Bitcoin has been dealing with fixed promoting strain over the past two weeks and now taking a relaxation round $65,500 ranges. Nonetheless, on-chain information means that the Bitcoin worth correction may not be over but and it might not be till $60,000 that the BTC worth sees a pattern reversal on the upside.

Bitcoin Worth Drop to $60,000 A lot Probably

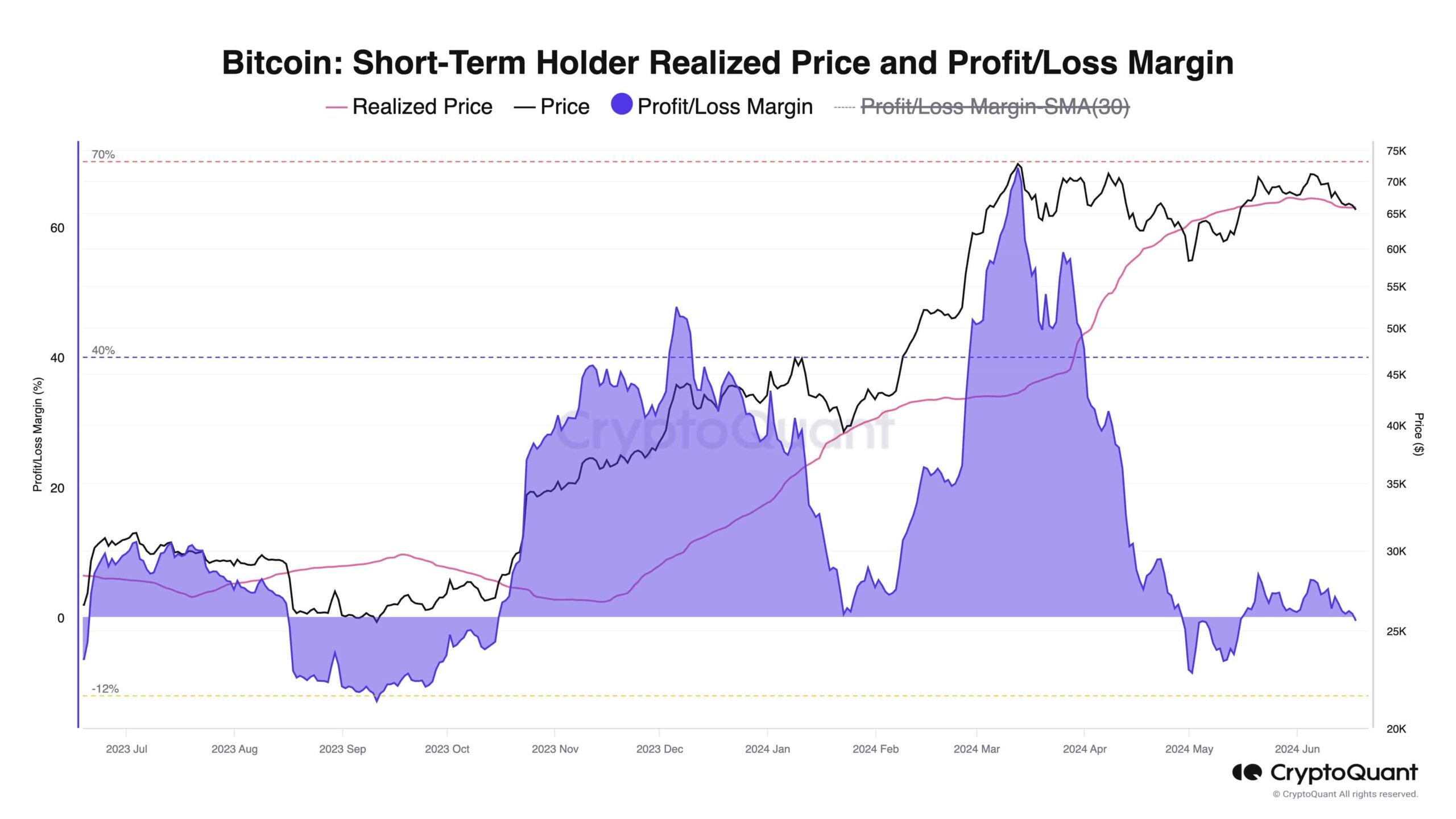

Julio Moreno, Head of Analysis at CryptoQuant, said that the Bitcoin price has fallen under its short-term help ranges, as per the crypto’s on-chain realized worth. Thus, he urged that the BTC worth might face an extra decline to $60,000.

The analyst additional highlighted the important thing demand dynamics, similar to shopping for by massive merchants and buyers, curiosity from US buyers, and stablecoin liquidity, are presently missing momentum.

One other crypto analyst Rekt Capital said that the BTC worth tends to kind clusters of worth motion close to the Vary Excessive resistance round $71,600. Over time, this results in a worth retracement to the draw back thereby leading to clusters of worth motion close to the Vary Low help space of round $60,600.

Bitcoin analyst Willy Woo states that there’s nonetheless an enormous open curiosity within the Bitcoin futures bets, as per the stable yellow chart under, representing a z-score oscillator. This oscillator highlights the native significance of those bets. Woo said {that a} substantial quantity of liquidations could be important earlier than Bitcoin can resume its bullish journey on the upside.

Thus, a number of on-chain indicators counsel that there’s nonetheless some froth within the Bitcoin worth which must be cleared earlier than we start a decisive rally to the upside.

Bitcoin Miners Promoting

As reported by CoinGape, the Bitcoin miners have been promoting in enormous numbers, particularly after the Bitcoin halving occasion in April, so as to cowl the operational prices. As per CryptoQuant CEO Ki Younger Ju, the miners have realized $550 million in earnings this 12 months within the Bitcoin worth vary of $62,000-$70,000.

On the similar time, the long-term whales have bought $1.2 billion value of BTC within the final two weeks, by brokers. Throughout the identical interval, the Bitcoin ETF outflows have skyrocketed to the tune of $460 million. Ju warned that if the $1.6 billion sell-side liquidity isn’t absorbed over-the-counter, brokers might begin depositing Bitcoins to exchanges, resulting in additional draw back.

#Bitcoin long-term holder whales bought $1.2B up to now 2 weeks, doubtless by brokers.

ETF netflows are unfavorable with $460M outflows in the identical interval.

If this ~$1.6B in sell-side liquidity isn’t purchased OTC, brokers might deposit $BTC to exchanges, impacting the market. pic.twitter.com/oYeKsRqKeF

— Ki Younger Ju (@ki_young_ju) June 18, 2024

The offered content material might embody the non-public opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any duty on your private monetary loss.

✓ Share: