,166 UNI($1.96M) from #Binance simply now.https://t.co/u15CE864hm pic.twitter.com/kyOBv0TB5G

— Lookonchain (@lookonchain) May 24, 2024

Uniswap (UNI) has damaged out of a 35-day consolidation part this week, indicating a possible rally that would enhance the token’s value by roughly 30%. Technical indicators and on-chain knowledge each help this bullish outlook.

If the bullish momentum round Uniswap continues and the UNI value sustains above $10.61, it might probably result in an additional rally all the best way to $12.80.

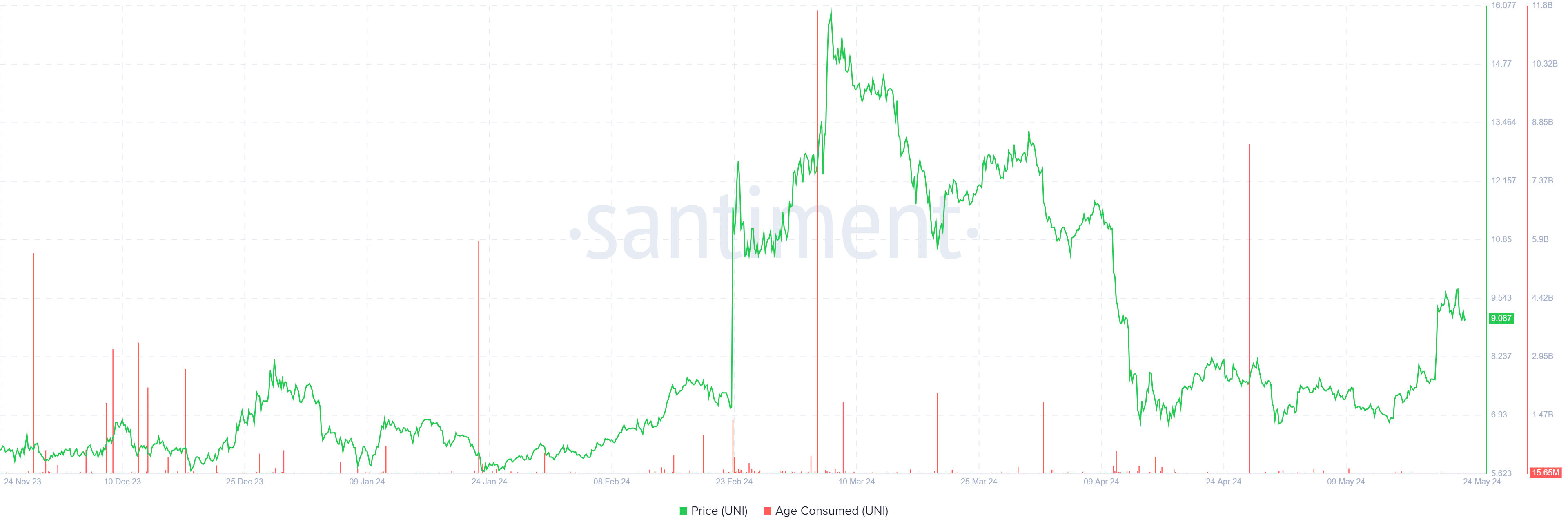

Santiment’s Age Consumed index helps the bullish outlook noticed from a technical perspective. Spikes on this index point out that dormant tokens are on the transfer typically signaling short-term native tops or bottoms. Traditionally, for UNI, these spikes have preceded value rallies. The newest enhance on April 25 recommended that UNI was poised for an uptrend.

$1.2 Million In Liquidations

As per knowledge from Coinalyze, greater than $1.2 million in Uniswap liquidations have occurred within the final 24 hours. Of those, greater than $780K brief positions have been liquidated whereas greater than $380K of UNI lengthy positions have been liquidated.

The open curiosity has shot up by 38% within the final 24 hours to $120 million displaying that the bulls are taking cost of the current value rally.

The introduced content material might embrace the private opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any duty on your private monetary loss.

✓ Share: