Ethereum (ETH) has been buying and selling inside a each day vary between $2,300 and $2,800 because the begin of August. Over the previous three days, the value has struggled to interrupt previous the $2,600 mark, elevating issues amongst analysts and buyers.

Associated Studying

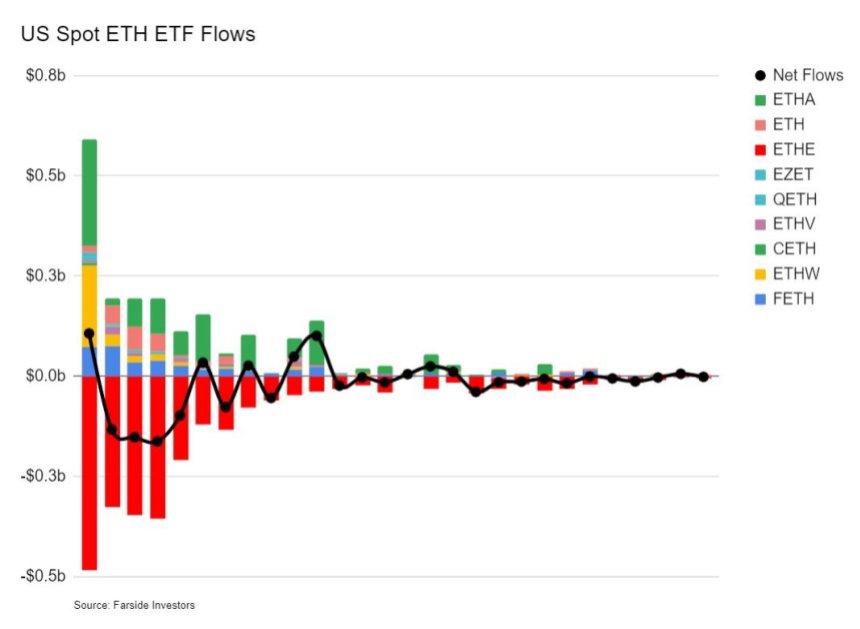

This efficiency has led to disappointment, significantly when in comparison with Bitcoin’s stronger displaying this yr. Essential knowledge from Farside Traders reveals reducing curiosity in Ethereum ETFs, which has added to the cautious sentiment surrounding ETH. This decline in curiosity could point out broader issues about Ethereum’s future efficiency.

As ETH continues to face resistance on the $2,600 degree, the market stays unsure about its capacity to interrupt larger. The following few days will likely be crucial in figuring out whether or not Ethereum can regain its momentum or if it should proceed to lag behind its friends. The market is carefully watching these developments, making this a pivotal second for ETH.

Ethereum ETFs’ Underwhelming Efficiency

The launch of Ethereum ETFs was anticipated with nice pleasure, nevertheless it shortly grew to become a “promote the information” occasion. Data from Farside Investors reveals that Ethereum ETFs have flopped in efficiency since their debut. Each inflows and outflows have gone to nearly zero, reflecting an absence of sustained investor curiosity. This response contrasts sharply with the passion that preceded their launch.

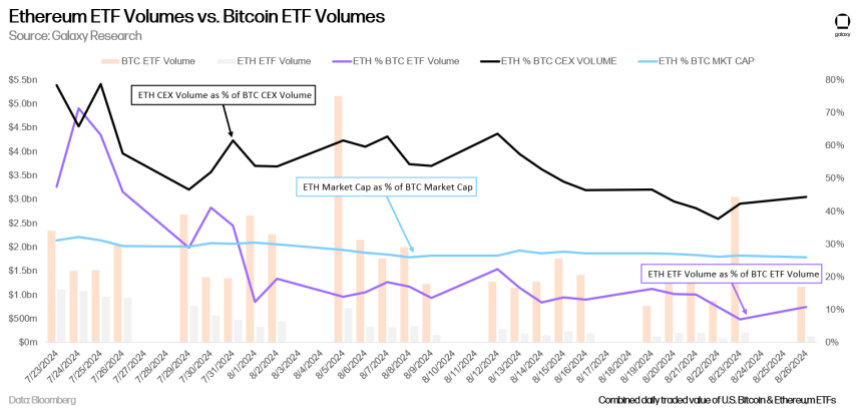

Furthermore, Bloomberg knowledge shared by Galaxy Research highlights that Ethereum ETFs are buying and selling at considerably decrease volumes in comparison with Bitcoin ETFs. This discrepancy is notable, significantly when contemplating the ETH/BTC buying and selling volumes and market cap ratios on centralized exchanges (CEX). Regardless of Ethereum’s sturdy market presence, these ETFs will not be capturing the identical degree of investor consideration as their Bitcoin counterparts.

The present knowledge means that, underneath prevailing market situations, buyers are extra inclined to favor Bitcoin and even discover options like Solana over Ethereum. The dearth of enthusiasm for Ethereum ETFs underscores the broader market sentiment, the place Bitcoin continues to dominate, leaving Ethereum and its monetary merchandise trailing. This improvement raises questions in regards to the future enchantment of Ethereum ETFs and whether or not they can acquire traction in an more and more aggressive market.

Associated Studying

ETH Worth Motion

Ethereum (ETH) is at the moment buying and selling at $2,522, reflecting a interval of uncertainty because it stays under the $2,600 mark since final Tuesday. This worth level is important as a result of $2,600 served as a robust help degree all through most of August. The truth that it has now become resistance means that ETH could possibly be dealing with additional declines within the close to time period.

For bulls to regain management and steer the value upward, breaking previous the $2,600 resistance is essential. Ought to this degree be breached, the subsequent goal can be the native excessive of $2,820, signaling a possible bullish reversal. Nevertheless, if Ethereum fails to reclaim the $2,600 degree, it might result in a continuation of the present downward development, with the subsequent key help degree round $2,310.

Associated Studying

This ongoing battle between help and resistance ranges highlights the significance of the $2,600 mark in figuring out Ethereum’s short-term worth course.

Cowl picture from Dall-E, Chart from Tradingview