PCE Inflation: Inventory and crypto market merchants anticipate the discharge of the US Federal Reserve’s most well-liked inflation gauge PCE for additional bullish cues. The U.S. Bureau of Financial Evaluation to launch the private consumption expenditure (PCE) worth index right this moment and economists see PCE inflation slowing for a second consecutive month to 2.5% from 2.6%, making the FOMC to debate rate of interest cuts.

Federal Reserve officers have not too long ago shared their dovish outlook on financial coverage, hinting at a pivot to fee cuts. The market expects the primary fee lower by the U.S. Fed in September.

Wall Avenue Estimates On PCE Inflation Information

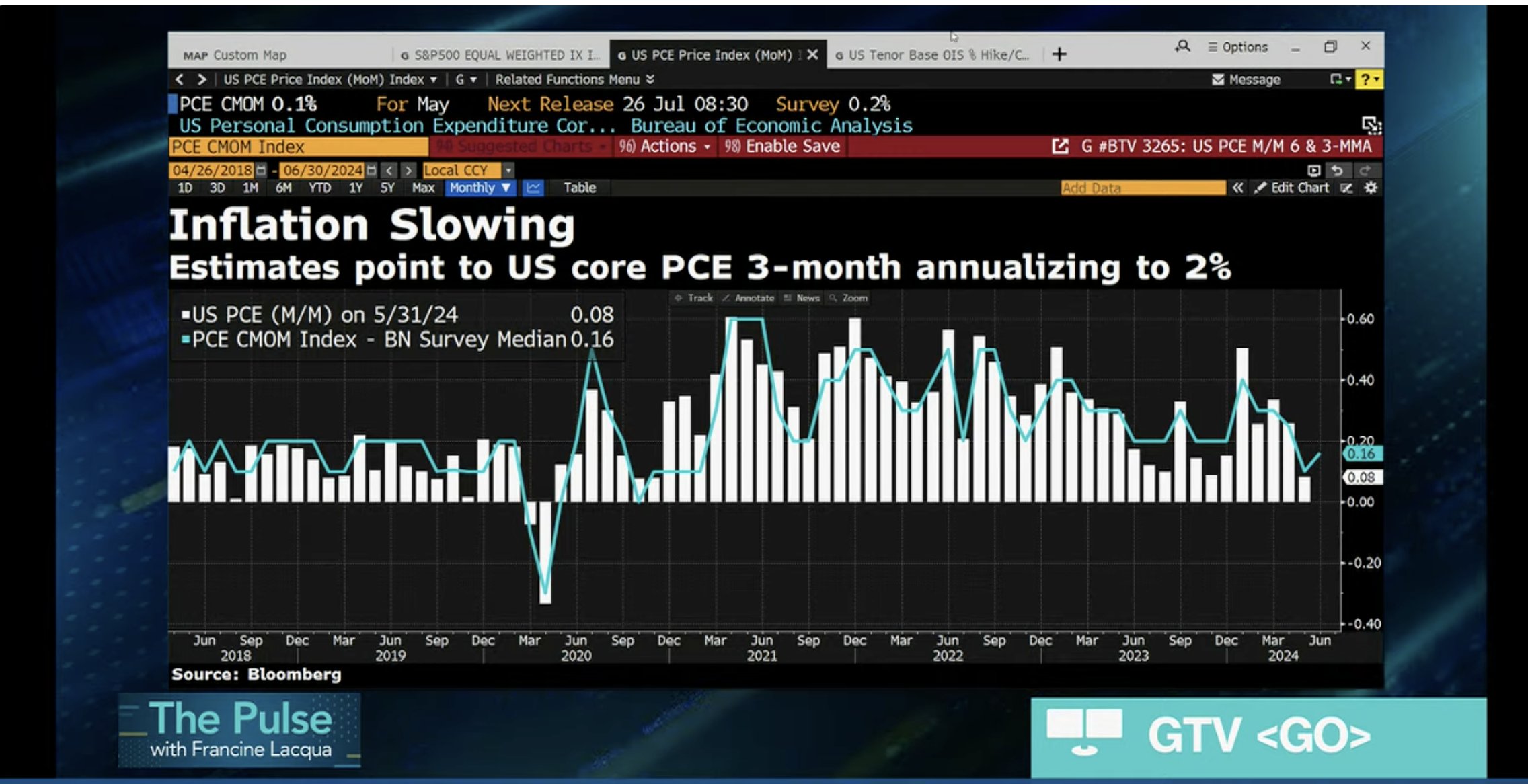

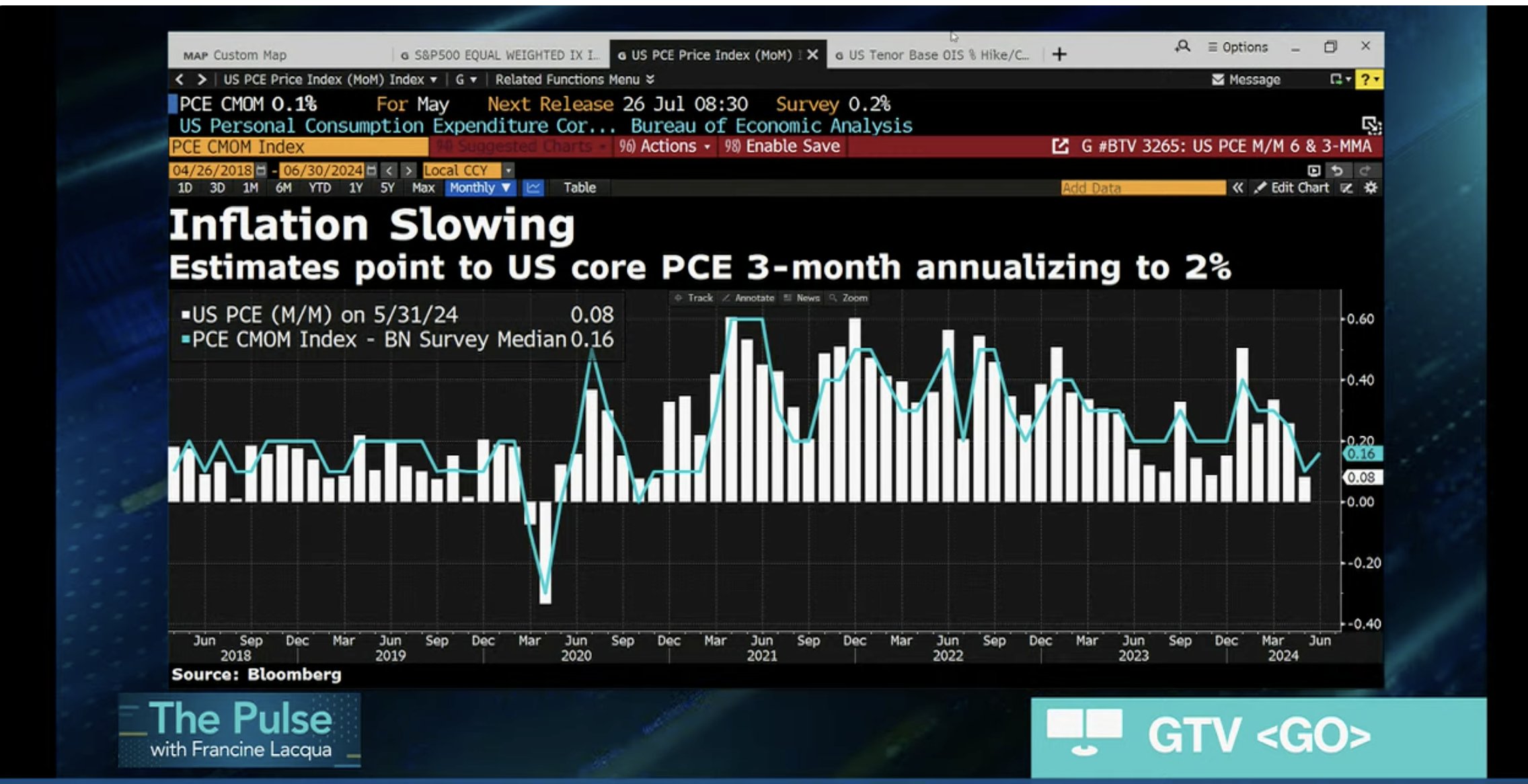

The PCE inflation is predicted to chill additional as per the newest evaluation by economists. The market expects annual PCE to fall to 2.5%, down from 2.6% final month. Equally, the annual core PCE inflation is projected to lower to 2.5%, a brand new low since March 2021, from 2.6%.

As well as, the month-to-month PCE inflation is predicted at 0.1% whereas the month-to-month core PCE can be anticipated to come back in at 0.1%. Notably, the Federal Reserve’s newest financial projections estimated annual PCE inflation at 2.6% and the core fee at 2.8% for the present 12 months.

Wall Avenue giants together with JPMorgan, Morgan Stanley, Financial institution of America, Goldman Sachs, Nomura, and UBS have estimated a median forecast of two.5% y/y and 0.1% m/m. In the meantime, the banks estimate core PCE inflation to come back in at 2.5%, consistent with the market forecast. Additionally, the estimates level to US core PCE 3-month annualizing to 2%, reaching the goal fee of the Federal Reserve.

Additionally Learn: LUNC Delisting – Terra Classic Seeks Clarification From TFL CEO And eToro

Bitcoin and Crypto Market Prepares for Rally

In line with Morgan Stanley, “Appreciable progress on inflation permits the Fed to inch nearer to fee cuts. Chair Powell ought to emphasize elevated confidence.”

Morgan Stanley joined Goldman Sachs to foretell three cuts this 12 months beginning in September. They anticipate Fed Chair Jerome Powell to proceed indicating that the Fed is nearing a call to decrease charges, with out committing to a particular timeline.

BTC price jumped 5% within the final 24 hours because the Bitcoin Convention fueled bullish sentiment. The worth is at the moment buying and selling over $67,300, with the 24-hour high and low of $63,473 and $67,466, respectively. Moreover, the buying and selling quantity has elevated barely within the final 24 hours, indicating an increase in curiosity amongst merchants.

In the meantime, the US greenback index (DXY) is shifting close to 104.38, with an additional drop anticipated as a result of anticipation of Donald Trump’s win within the presidential election. Furthermore, the US 10-year Treasury yield dropped to 4.244% right this moment. As Bitcoin strikes reverse to DXY and Treasury yields, the stress is decreasing.

Additionally Learn: Bitcoin Conference – Donald Trump Refuses To Debate With Kamala Harris

The introduced content material could embrace the private opinion of the creator and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The creator or the publication doesn’t maintain any accountability to your private monetary loss.

✓ Share: