Luna has been on a tear not too long ago, capturing up a staggering 50% within the final week. At $34 billion, it’s at present the seventh largest cryptocurrency by market cap. Much more headline-worthy is that it has now flipped Solana ($32 billion) and Cardano ($31 billion), who occupy the eighth and ninth spots respectively.

Through CoinMarketCap

Through CoinMarketCap

Luna Token

Luna, in fact, is the token that fuels the DeFi ecosystem of Terra Labs. The true product is a bunch of stablecoins, the most important of which is the dollar-pegged UST. To boil the token’s utility down in easy phrases, Luna’s worth will go so far as UST goes.

As UST beneficial properties adoption, Luna rises, and vice-versa. If UST market cap rises, Luna provide is burned and therefore the Luna worth goes up (and vice-versa). That is because of the distinctive algorithmic mechanism by which the Terra stablecoins retain their fiat pegs (market brokers are incentivised to do that through arbitrage).

Proper now, the UST stablecoin is sitting fairly with a market cap of $13 billion (fifteenth largest crypto) – the fourth largest stablecoin however the one one providing the tantalising high quality of decentralisation. This decentralisation is the distinctive promoting level of UST, in fact. The three heavy hitters forward of UST are all centralised, which could be very a lot a grimy phrase in crypto. The most important is the much-maligned Tether ($79 billion, third largest crypto), Circle’s USDC is subsequent ($53 billion, fifth largest) and Binance USD is third ($18 billion, twelfth largest).

So with Luna’s meteoric rise during the last yr in thoughts, it follows that we will count on to see comparable development within the stablecoin – which the graph under from CoinMarketCap particulars, a formidable rise from simply $2.8 billion this time final yr to in the present day’s $13 billion for the market cap of UST.

UST market cap through CoinMarketCap

UST market cap through CoinMarketCap

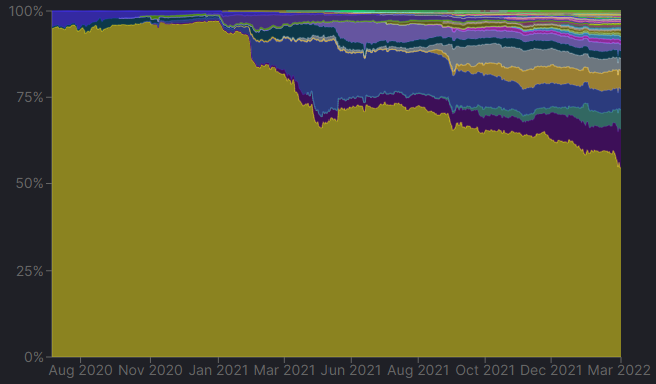

Complete Worth Locked

One other method of monitoring the mushrooming UST market cap is to look at the whole worth locked (TVL) within the Terra ecosystem. Very like each different datapoint associated to Luna, it makes for spectacular studying. A chunky 11.2% of the $290 billion TVL in all the DeFi house is now locked up in Terra, in accordance with DefiLlama. Galloping previous Solana, Avalanche, Fantom and BSC, Terra now comfortably sits in second, with its $23.5 billion in TVL properly away from BSC in third at $12.4 billion. Ethereum, in fact, nonetheless guidelines the roost with its $117 billion representing a 55% share of TVL.

TVL on Luna (purple on graph) has been rising steadily, now representing 11.2% of whole DeFi TVL

TVL on Luna (purple on graph) has been rising steadily, now representing 11.2% of whole DeFi TVL

Contra-Market

However it’s not simply the gross beneficial properties that stand out. An intriguing quirk of Luna during the last yr or so has been it’s propensity to maneuver countercyclically. It’s at present solely 10% off all time highs (Bitcoin is 36% off all time highs whereas most alt cash are considerably worse off) – an emblem of the way it has been resilient by means of a fallow interval for crypto over the previous couple of months. Certainly, at a correlation of 0.34 with Bitcoin during the last 9 months, it’s remarkably low by crypto requirements. The explanation for that is that in durations the place crypto has fallen, traders have shed crypto publicity and as a substitute purchased up the stablecoin UST, therefore pumping the Luna worth.

So to wrap this up, Luna now boasts the next:

- Second largest TVL within the DeFi house

- Largest decentralised stablecoin (UST)

- Solely 10% off all time highs

- Extraordinarily low correlation to the broader market by crypto requirements

With these spectacular attributes and a market cap of $34 billion, Luna is now not an alt coin. It’s within the bigtime.