Bitcoin, the flagship cryptocurrency, has captivated the crypto market just lately attributable to its risky efficiency. After a robust run within the prior week, BTC has witnessed a stoop after the sturdy U.S. job data.

In the meantime, amid these fluctuations, a brand new evaluation by 10X Analysis means that Bitcoin could be on the cusp of a major rally. This prediction has caught the eye of each merchants and long-term traders, hinting at a possible upward trajectory for the digital asset.

On-Chain Exercise Indicators A Huge Week

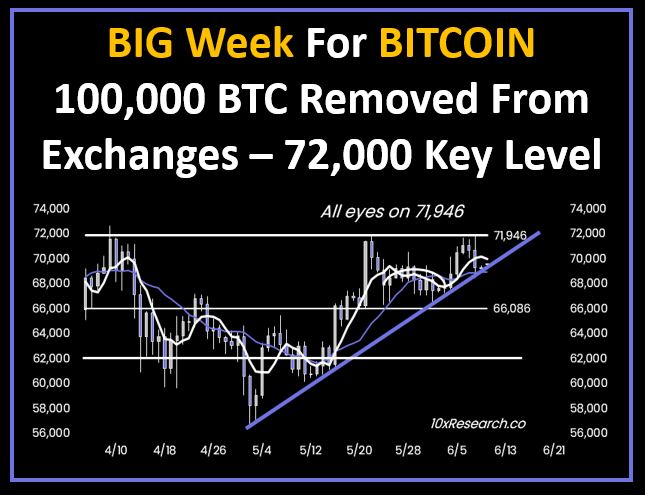

Bitcoin’s current actions have been carefully scrutinized by market analysts. In keeping with 10X Analysis, almost 100,000 Bitcoins had been withdrawn from exchanges up to now month, valued at roughly $6.75 billion.

Notably, this outflux from crypto exchanges was largely led by two main U.S. platforms: Kraken and Coinbase. Kraken noticed a withdrawal of 55,000 Bitcoins, price round $3.8 billion, whereas Coinbase skilled a withdrawal of 24,000 Bitcoins, valued at $1.7 billion.

In the meantime, these huge withdrawals point out a possible bullish sentiment amongst traders. When massive quantities of Bitcoin are moved off exchanges, it usually signifies that holders intend to maintain their property slightly than promote them within the close to future. This pattern might tighten the accessible provide on exchanges, driving up the value if demand stays regular or will increase.

Notably, the agency’s evaluation, shared on the social media platform X, highlights the unprecedented nature of those withdrawals and the implications for Bitcoin’s worth motion.

Additionally Learn: How Bitcoin Will Benefit From End Of US-Saudi Petrodollar Deal

Bitcoin Value & Efficiency

The present market dynamics recommend that Bitcoin could be making ready for a major breakout. The mix of diminished trade provide and the lingering results of the Bitcoin halving might create situations ripe for a worth surge. Notably, traders and analysts alike will likely be keenly watching the marketplace for indicators of a breakout, probably making this a vital week for Bitcoin.

Nevertheless, the current risky efficiency available in the market, particularly after the sturdy job information has sparked issues over a hawkish stance by the Federal Reserve. Now, the market will maintain an in depth watch on this week’s U.S. Consumer Price Index (CPI), and PPI information to trace the inflation degree within the nation. Moreover, the FOMC interest-rate determination can even play a vital position in shaping the market sentiment.

As of writing, Bitcoin price was up 0.23% and exchanged palms at $69,432.50, with its buying and selling quantity hovering 19% to $15.27 billion. The crypto has touched a excessive of $69,817.52 within the final 24 hours, after hitting a 30-day excessive of $71,946.46.

Additionally Learn:

The introduced content material could embody the private opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any duty on your private monetary loss.

✓ Share: