The on-chain analytics platform Santiment has offered helpful insights for buyers contemplating shopping for the Bitcoin dip. The platform instructed that the worst won’t be over because the flagship crypto may nonetheless expertise additional dips from its present value vary.

To Purchase Or Not To Purchase The Bitcoin Dip?

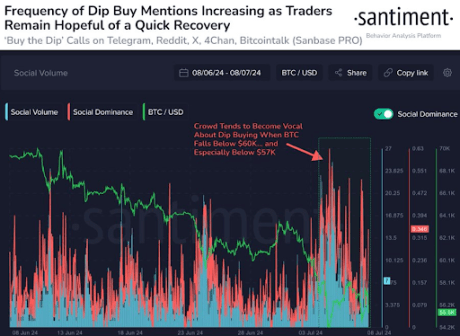

In an X (previously Twitter) post, Santiment talked about to these contemplating shopping for the dip that market individuals additionally anticipate a rebound. They added that these dramatic dips, just like the one Bitcoin just lately skilled, are normally met with FUD (Fear, Uncertainty, and Doubt).

Associated Studying

This implies that these seeking to purchase the Bitcoin dip could should watch out as Bitcoin may dip additional attributable to these ready to dump their holdings out of panic as soon as the flagship crypto recovers. Concerning FUD, there have additionally been calls that Bitcoin may nonetheless drop to the $40,000 range. As such, such statements may show bearish for Bitcoin’s value, inflicting it to additional decline.

In the meantime, Santiment famous that Bitcoin normally recovers from such dramatic dips after the common dealer has given up hope on crypto. Crypto analyst CrediBULL Crypto additionally had some phrases for these seeking to purchase the dip at Bitcoin’s present value vary. He talked about in an X post that anybody seeking to purchase at these present value ranges have to be okay with being “underwater” for some time.

He added that anybody uncomfortable with being underwater for some time ought to wait till some optimistic value motion develops. He famous that this optimistic value motion may ideally come within the “type of a significant liquidation flush (open interest reset) or some LTF impulsive value motion.”

The crypto analyst additionally addressed spot Bitcoin consumers. He assured them that they needn’t fear about this present value vary, claiming that Bitcoin may drop decrease on the upper timeframe (HTF) with out invalidating the HTF bullish construction. Primarily based on Bitcoin’s bullish construction, he talked about that the value correction following this downtrend will ship the flagship crypto to $100,000.

Institutional Buyers Are Shopping for The Dip

Current information from Farside buyers exhibits that institutional investors are shopping for the Bitcoin dip. On July 8, the Spot Bitcoin ETFs recorded whole internet inflows of $294.8 million. BlackRock’s IBIT, Fidelity’s FBTC, and Grayscale’s GBTC all recorded spectacular internet inflows of $187.2 million, $61.5 million, and $25.1 million, respectively.

Associated Studying

These Spot Bitcoin ETFs additionally recorded internet inflows of $143 million on July 5, which marked a turnaround contemplating that they’d skilled two consecutive days of outflows earlier than then. These inflows into Bitcoin have contributed to the current value rebound that the flagship crypto has witnessed.

On the time of writing, Bitcoin is buying and selling at round $57,100, up over 2% within the final 24 hours, in accordance with data from CoinMarketCap.

Featured picture created with Dall.E, chart from Tradingview.com