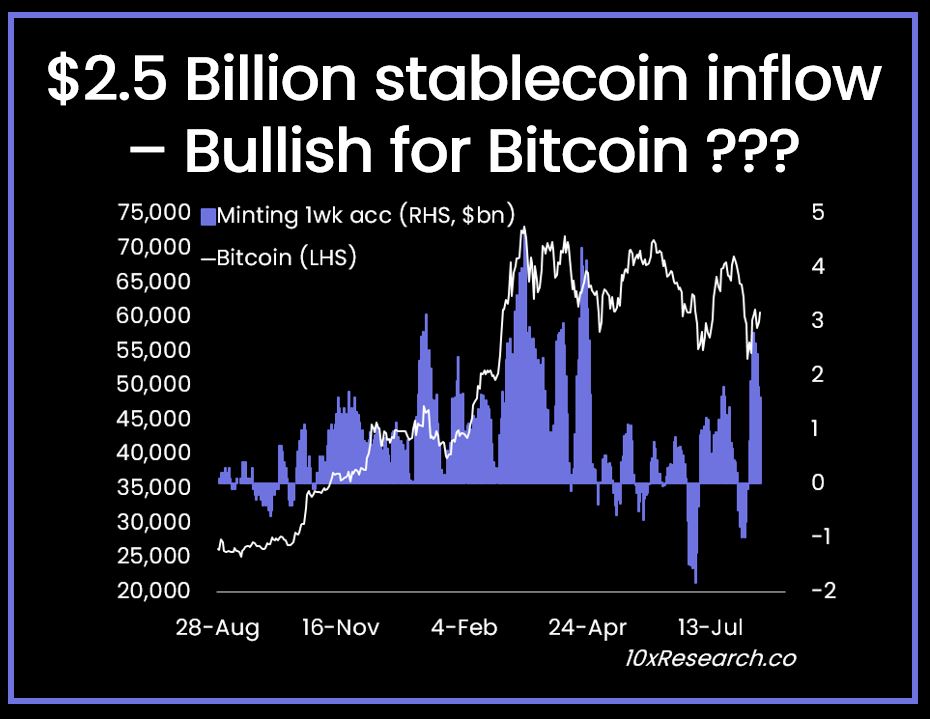

With eyes on the US CPI inflation information, Bitcoin and the broader crypto market have staged a robust restoration within the latest brief masking. The Bitcoin value has surged one other 3% at the moment taking pictures previous $61,000 ranges amid the robust stablecoin inflows occurring over the previous week.

Bitcoin Merchants Wager on $2.5 Billion Stablecoin Influx

Bitcoin merchants predict a possible bullish impression concerning the $2.5 billion stablecoin inflows occurring over the previous week. As per the info from 10X Analysis, Tether and Circle have been behind in issuing the USDT and USDC stablecoins over the previous which which means that institutional traders are able to inject contemporary capital into the market.

The merchants imagine that this might probably be the explanation behind the latest Bitcoin short covering. Moreover, inflows into the spot BTC ETFs have additionally picked up just lately suggesting the rising institutional demand for the BTC asset class. Banking large Goldman Sachs submitted a disclosure to the Bitcoin ETF trading activity for the second quarter revealing its $418 million to those funding merchandise.

10x Analysis famous that cash flows have paused since April 2024, which has led to a subsequent value correction for BTC. Nonetheless, the resurgence within the cash flows by means of the rising USDT and USDC provide has offered some increase to the broader crypto market. Moreover, the on-chain reveals that Tether has minted greater than $1 billion in USDT within the final 24 hours whereas additional transferring them to centralized exchanges (CEXs) together with binance, Coinbase, Kraken, and so on.

The #TetherTreasury minted 1B $USDT on #Ethereum and transferred 183.2M $USDT to #Cumberland for CEX deposits prior to now 13 hours!

Cumberland has obtained 953M $USDT from Tether and injected 906.7M $USDT into varied CEXs, together with #Coinbase, #Kraken, #OKX, #Binance, and… https://t.co/XLlzMYRG3X pic.twitter.com/qEUJJ0KWI1

— Spot On Chain (@spotonchain) August 14, 2024

Crypto Market Restoration Amid USDT, USDC Flows

The Bitcoin price has staged a robust restoration this week gaining greater than 10% on the weekly charts amid the liquidity resurgence. Moreover, the broader crypto market has seen related related upside with Ethereum main the altcoin market.

The macro developments this week could be key in deciding the longer term trajectory of the crypto market from right here onwards.

Disclaimer: The introduced content material could embody the private opinion of the writer and is topic to market situation. Do your market analysis earlier than investing in cryptocurrencies. The writer or the publication doesn’t maintain any accountability in your private monetary loss.

✓ Share: