Ethereum exchange-traded funds (ETF) have been the speak of the city – and rightly so – after the USA Securities and Change Fee (SEC) authorised the itemizing of the funding merchandise through the week. In the meantime, the Bitcoin spot ETF market continued its resurgence on one aspect, marked by a second consecutive week of constructive inflows.

This streak of constructive inflows represents an entire shift from earlier weeks when funding exercise was dangerously low. Nevertheless, this latest turnaround displays an increase in investor confidence over the previous two weeks.

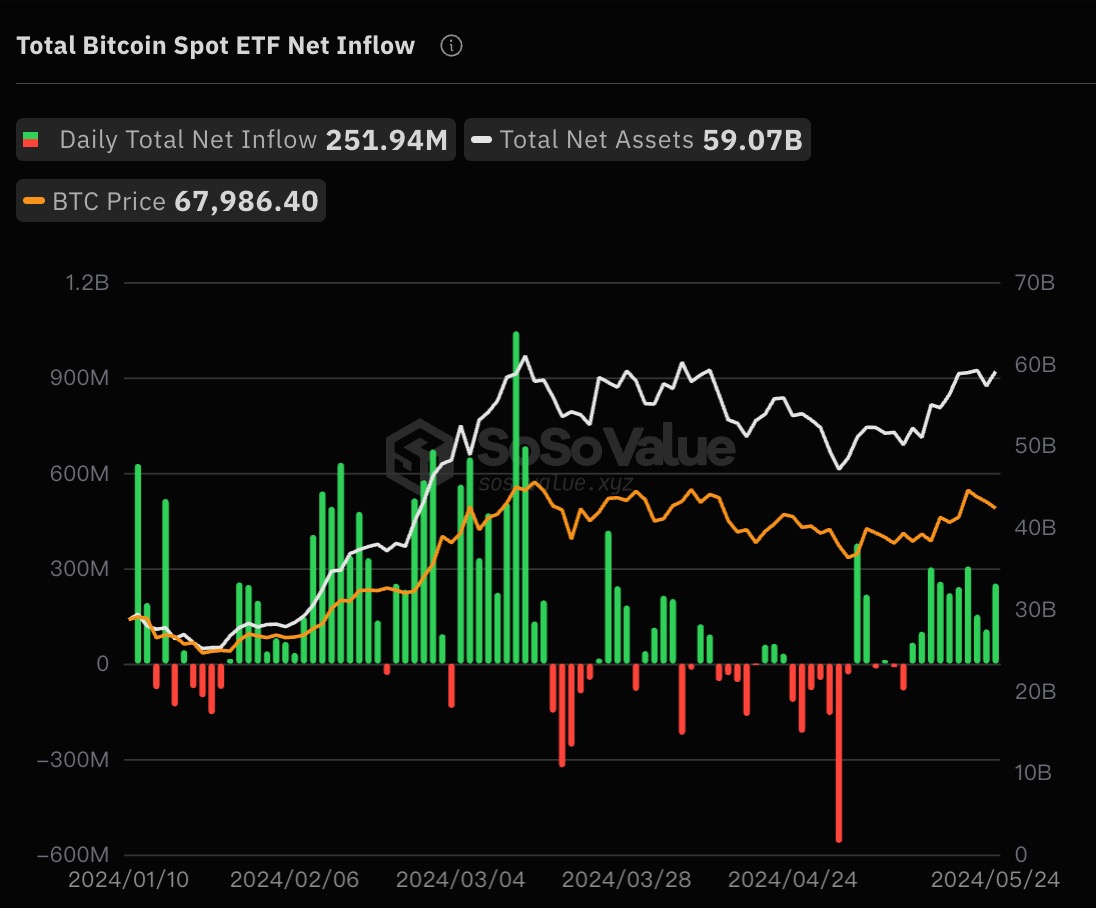

Bitcoin Spot ETF: $252 Million In Web Inflows In One Day

On Friday, Could 24, the US Bitcoin spot ETF market noticed one other day of constructive inflows, marking the tenth consecutive day of serious funding into these funds. In keeping with data from SoSoValue, the market recorded a complete internet influx of roughly $252 million to shut the week.

Associated Studying

Breaking this down, BlackRock amassed a considerable share of the entire day by day funding, with the IBIT ETF posting an influx of $182 million. Grayscale Bitcoin Trust (GBTC), then again, didn’t appeal to any capital on Friday, ending the week with zero day by day outflows and influx.

Different ETF issuers, resembling Constancy, Bitwise, and ARK Funding, additionally witnessed spectacular inflows on Friday. Most notably, Constancy’s FBTC got here second to BlackRock’s fund after attracting about $43.7 million on the final day of the week.

Extra importantly, this constructive influx day signifies that the Bitcoin spot ETF market has amassed vital funding each day for the second week in a row. And after the shut of Friday’s buying and selling session, the online influx prior to now week stood at a powerful $1.06 billion.

This sustained constructive pattern by way of capital inflow means that investor confidence in Bitcoin ETFs is perhaps again at an all-time excessive. The final time there was a constant constructive capital influx into these merchandise, the Bitcoin value rose to a brand new all-time excessive.

With Ethereum spot ETFs getting ready to buying and selling within the US, crypto exchange-trade merchandise appear to be in style for the time being. And so they may simply be the catalyst that the crypto market – notably Bitcoin – must resume what is left of the bull cycle.

Bitcoin Value At A Look

As of this writing, Bitcoin is valued at $68,868, reflecting a 2.5% value enhance within the final 24 hours. In keeping with information from CoinGecko, the premier cryptocurrency is up by 3% on the weekly timeframe.

Associated Studying

Featured picture from iStock, chart from TradingView